One Big Thing

Treasury yields are soaring of late so of course a lot of the conversation around commercial real estate in general and multi-family in particular is when cap rates will begin to reflect this. I have a bit of a contrarian take that I outlined on a Twitter thread yesterday. Rather than re-writing it, I’ll post the entire thing below:

1/8 THREAD: Seeing a ton of chatter about treasuries spiking and questions as to when it will be reflected in cap rates, especially in multi-family. IMHO, the correct, but somewhat painful (for some) answer is roughly May …… of 2020. Allow me to explain:

— Adam Deermount (@ADeermount) February 25, 2021

2/ 8 Just like any other asset, real estate pricing does not happen in a vacuum. Instead, it is valued on a relative basis to other assets, mainly of the fixed income variety.

— Adam Deermount (@ADeermount) February 25, 2021

3/8 After the initial COVID market shock wore off last spring, bond prices soared and yield plummeted in BAA corporates and HY bonds, yet unleveraged return expectations and cap rates barely budged (outside of some obviously impacted sectors like hospitality and retail). pic.twitter.com/Lgc4dop6SK

— Adam Deermount (@ADeermount) February 25, 2021

4/8 This happened amidst a backdrop of plunging multi-family borrowing costs, which was also why we saw so many GPs touting high single digit cash on cash returns on what seemed like low nominal cap rate purchases.

— Adam Deermount (@ADeermount) February 25, 2021

5/8 This was essentially arbitrage an arbitrage opportunity in a space where borrowing costs fell much faster than cap rates and real estate became cheap relative to other fixed income investments.

— Adam Deermount (@ADeermount) February 25, 2021

6/8 There are three ways for such a return mismatch to resolve:

— Adam Deermount (@ADeermount) February 25, 2021

1) Real estate cap rates fall

2) Bond Yields rise

3) A combination of both pic.twitter.com/v28Z1wL8DD

7/8 Could we see cap rates rise here? Sure. As we saw over the past year, nothing is set in stone and relative returns fluctuate all over the place. However, they typically return to the historical norm. pic.twitter.com/8NJFEHoibS

— Adam Deermount (@ADeermount) February 25, 2021

8/8 Cap rates never really adjusted to low fixed income yields over the past year. Why should we expect them to rise now that fixed income yields are increasing, bringing the historical relationship back into balance?

— Adam Deermount (@ADeermount) February 25, 2021

Conclusion: Rising fixed income yields eventually put upward pressure on cap rates but I’m skeptical of the view that it will happen at these levels, given that cap rates and unleveraged returns never really followed yields south in a meaningful way in 2020.

What I’m Reading

Bounce: Zumper’s national rent report for March found that apartment asking rents in expensive markets like New York, San Jose and Boston rose for the first time since Q1 2020. However, San Francisco rents continued to fall. Zumper

Deeper Cut: Cash usage has been declining for years, making credit card fees an increasingly bigger issue for low-margin retailers. The pandemic exacerbated this, especially in light of the fact that swipe fees are often higher on online orders. Now Mastercard and Visa are planning on a fee increase, deepening retailer pain. Wall Street Journal

Tailwind: The Case-Shiller housing index rose 10.9% YoY in January and its difficult to see an imminent slowdown in housing prices anytime soon. Calculated Risk

Bumpy Ride: Conventional wisdom that construction prices would fall during the pandemic have been dead wrong as a combination of soaring housing demand, labor issues and raw material supply chain issues have maintained upward pressure. Lumber has been particularly volatile, experiencing wild price swings and setting a record high last week. The volatility will continue well into 2021 thanks to Canadian tariffs and low output from mills. Globe Street

Underwater: The return of indoor dining in New York City couldn’t come soon enough for struggling Big Apple restaurants, as a new survey by the NYC Hospitality Alliance reveals 92 percent of more than 400 respondents couldn’t afford to pay December rent, a number that has steadily increased since the start of the pandemic.

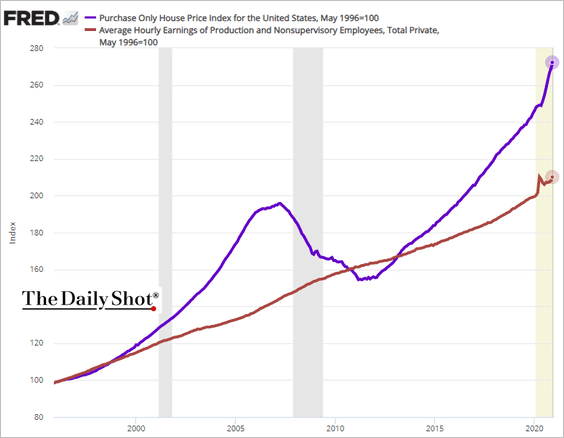

Chart of the Day

The gap between US wages and home prices keeps widening. This can’t go on forever, but it can probably go on for a lot longer than most of us think so long as rates stay low. That being said, if rates continue to rise, it will become unsustainable very quickly.

Source: The Daily Shot

WTF

High Bar: In what appears to be a new record for extreme DUI, an Oregon motorist’s blood alcohol content was measured at .77–more than nine times the legal limit – after he crashed his car following a short police chase. This one will be difficult to top. The Smoking Gun

Honest Mistake: A motorist blamed a rap song for driving 120 mph and claimed to not know that “driving reckless was illegal” because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com