Cracking the Code: Dr. Peter Linneman of Linneman Associates and Matt Larriva, vice president of research and data analytics at Chevy Chase, Md., property firm FCP, believe they have devised a methodology that accurately forecasts acquisition yields up to a year into the future. The model is based on the unemployment rate and the flow of commercial mortgage debt, metrics that are a proxy for U.S. economic performance and capital flows into commercial real estate.

Perhaps the biggest surprise here is that the model finds little correlation between cap rates and interest rates, bucking conventional wisdom. Rather, it points to mortgage debt as a percentage of GDP as the primary driver. When this measure rises, cap rates tend to fall and vice versa. (h/t Steve Sims) Commercial Property Executive

Better Than Expected: There has been no shortage of doom and gloom forecasts for small banks thanks largely to their high commercial real estate concentrations. However, a large share of government relief for businesses and consumers ended up at smaller banks, boosting deposits and loans and resulting in surprisingly strong performance. Wall Street Journal

Schrodinger’s REIT: Non-traded REIT valuations – which are opaque in stable markets – have been downright chaotic in the age of COVID. Investment News

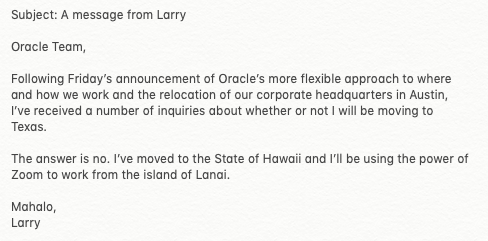

Last One Out Turn Off The Lights: Oracle announced that it will be relocating its headquarters from Redwood City to Austin. Perhaps the sliver lining for those inclined to be sympathetic to California is that it led to the ultimate boss flex by founder Larry Ellison who announced that he would not be joining the team in Austin but rather residing on his private island:

At a certain point, California elected officials are going to need to acknowledge that this is indeed a growing problem and start talking about how to fix it. Despite the current carnage, most of them seem more focused on what pronouns they are using and blocking housing developments than actually devising a plan to stop a large portion of the state’s tax base from fleeing. Globe Street

Limited Supply: The FHFA’s market cap for 2021 will be $70 billion, down from $80 billion in 2021. This means Fannie and Freddie will have less capital to lend. To make things tighter, at least 50% of the GSE’s loan originations must be dedicated to affordable housing, which is an increase from 37.5% in 2020. The result will likely be wider spreads and a more competitive environment for scarce resources. Globe Street

Chart of the Day

This is JP Morgan’s projection for CMBS workouts. If correct, we should start to see liquidations in Q2 and Q3 of 2021.

Source: Marketwatch

WTF

Makes Sense: An intoxicated minor who was driving with a loaded AR-15 rifle in his lap Saturday evening told police that he carried the assault weapon because he “has seen crazy stuff since moving to Florida.” The Smoking Gun

Going For Two: Reigning NFL MVP Lamar Jackson led his Baltimore Ravens to a thrilling comeback victory Monday night after (allegedly) running to the locker room to take a poop in the 4th quarter. Jackson denies it but anyone who watched him run down the tunnel to the locker room knows that he took the Browns to the Super Bowl. NY Post

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com