What I’m Reading

Sleight of Hand: WeWork is once again attempting to go public, this time via SPAC merger. However, the co-working company’s aggressive projections and unconventional financial metrics are once again raising investor concerns about its viability. Globe Street

More of the Same: When it comes to people moving during the pandemic, the general rule was that areas that were already attracting new residents kept attracting them. Those that were losing residents lost more. And there are few examples, at least in the data so far, of previously down-and-out regions drawing people in. New York Times

Mind the Gap: Lumber prices are soaring but the price of trees is actually stagnating. Yahoo Finance

Stigma: Hotels that were used for COVID quarantine are facing a new problem – a stigma about their use over the past year. Wall Street Journal

Normalizing: The House of Representatives overwhelmingly passed the Secure and Fair Enforcement Banking Act. The proposed law would allow banks and financial institutions to avoid federal sanctions or prosecution if they do business with cannabis providers. The measure will now move on to the Senate where it stalled in 2019. It would be an understatement to say that the SAFE Act’s passage would be a huge deal for the cannabis industry and its landlords, both of which have struggled with costly financing to compensate for a lack of bank financing. Bisnow

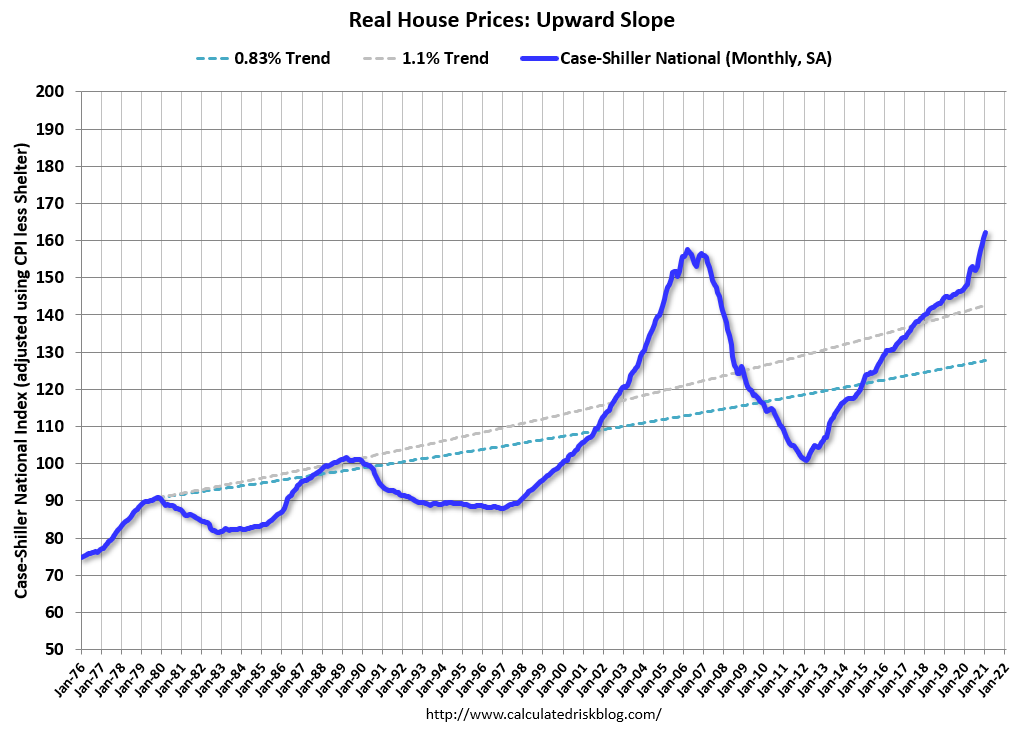

Chart of the Day

Bull case for rental market in one picture – especially when coupled with an increasing interest rate environment.

Source: Calculated Risk

WTF

Stash: A sheriff’s sergeant was demoted to deputy after an investigation found that he wrongfully took more than 5,000 rounds of ammunition from the agency for his own personal use because Florida. TampaBay.com

Basis Points – A candid look at the economy, real estate, and other things sometimes related. Visit us at RanchHarbor.com