What I’m Reading

On the Fence: China’s cabinet is split over whether or not to provide stimulus to bail out the country’s tanking property market as fears of re-inflating a bubble persist. Financial Times Watch this space. Developers in China account for a large percentage of global commodity consumption. If development there continues to freefall, it’s very deflationary.

Moon Shot: Cushman and Wakefield projects rents for warehouse and distribution space will climb 30% over the next five years in several key US industrial markets, as demand continues to outpace supply for the sector. Globe Street

Top Tick: Commercial mortgage debt outstanding hit a record high in Q4 2021, increasing 7.4% YoY. Commercial banks continue to hold the largest share (38 percent) of mortgages at $1.6 trillion. Agency and GSE portfolios and MBS are the second largest holders of mortgages at $901 billion (22 percent of the total). Life insurance companies hold $618 billion (15 percent), and CMBS, CDO and other ABS issues hold $609 billion (15 percent). Commercial Property Executive

Got Wood: The “mass timber” movement is a growing worldwide effort to build high-rises and other buildings out of wood composites rather than steel and concrete, for environmental reasons. Axios

Up and To the Right: US home prices rose by nearly 20% year-over-year in February. However, affordability has become severely strained thanks to soaring prices and mortgage rates, which will likely cause demand to cool somewhat moving forward. CNN

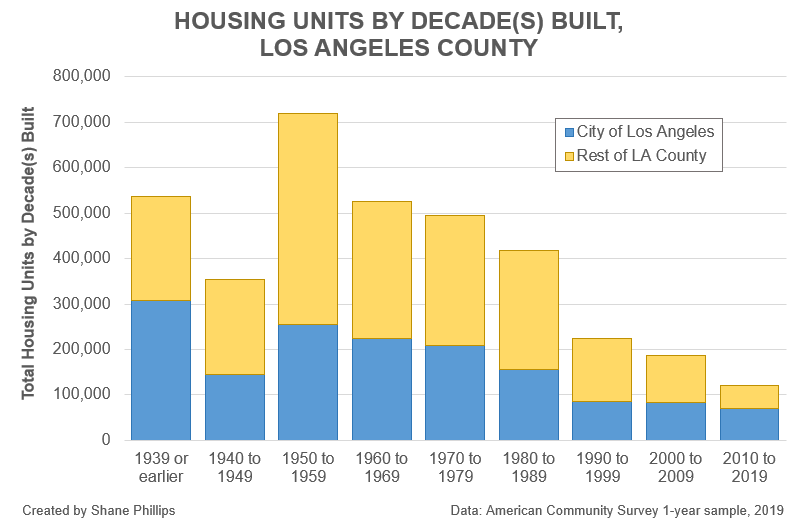

Chart of the Day

Hey you guys, I think I found the problem.

Source: Shane Phillips

WTF

Indecent Exposure: A man was arrested for video calling random people while completely nude and making lewd gestures because Florida. WFLA

Catching Rays: A crocodile sunning itself led to the the shutdown of a Naval Air Station runway because Florida. WSVN

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com