What I’m Reading

Spooked: With $300 billion in outstanding debt, troubled mega-developer Evergrande has been dubbed the “Chinese Lehman.” After expanding for years, the company has been scrambling to pay suppliers, and warned investors twice in as many weeks that it could default on its debts. If this were to occur, it could have massive disruptive implications for the global economy as Evergrande’s creditors include some of the largest institutions in the world, risking cross defaults and contagion.

Now, the question is whether or not the CCP will bail out Evergrande, risking moral hazard but avoiding an economic catastrophe in the lead-up to the 2022 National Congress of the Chinese Communist Party. CNBC

My working assumption, at risk of sounding like the guy who claimed that the subprime crisis was contained, is that this will not cause a larger contagion in the US, etc. I was going to write a longer piece as to why but then Mark Dow summed it up perfectly in a tweet:

TL;DR Evergrande take:

— Dow (@mark_dow) September 21, 2021

1) China will make an example of them, but won’t put their system at risk

2) No one systemically important in US or EU is materially exposed to China HY. HFs lose money? Yeah. So what?

3) We buy from China, they don’t buy from us. Chinese slowdown NBD

There are a lot of folks out there who have been predicting/cheerleading another crash in asset prices and a substantial expansion in cap rates since the early days of the pandemic. Thus far, they have been precisely wrong. The Evergrande debacle is the latest doom porn darling of the moment and that same crowd is, of course, jumping on the bandwagon. At some point, another market crash will eventually occur and many people who have been wrong for years will claim to be prescient in their bearishness – broken clocks, after all are right twice a day. However, Evergrande will not be that moment. Please feel free to bookmark this so you can call me out if Evergrande does indeed cause contagion.

Grass Isn’t Always Greener: Home prices and rents are soaring across the globe. The prospect of people not being able to afford a decent place to live has spurred government action in several countries – most of which has led to negative consequences. While the US market continues to come under scrutiny, its important to remember that this is a global issue and other developed markets are in even worse shape. Bloomberg News Network

Shrinkage: According to a recent Gensler survey, roughly 43.5% of companies want to downsize their office footprint after the COVID pandemic is over. Bisnow As an aside, I find the language in a lot of these surveys interesting in that there is this assumption that the pandemic “ends” at some point. Meanwhile, most of what is out there from the science community seems pretty conclusive that it is endemic.

Mixed Signals: While house prices compared with household income are close to or at an extreme high, affordability looks much better when viewed in terms of monthly mortgage payment, since rates have declined so much in the past 15 years. Bonddad Blog

Under the Microscope: The justice department is investigating home sale commissions, which could eventually put downward pressure on the fees paid by home buyers and seller. Wall Street Journal

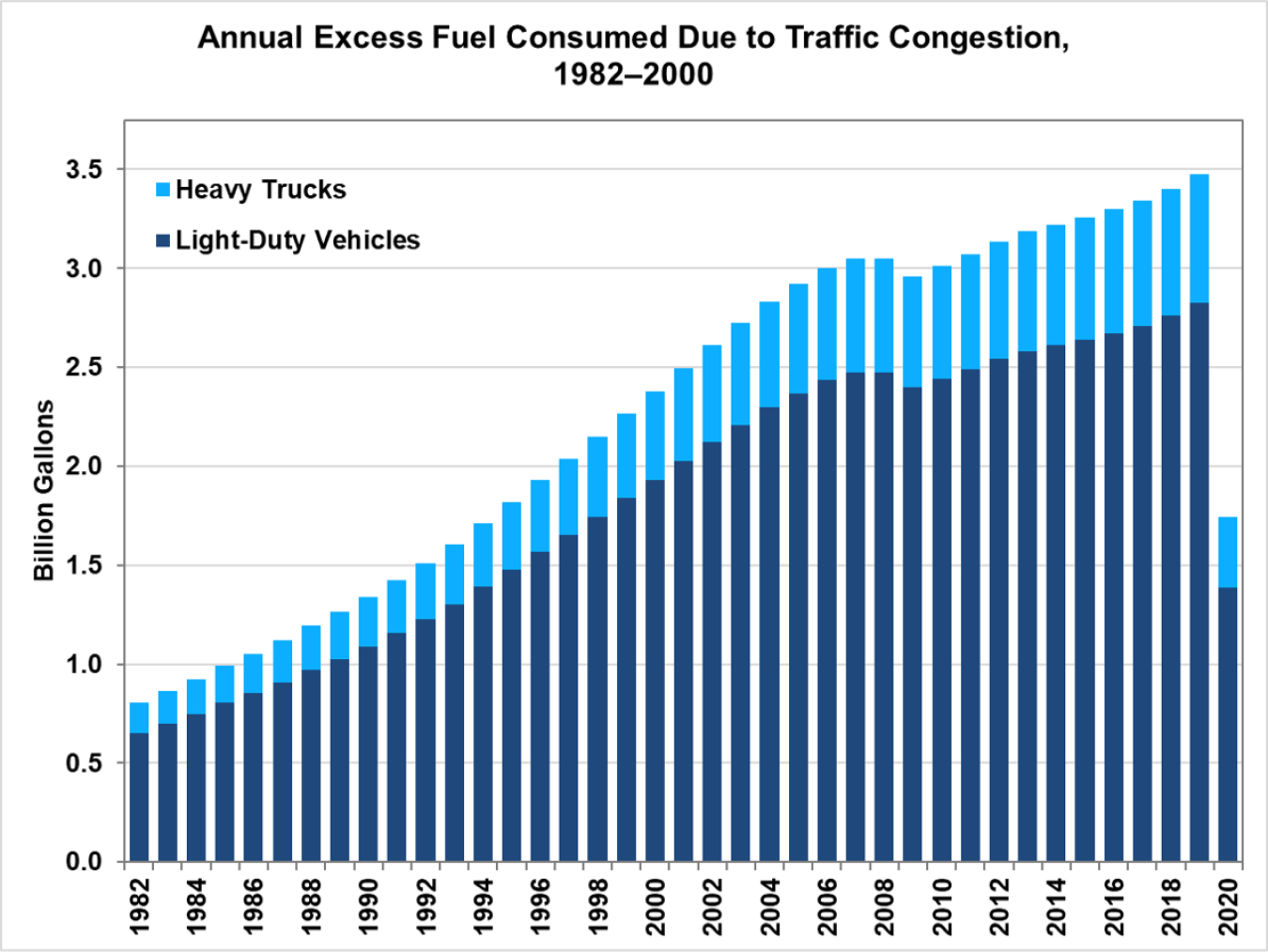

Chart of the Day

COVID effectively eradicated traffic congestion in 2020.

Source: Energy.gov

WTF

Anger Management: A specialist in mindfulness and emotion regulation at an assisted living facility has been ordered to complete eight hours of anger management after starting a brawl at work because Florida. Villages News

Honest Mistake: A man who was pulled over for suspected DUI was found to have no pants on because Florida. iHeart Radio

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com