What I’m Reading

Got Ya Covered: As commercial real estate lenders and investors eye new yield opportunities, the industrial outdoor storage (IOS) sector has emerged as an asset class with large-scale, long-term growth potential. Commercial Observer

The Big Short: Wall Street investment firms are buying up more vacation homes, aiming to cash in on growing demand from tourists and remote workers. Wall Street Journal IMO, this is likely to push prices up even more as institutions will have lower borrowing costs than one-off owners. It could also further galvanize local pushback against short term rentals.

Flexing: Just 3% of white collar workers want to return to the office five days a week, according to a poll by management consultancy Advanced Workplace Associates. A full 86% of employees want to work from home at least two days a week, the consultancy said after surveying nearly 10,000 people around the world across areas including finance, technology and energy. The sentiment was consistent across age groups. Bloomberg

Don’t Call it a Comeback: Pent-up demand for in-store shoppers helped drive a 9.7% increase in total retail spending in 2021. Chain Store Age

Feeling the Flow: Commercial real estate lending markets continued with high liquidity in the fourth quarter of 2021 despite rising interest rates, according to a new report from CBRE. Globe Street

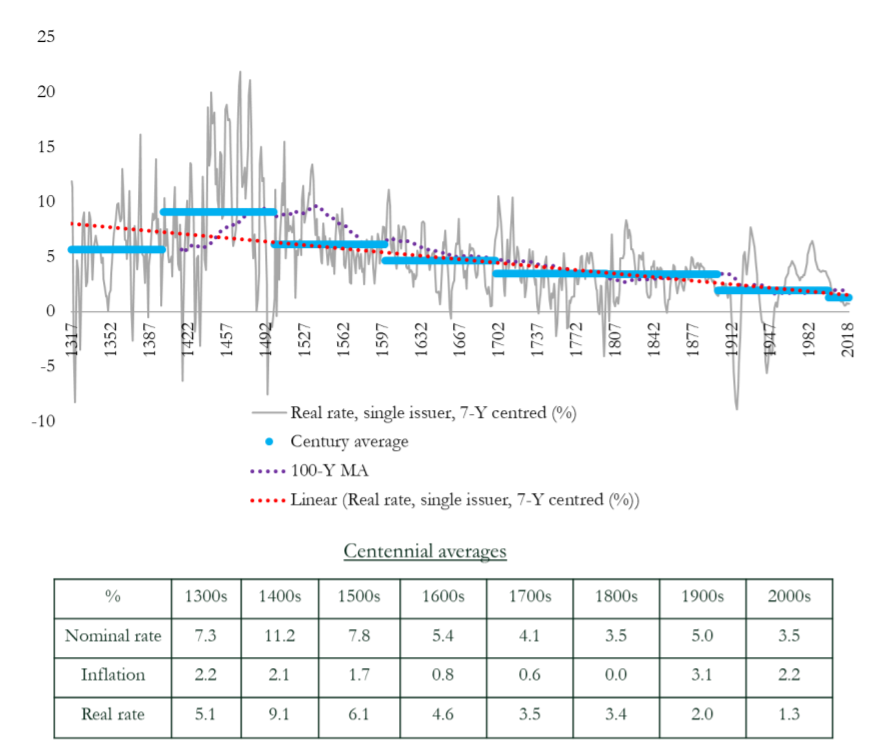

Chart of the Day

If you look back far enough, the trend in real interest rates is around a 1pp drop every century or so.

Source: Alfonso Peccatiello

WTF

You’re Out! A little league umpire in Texas was arrested after he allegedly brought meth to a tournament. Fox 51

Getaway Car: Firefighters were able to stop a man who attempted to carjack an ambulance because Florida. ABC 9

Basis Points – A candid look at the economy, real estate, and other things sometimes related. Visit us at RanchHarbor.com