One Big Thing

Deep Freeze: If the Biden tax plan is passed in its entirety, it would likely result in an initial rush to sell properties most impacted before the changes take effect, followed by a substantial drop in the number of property sales and less market liquidity. Commercial Property Executive

Fortunately, there is a good proxy for elimination of the 1031 exchange – Canada. Our neighbors to the north used to have something similar to the 1031 which they eliminated back in the early 1970s. The result has been that Canadian properties trade hands a lot less often as sellers do not have the same incentive to transact due to the drag from taxes. In other words, a less-than-dynamic market. Canadian investor Jay Vasantharajah put together an excellent Twitter thread in defense of the 1031 late last year that should be required reading.

What I find of particular interest is that cap rates in Canada are NOT SUBSTANTIALLY DIFFERENT than they are in the US despite a lack of tax deferred exchanges. This suggests that the “cap rates must expand if the 1031 goes away” view may be a bit overly simplistic in its approach as it doesn’t account for WHY transaction volume will decrease in an environment sans tax deferred exchanges.

In an environment where transaction volume falls thanks to a lack of demand and liquidity, cap rates should fall. However, in an environment where transactions decrease because supply falls as much or more than demand, that is not the case. I suspect that elimination of the 1031 exchange would most likely result in scenario two above.

What I’m Reading

Risk Curve: Competition is heating up in the bridge loan space, pushing more lenders into construction lending and compressing spreads. Globe Street

Hitting the Slopes: Affluent remote workers descended on resort towns over the past year, driving up prices and straining local resources in the process. Now some of those who can work remote on a permanent are staying, raising the possibility that resort towns become the suburbs of the remote work era. LA Times

Eject Button: After a year of early-morning Zoom calls, the specter of a deadly virus and soaring stock and real estate values, working American baby boomers who can afford it plan to get out while the getting’s good. About 2.7 million Americans age 55 or older are contemplating retirement years earlier than they’d imagined because of the pandemic, according to government data. Bloomberg

Structural Imbalance: Goldman Sachs is projecting a housing market with a persistent supply-demand imbalance in the years ahead, forecasting double digit price gains in both 2021 and 2022. This is thanks to demographic tailwinds, low mortgage rates, still conservative lending standards and household wealth as a percentage of income at its highest level in US history. Calculated Risk

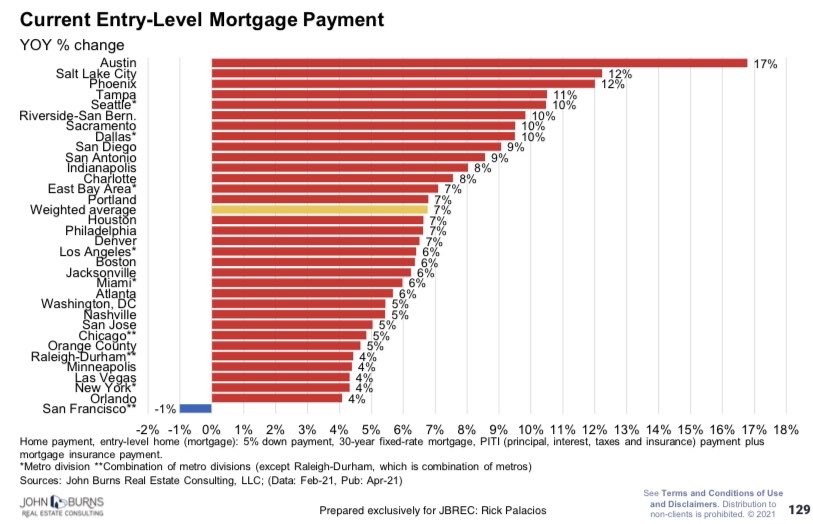

Chart of the Day

Balance sheets and incomes are strong which is a good thing given what is going on with housing costs.

Source: Rick Palacios

WTF

Moooove: An alligator and a cow caused traffic to stop on Houston freeways in separate incidents last week when the animals found their ways onto major roads. Nature is healing. KSAT.com

Shitty: A property line dispute between neighbors in Southeast Michigan led to the construction of a 250-foot-long wall of poop – or a “compost fence.” (h/t Steve Sims) MLive

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com