What I’m Reading

Rebound: Apartment List’s rent index posted its largest monthly increase since 2017 in March. The markets that saw the fastest declines in 2020 led the way. Globe Street

Wiped Out: More than 10% of restaurants in the United States have closed permanently since the coronavirus pandemic began last March, according to foodservice research firm Datassential. Nation’s Restaurant News

Size Matters: The next few generations of cargo ships are going to be substantially larger than the recently-stranded Ever Given, which was one of the largest when it was launched in 2018. This is due to acceleration of global trade and eCommerce buy may cause issues for some ports which can’t handle ships this large due to both infrastructure (cranes and docks) and geological (depth) challenges. Bloomberg

Drip, Drip, Drip: Large companies like JP Morgan, Saleforce and PricewaterhouseCoopers continue to look to unload big blocks of office space via sublease. Wall Street Journal See Also: How partial adoption of remote work could change Manhattan. New York Times

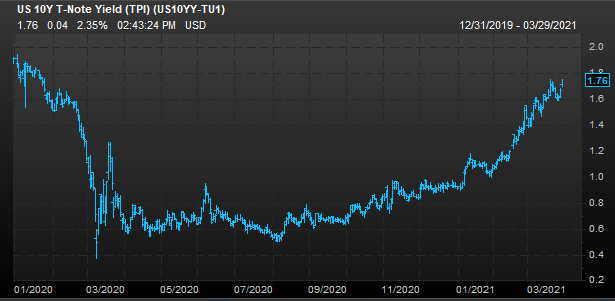

Rocked: Over the past eight months, 10-year Treasury notes have shed 9.5% of their value, while 30-year bonds have dropped by 23.9% as risk-on sentiment coupled with inflation fears spook investors. This likely continues until sentiment (likely driven by inflation expectations) changes. Morningstar

Chart of the Day

10-Year yield is pretty much back to where it was when the Wuhan lockdowns began in late-January of last year.

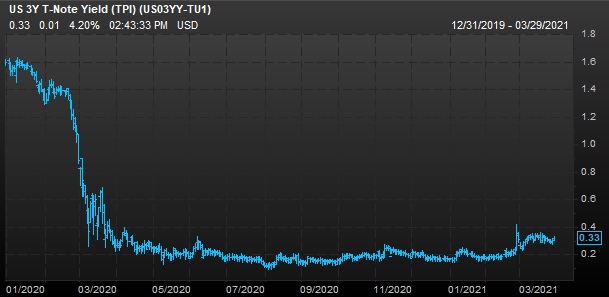

Short end of the curve hasn’t moved much though.

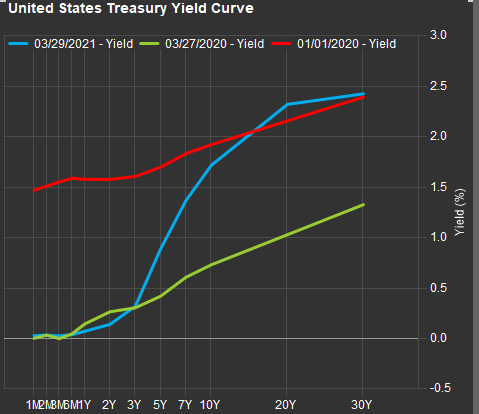

And the yield curve is steep AF.

Source: Mike Bird

WTF

Tangled Web: A pastor’s wife wife and her accomplice were arrested for plotting said pastor’s murder amid a love triangle because Oklahoma. Oklahoma’s News 4

Mo Money, Mo Problems: A 77 year old man was stabbed with a steak knife by his 46 year old female roommate after an argument about a $60 stimulus check because Florida. The Free Press

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com