One Big Thing

One universal rule that becomes even more apparent when raising young children is that incentives drive everything. Tell a kid to clean her room and you may get an attitude. Promise her a reward of some sort if its clean for a week and the response is very different.

Last week’s announcement of a proposed federal capital gains tax increase from 23.8% to 43.4% roiled financial markets and reminded me of this critical parenting lesson. Big tax policy changes drive major changes in behavior from market participants. Assuming the proposal becomes policy (still far from a sure thing given razor thin majorities in both houses), here’s an overview of what can be expected in real estate markets:

- Diamond Hands – The most obvious behavioral consequence of the proposal is that holding periods for investments will get substantially longer. The post-tax return on flipping and shorter term value add business plans will fall substantially, meaning that long term cash flow prospects will become more valuable than short term pops in valuation. Investment vehicles that are structured for flexibility and indefinite hold periods will likely gain share over those with a well defined time period.

- Lenders – Providers of debt will be a big winner here as the incentives under the new tax structure lean heavily towards maximizing cash out refinances – which are not taxable events – over sales – which are taxable events. Over time this results in a more highly leveraged system that is more vulnerable to economic downturns. Wall Street banks are a big winner as more debt means more spread income and fees.

- 1031 Exchanges: Assuming that they aren’t ended (as was floated during the campaign), 1031s will gain in popularity as the consequences of a sale versus an exchange become more punitive. 1031 exchanges will become even more widely used and investment structures that allow for their implementation – think TICs – will likely gain in popularity.

- Cap Rates and Valuation – Higher capital gains taxes make yield generating investments that don’t need to be sold to generate a cash flow relatively more attractive than non-yield investments. It also means that 1031 exchange participants are willing to accept lower returns on their Upleg to avoid paying higher taxes. When these incentives coincide with decreased sale volume (in response to tax incentives to hold), they should lead to lower cap rates and higher property values.

- Homebuilders – One unexpected beneficiary of increased capital gains taxes is homebuilders. Builders are classified as dealers rather than investors by the IRS and their profits are taxed as earned income. If capital gains rates increase to parity with earned income rates, an investment in for-sale housing becomes relatively more valuable on a post-tax basis.

Tax policy changes but human response to incentives does not. Those who get in front of changing capital flows resulting from substantially higher capital gains taxes will reap the benefits down the road.

What I’m Reading

The Oracle Speaks: Blackstone Group’s president and COO Jon Gray thinks higher inflation is on the way, and he thinks real estate investment in multifamily in areas primed for job growth could be the anecdote for investors. The Real Deal

Sweet Spot: The Phoenix area is expected to add 12,000 new apartment units by the end of 2021. However, in a market that added 75,000 new residents last year and was already experiencing a housing shortage, that isn’t nearly enough to keep pace. As a result Marcus and Millichap is forecasting rents to increase by 7.2% and vacancy to fall from 3.8% to 3.3%. Daily Independent

On the Fence: The Biden administration is weighing how to overhaul the Qualified Opportunity Zone program that was pitched as a way to drive investment to economically depressed swaths of the country but which early evidence suggests has primarily fueled real estate development in already-hot markets. The latest 43% capital gains rate proposal will only drive interest in this space. New York Times

Up, Up and Away: Federal government stimulus payments and expanding payrolls are boosting savings, enabling building managers to lift rent prices on apartments and houses nationwide. (h/t Scott Ramser) Wall Street Journal

Help Wanted: Millions of restaurants are hiring all at once, contributing to a national worker shortage. According to Census survey data from early April, a whopping 37% of small businesses in the hospitality and food sectors say their operating ability was affected by worker availability. Axios

Charts of the Day

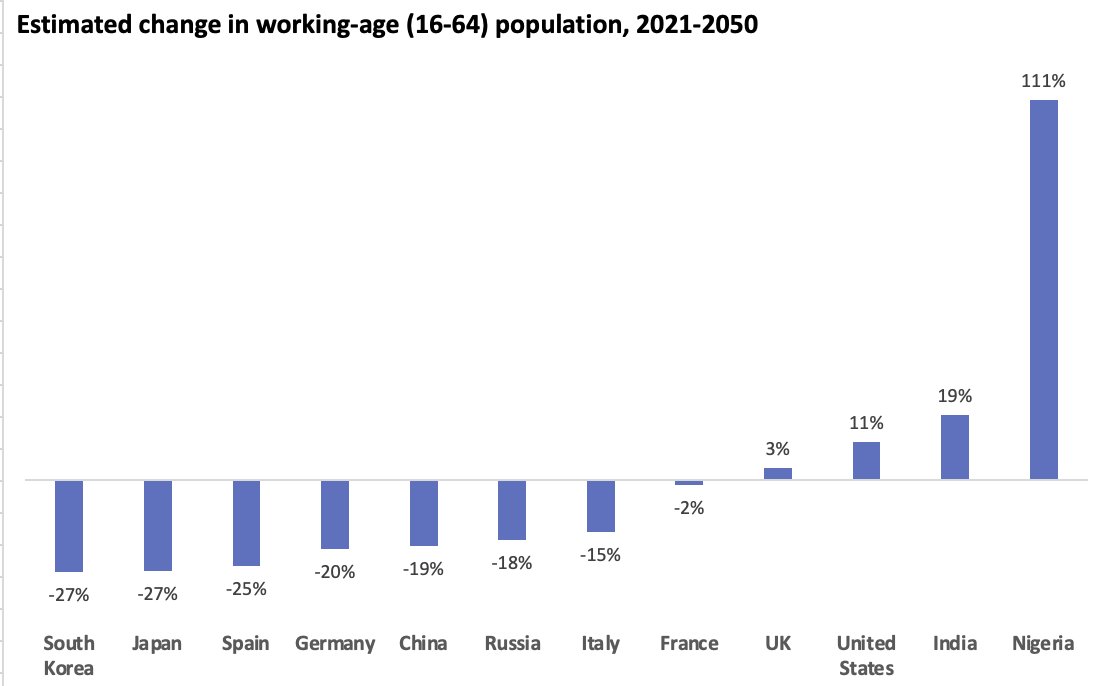

Some of this – especially China – is quite surprising.

Source: Morgan Housel

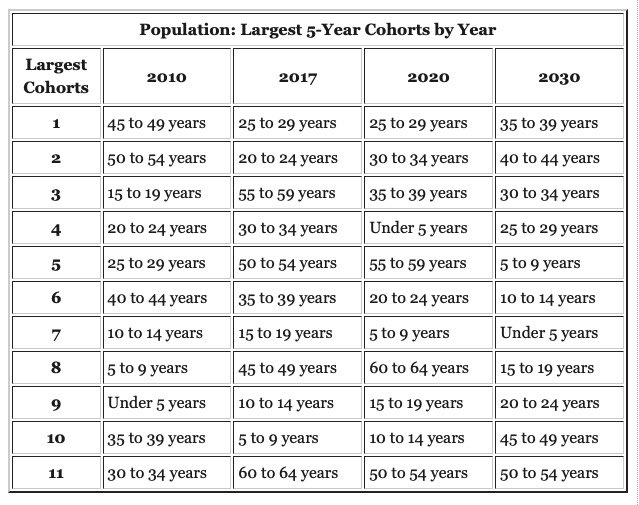

Also, this is incredibly bullish for the US economy over the next few years.

Source: Calculated Risk

WTF

Early Risers: Two intruders entered a closed Denny’s restaurant yesterday and made themselves eggs before being chased from the eatery by a worker who had been alerted to the predawn trespassing. The Smoking Gun

Junk in the Trunk: A man appeared to be getting a butt injection while appearing on a Zoom court hearing because Florida. Above the Law

Basis Points – A candid look at the economy, real estate, and other things sometimes related. Visit us at RanchHarbor.com