Chart of the Day

As a general rule, most large apartment landlords set rent to try and maintain 95% occupancy at their properties. A 5% vacancy factor is typically used for loan sizing, so there is very little upside from a valuation perspective. The prevailing view in the industry is occupancy above 95% is an indicator that rents are set too low. Given that backdrop, it is incredible that we are seeing the type of nationwide occupancy stats in the chart below on a nationwide basis Occupancy at 96.5% indicates that landlords have not been able to raise rent quickly enough to meet demand – and they are currently raising rents quickly.

Source: RealPage

Coincidentally, the last time that occupancy was this high, the federal government began pushing for more mortgage financing to flow to those with lower credit scores. This turned a lot of would-be renters into owners and occupancy never went above 95% again until several years after the GFC. Interestingly enough a story dropped in Politico yesterday about how some lawmakers are pushing the Biden administration to get the GSEs to lower credit standards. I mean, what could possibly go wrong?

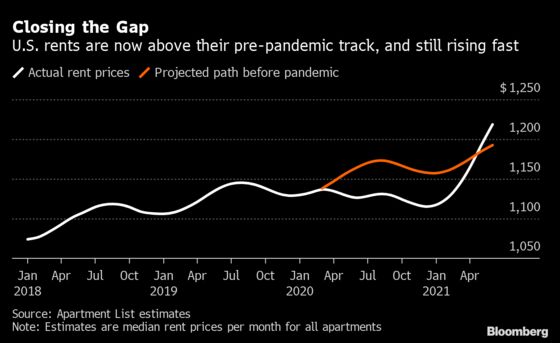

Housing affordability is currently stretched in most markets and – never say never – I don’t see much of a chance of extremely loose credit coming back into the system a mere decade after the housing bubble popped. The result of the conditions outlined above should be a continued upward bias for rent.

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com