What I’m Reading

Coming in Hot: YoY inflation is now 7.5%, the highest rate since 1982. As expected OER, which tends to be sticky turned sharply higher. This seals the deal for a 25 basis point increase at the Fed’s March meeting. It also increases the odds of a 50 basis point increase or even an incredibly rare inter-meeting hike. As I am writing this, the entire yield curve is flattening out with the 7/10 inverted, indicating that the market believes that the Fed is behind the curve and will be forced to over-tighten. Bonddad Blog

Passing Through: Even as the pandemic wanes, restaurant interest in drive through buildings continues to build. As a result, competition for space is often fierce and prices are rising. Restaurant Business

Continuation: Prologis’s latest Industrial Business Indicator showed national vacancy at an all time low of 3.4% and projects that rent will increase another 10% YoY in the sector for 2022. Prologis Once functional obsolescence is factored in, the vacancy rate here is probably pretty close to zero, IMO.

Terminal Velocity: We are in a traditionally slow season for the housing market and yet homes are selling faster than ever before. The average home spent just 61 days on the market, according to a January reading from Realtor.com. That is the fastest pace ever recorded. In some markets (where I live, for example), it is much less than that. The spring selling season is right around the corner. With mortgage rates substantially higher than they have been, there are likely to be less sellers than normal as most owners are locked in at substantially lower mortgage rates than they could find buying a new house today. CNBC

Orders of Magnitude: Interest rates have been rising for over a year now and cap rates have continued to fall. With the Fed on the precipice of hiking, the question now becomes how high do interest rates have to go to impact capital flows into CRE, pushing cap rates higher. Globe Street

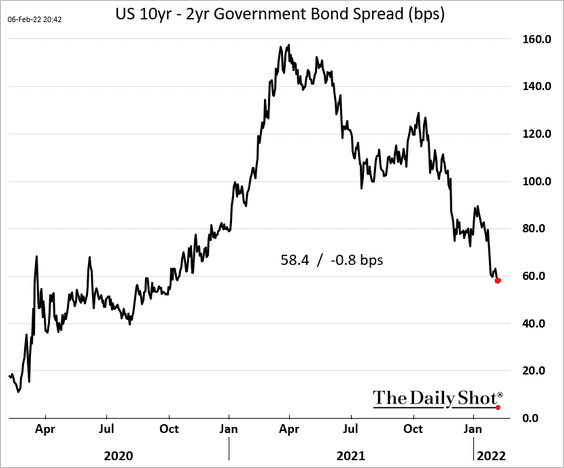

Chart of the Day

The yield curve keeps flattening out as economic activity appears to be peaking.

Source: The Daily Shot

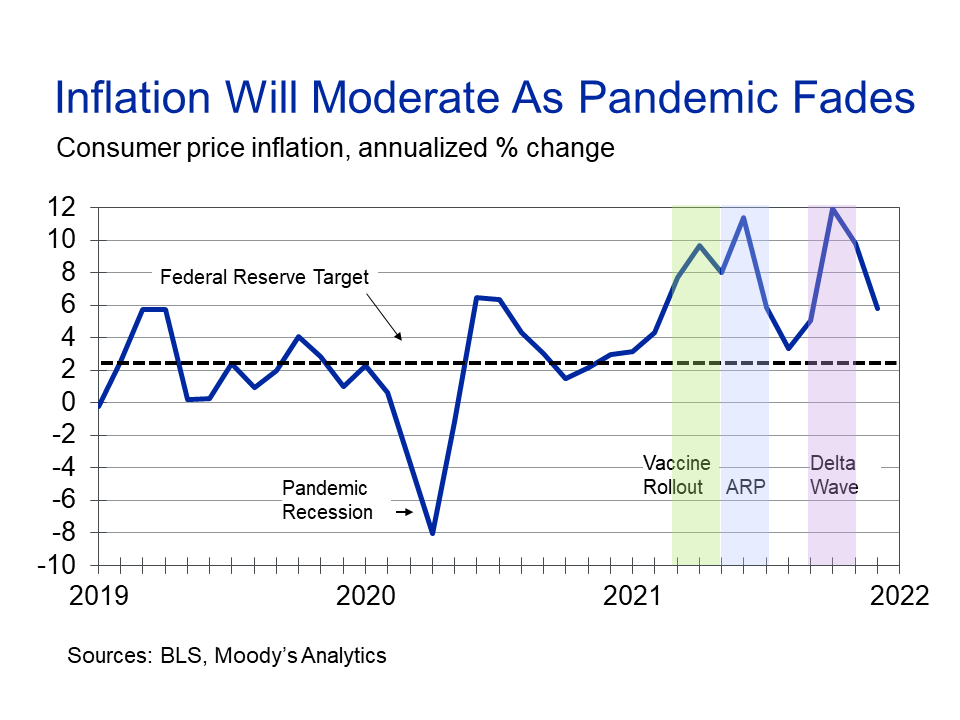

Despite yesterday’s hot CPI reading, inflation may have already peaked.

Source: Mark Zandi

WTF

People Moving: Disney World’s PeopleMover ride was halted after a couple was caught “getting frisky” on one of the cars because Florida. Inside the Magic

Mistaken Identity: A man was arrested for harassing people outside of a restaurant while claiming to be Mick Jagger because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com