What I’m Reading

Unmasked: The Corporate Transparency Act, which was tacked onto a defense bill, would require corporations and limited liability companies established in the United States to disclose their real owners to the Treasury Department, making it harder for criminals to anonymously launder money or evade taxes. The rule applies to future and existing entities alike and was passed with veto-proof majorities in both the house and senate. I would expect that this will be another blow to the real estate markets in certain gateway US cities that have long been havens for anonymous foreign investment of questionable origin. (h/t Steve Sims) Washington Post

Double-Edged Sword: The unexpected 2020 housing boom has created an conundrum for homebuilders – a growing shortage of finished lots ready for construction. Wall Street Journal

Cyclical: This short Medium post by Gavin Baker is the best argument for business travel (and for that matter the office market) that I have seen:

Business travel is coming back for the same reason that suits always come back.

Suits are cyclical. Almost all offices go casual late in the cycle. Then the economy rolls over and a few months into the recession, someone shows up at the office wearing a suit because they are worried about their job. The next day everyone is wearing a suit.

Business travel will be the same. Every business will try to avoid travel and stay on Zoom. But then one company, struggling with sales, will send their sales representatives on the road and conversions will increase. The next quarter all of their competitors will be on the road. The same will go for conferences, for diligence, for deals, for executive retreats, for everything.Business travel will come back.

Drowning: The 30-year U.S. real yield has been negative since mid-June after never falling below zero at any point since at least 2004. This has dire consequences for US pensions, which were struggling to tread water in the midst of a decade-long bull market before 2020. NREI

Exposed: US taxpayers are ultimately on the hook for $1.65 trillion in apartment building debt, much of which is in gateway cities and backed by properties that are not performing well. Wolf Street

Reborn: Unused hotels are getting a new life as tiny apartments. This conversion seems like a natural fit since nearly every city in the US currently has excess hotel units and a shortage of affordable housing. However, the process can also be fraught with risk as cities are often reluctant to give up revenue producing hotel rooms (occupancy tax) for resource-consuming housing. Wall Street Journal

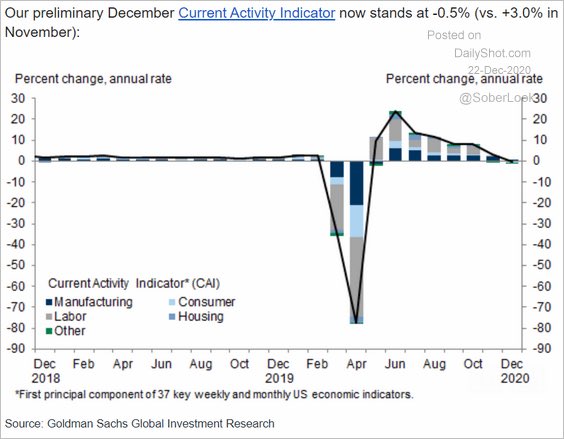

Chart of the Day

Goldman Sachs sees current activity turning negative for the first time since April. Hopefully the new fiscal support package provides some cushion.

Source: @SoberLook

WTF

Oops: A woman was arrested for trying to sell an undercover cop 8.8 lbs of meth because Florida. Breaking 911

Recipe for Disaster: A man who was caught with a scale and bags containing white and brown substances in his backpack, claimed that he was carrying “a bag of sugar and a bag of corn starch to bake a cake.” Instead, field tests found that it was ecstacy and meth because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com