What I’m Reading

Up, Up and Away Part I: Demand for single-family rental homes is soaring, pushing prices to record highs, as Americans continue to want larger homes with outdoor spaces per the latest report from CoreLogic. Sunbelt cities like Miami and Phoenix are leading the charge. CNBC

Up, Up and Away Part II: Multifamily rents are also soaring across the US, according to the latest numbers from Yardi Matrix. Yardi analysts predict that growth will start slowing soon but has shown little signs of slowing. Globe Street I’ve been beating this drum for a while. Rises in housing prices and mortgage rates have made buying a house substantially more difficult and less affordable. At the same time, we are in the sweet spot for household formation in the massive millennial generation. Marginal buyers are becoming / staying renters, which will continue to push rents higher until enough units are delivered to get to equilibrium.

Here We Go Again: Ocean carriers are scrambling to adjust their networks as the Chinese city of Shenzhen begins a week-long lockdown. Carriers are predicting that the lockdown will hit supply chains harder than the Suez Canal blockage last year. The Loadstar So much for supply chain normalization in 2022.

Houston, We Have Problem: Houston has set the standard for bringing office workers back during Covid-19. However, buildings are less than half full workers are showing up at the office about 10.7 days a month, compared with 17 before the pandemic. This despite regularly packed restaurants and sporting events in the city. Wall Street Journal Goes without saying that this doesn’t bode well for office investors.

Canary in the Coal Mine: If the Fed tightening cycle will lead to a recession, we should see housing turn down first, primarily new home sales, single family starts, residential investment. Calculated Risk Blog

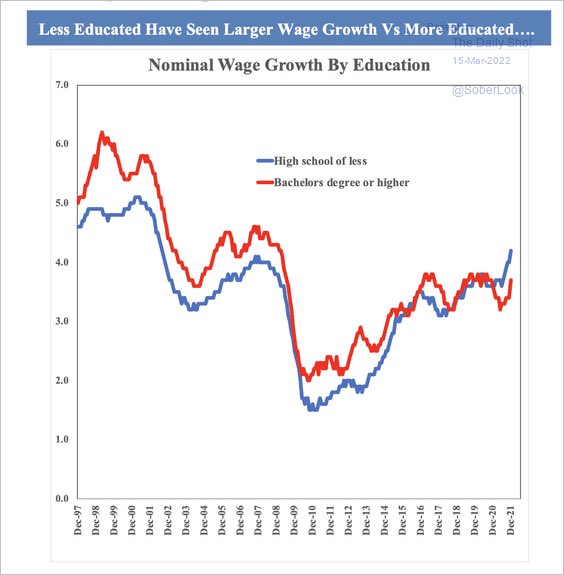

Chart of the Day

I wonder how sustainable this is as it very likely results in a further push towards automation.

Source: The Daily Shot

WTF

Style Drift: In an apparent bid to become a hedge fund, noted meme stonk and theater owner AMC purchased a gold mine. This is an actual quote from AMC’s CEO:

Commenting on the investment in Hycroft, Adam Aron, chairman and CEO of AMC Entertainment said, “The strength of SPIDER-MAN: NO WAY HOME and THE BATMAN, as well as 2022’s promising industry box office, heighten AMC Entertainment’s conviction that we are on a glide path to recovery. Our strategic investment being announced today is the result of our having identified a company in an unrelated industry that appears to be just like AMC of a year ago. It, too, has rock-solid assets, but for a variety of reasons, it has been facing a severe and immediate liquidity issue. Its share price has been knocked low as a result. We are confident that our involvement can greatly help it to surmount its challenges — to its benefit, and to ours.”

What at time to be alive. Bloomberg

Fake ID: A UK driver who was arrested for reckless driving gave officers an ID from Lego Land. New York Post

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com