What I’m Reading

Halt: As expected, the CDC extended their eviction ban residential evictions until the end of June. However, the extension makes no substantive changes to the policy, despite housing advocates pushing the administration to boost enforcement measures to prevent landlords from going around the moratorium. Politico Next Wave’s Jordan Fisher pointed out in a highly entertaining blog post that the under-the-radar beneficiary of this may actually be landlords – who have been forced to act like a cartel – in stronger-performing markets (Next Wave / Jordan are landlords in such markets):

So how does this affect apartments? Apartments aren’t immune to market forces. When a person can no longer afford his/her apartment the next step isn’t usually homelessness. Its usually to move to a more economical situation — share an apartment, move in with family, etc. In a recession or downturn, this could lead to an aggregate reduction of demand. Apartment owners facing rising vacancies react competitively to this reduced demand by lowering rents to attract new renters. At some price level, demand reappears and the growth cycle resumes.

The housing rental market is an incredibly fragmented industries. Even the largest owners only own small percent of a market’s total housing, so it would be nearly impossible to establish any sort of cartel even if it were legal. But what would they do if they could? Wouldn’t it be in their best interest for apartment owners to cooperatively reduce supply of vacant units to keep from reducing rents? Well, that is EXACTLY what the eviction moratorium has done. It has kept residents that are unable to afford an apartment from moving out. It has kept both demand high by preventing the need for tighter living situations such as moving in with the parents, and it has kept supply low, by preventing these units from being rented out to new residents. Right now people that are moving to the growth markets we operate in are finding rents rising quickly and vacant units in short supply.

So in a turn of irony, the eviction moratorium, so hated by landlords, has effectively forced them, kicking and screaming, into acting in their own best interest. I would write more, but I have about about 100 TikTok dances I need to go learn.

Going Big: The federal government has passed an unprecedented $5.3 trillion in stimulus as a response to COVID-19 and another $3 trillion infrastructure package appears to be on the way. Economists project that this will lead to the strongest recovery since the early 1980s but it also is causing concerns about inflation and interest rates. Commercial Property Executive

Long Shot: Economic slumps traditionally set off battles between local governments trying to make up lost revenue by holding the line on property taxes and property owners trying to cut their taxes to be more in line with their diminished bottom lines. However, the short duration of this recession probably means that property owners are going to have a more difficult time with property tax challenges this time around. Bisnow

Taking Water: Cerberus just raised a $2.8 billion opportunistic real estate fund to:

invest in direct assets, real estate companies, entities with significant real estate exposure and real estate-related debt, including non-performing loan portfolios.

On the positive side, at least they didn’t use the word distress for this one. However, the targets appear to be the same distressed assets that every institution and their cousin has raised money for. All indications are that distress will be limited to retail (some) hospitality and (potentially down the road) office. Question remains: what happens to all these billions in “dry powder” when the opportunities they have raise for fail to materialize? Globe Street

Counterintuitive: COVID was supposed to lead to a surge of bankruptcies. However, government checks and other rescue measures actually led to declining bankruptcy in 2020 despite high unemployment. Source: Wall Street Journal

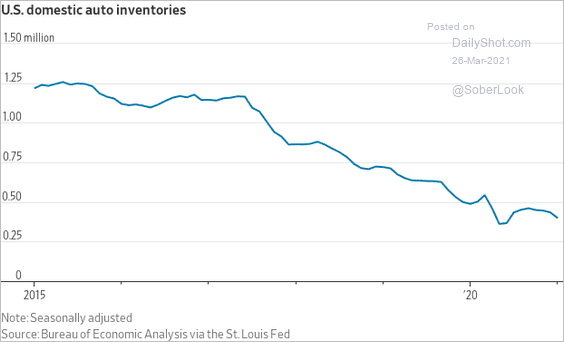

Chart of the Day

It’s not just housing. US domestic auto inventories are also near multi-year lows.

Source: The Daily Shot

WTF

Too Much Free Time: A man broke the Guinness World Record for the most cinema productions attended of the same film after watching “Avengers: Endgame” 191 times because Florida. Insider.com

Precious Cargo: A ship carrying 20 containers full of ‘dildos, vibrators and male masturbators’ was stuck in the Suez Canal earlier this week. Funny that the Ever Given was ungrounded not long after this information was released. Looks like someone was desperate. Metro

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com