What I’m Reading

Fighting the Last War: We tend to look to the recent past to understand today’s market. However, the inflationary period of the late 1970s – which saw a decline in real housing prices with nominal prices up somewhat – is probably a better analogy for today’s market than the housing bubble. Calculated Risk

Cracks Appearing: Real time data continues to deteriorate in the trucking industry and signs of a freight recession are growing. Freight Waves

Squeezed: The Russian invasion of Ukraine is squeezing already struggling US homebuilders but sending commodity costs soaring. Builders, who had been dealing with pandemic supply chain disruptions are now bracing for even further cost hikes and delays, putting the squeeze on already tight housing inventory and affordability. CNN Business

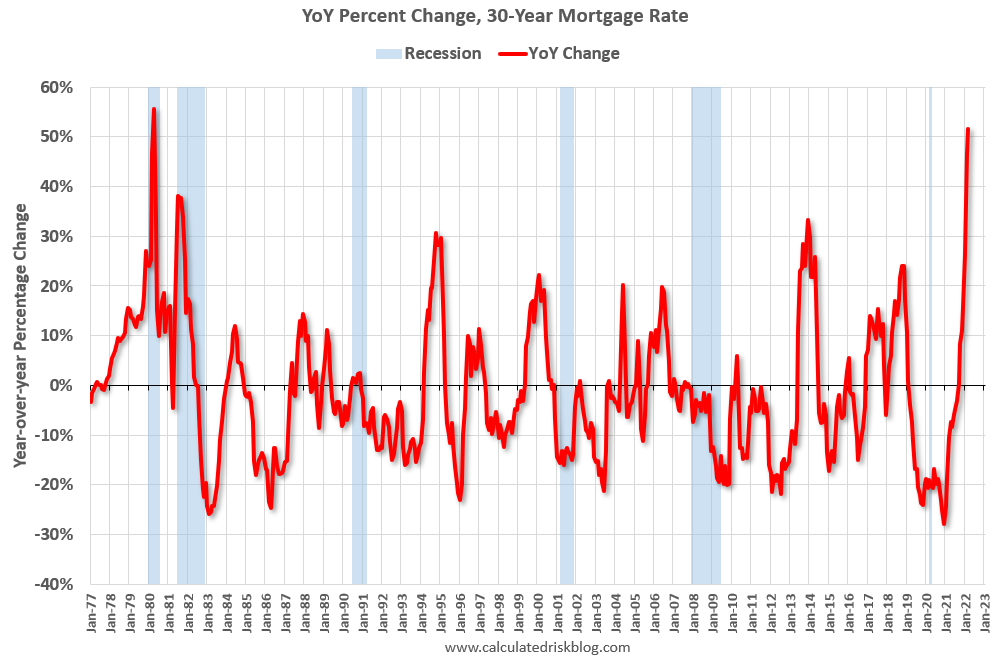

Moonshot: Mortgage rates have soared to 4.67%, their highest level since 2018. Rates are up 1.56 percentage points since the end of 2021, the largest increase since May 1987. However, this doesn’t tell the entire story. In 1987, rates went from 9.03% to 10.7% in 3 months, an increase of 18.5%. In 2022, that 1.56% move previously mentioned was > 50%. Housing Wire

Pain Point: Barclays sees global office demand potentially dropping between 10 and 20 percent in the long run as companies continue to grapple with the implications of hybrid work. This isn’t necessarily anything new but the office market outlook isn’t improving, even as the economy fully reopens. Globe Street

Chart of the Day

While absolute levels may still be relatively low, the rate of change in the 30 year mortgage is massive.

Source: Calculated Risk

WTF

True Love: A 32-year-old paralegal who’s going to law school married an inmate on death row because Florida. Tampa Bay Times

Self Policing: A drunk man shot himself in the groin with a stolen gun while tryin gto burglarize cars because Florida. Tampa Free Press

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com