What I’m Reading

Tick Tock: Multifamily forbearance for agency borrowers has been extended through June 30, 2021 after having been set to expire on May 31st. Once the forbearance period ends, owners generally have to start repaying the deferred amount immediately and within 12 months, and while some owners have allowed tenants to repay accrued rent over time, others may not have had the financial resources to make up for an extended period of missed payments. This will impact smaller mom and pop landlords the most as forbearance rates were highest among smaller properties, with 5.4% of FHA- or enterprise-backed properties with five to nine units under forbearance, as opposed to about 1.% among properties with 50 or more units. While multifamily distress has been minimal thus far, this development should be monitored closely. Globe Street

Creative Destruction: For the first time in years, retailers plan to open more stores than they close in 2021, capitalizing on vacant space, cheap rent and accommodating landlords. CNBC

Cutting Edge: A Miami Beach nightclub called Treehouse is for sale, and the seller will accept Bitcoin as payment. If a Bitcoin buyer emerges, it could be the first U.S. commercial real estate transaction using cryptocurrency. While this is certainly interesting, I still can’t imagine using such a volatile medium of exchange to purchase anything. Brings back memories of the guy who bought two Papa Johns pizzas (not even something decent) back in 2010 for what would be $613MM at today’s value. Can’t help but think that either buyer or seller will regret this depending on the future price of Bitcoin. Bisnow

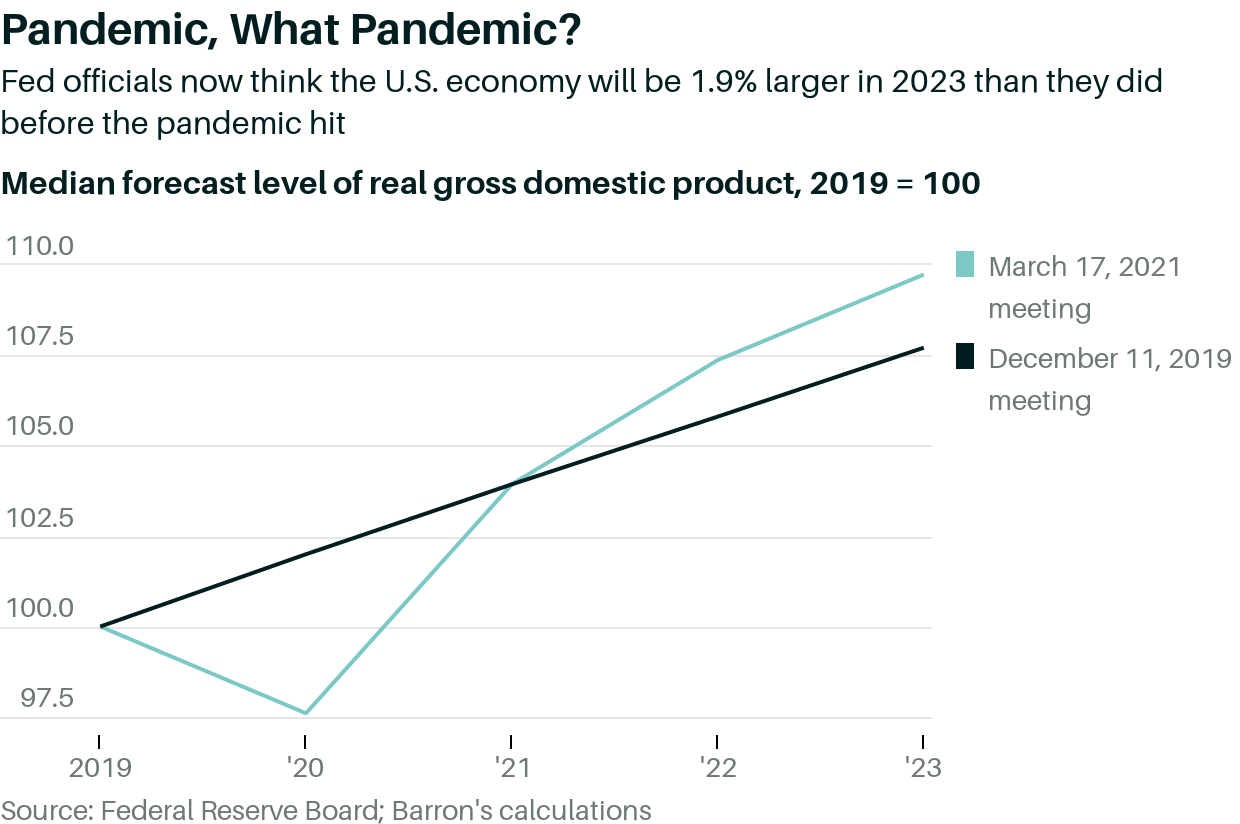

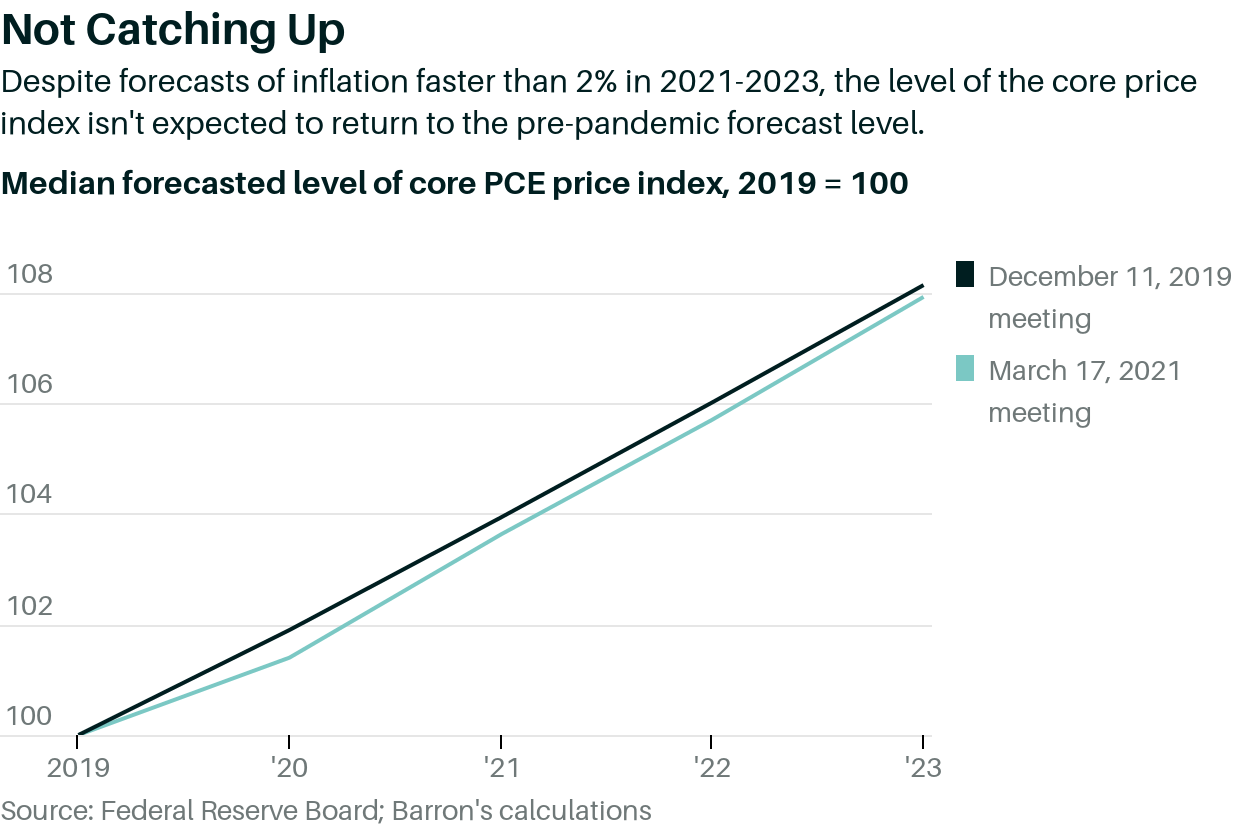

Boogeyman: Despite what you hear in the financial press, economic indicators aren’t really showing much inflation yet. It may come as a surprise but this is still more of a hypothetical concern than something showing up in the economy today. No doubt that reopening is leading to price increases but the staying power of those increases remains to be seen. Bloomberg

Wrong Direction: Shitty weather, supply chain issues and high construction costs sent applications for new housing construction down 10.8% in February. It goes without saying that this is less than idea in a market that is dramatically undersupplied. Associated Press

Chart of the Day

This is incredible.

Source: Matthew C. Klein

WTF

Let it Rip: A man is taking advantage of the cryptocurrency craze for non-fungible tokens by selling a year’s worth of fart audio clips that he uploaded to the blockchain. The current high bid is $83. In other news, I’m an artist now. New York Post

Drive By: Four women robbed a Popeye’s drive through and started a brawl which was caught on video by a customer because Florida. New York Post

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com