What I’m Reading

Swept Under the Rug: October marked the fourth straight month that the overall lodging delinquency rate has fallen, according to Trepp. Unfortunately, this isn’t due to improved property performance but rather granted forbearance that is allowing loans to “current” status. Globe Street See Also: A new survey of American Hotel & Lodging Association found that 71% of respondents don’t think that they will make it another six months without further government relief. IREI

Hemorrhaging: NAIOP expects office net absorption to be negative 18 million square feet in Q4 2020 and negative 10 million square feet in Q1 2021, a downgrade from its prior office demand forecast. Net office absorption has already contracted 50.7 million square feet in the first three quarters of 2020, according to CBRE. This is worse than in the Great Recession. It should be noted that NAIOP is still forecasting a strong bounce back in absorption between Q2 2021 and Q3 2022 that would wipe out the losses from the recession, but that seems rather optimistic and things will surely get worse before they get better. NAIOP

Boom: Housing starts increased nearly 5% from an upwardly revised September reading (August was also revised upward). This gain was solely due to single family starts which increased in October, and were up 29% year-over-year. It is simply amazing how strong the housing market has been in the face of the pandemic, especially when considering how meh it was for years before. Incredible. Calculated Risk

Virtual Reality: Airbnb and DoorDash have successfully done something that sounds simple but is remarkably difficult – digitizing analog activities. Stratechery

Building Stress: With shutdowns starting again, the stress of troubled loans is mounting, especially among the country’s midsized and community banks, as government support propping up businesses at the start of the pandemic has evaporated. Thus far, the Fed hasn’t really forced banks to recognize what is going on in their commercial real estate portfolios. However, a rising Texas Ratio – which measures the value of banks’ nonperforming loans compared to their total asset value plus loss reserves – is a sign of trouble. Bisnow

Chart of the Day

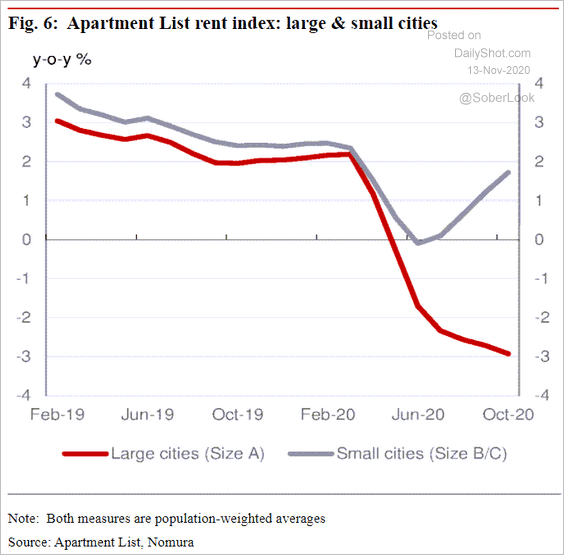

This is why I don’t pay much attention to data that looks at the entire US apartment market. There are now two distinct markets that are moving in different directions.

Source: @Nomura

WTF

I Thought This Was America? A rapper turned himself in for waving flamethrower and dancing on a bus because Brooklyn. AMNY

Fake Out: An apparent decapitated body that floated up on a beach, causing a 911 call turned out to be a store mannequin because Florida. WKRG

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com