One Big Thing

I’ve been hearing a lot of chatter about the future of cities of late, especially those of the large gateway variety that boomed in the years following the Great Recession. The latest example is a Globe Street piece last week that excerpted a CBRE podcast about the future of New York and how it would bounce back. The article contained all of the typical clichés and platitudes about how cities attract talent, how they are vital centers of innovation and capital deployment and how people have called for NYC’s demise over the past 50 or so years and always been wrong.

This sort of ‘analysis’ annoys me to no end. Its not that I disagree with the premise – that downturns in gateway cities tend to be cyclical in nature – but rather that they leave out two key elements: time and price. Yes, the people who said that NYC was dead in the 1970s and 80s were eventually proven wrong but that didn’t mean that there weren’t many years of pain in the interim that drove real estate values so low that the seeds of creative destruction could take root again.

Almost as if on cue, a story leaked yesterday that Goldman Sachs is considering moving its asset management business to Florida, as success in operating remotely during the pandemic has emboldened leadership that they can move roles out of NYC to save money. Bloomberg This is just one division but at some point, one of the big investment banks is going to move its front-office jobs to another city. when that happens, other firms will begin to ask why they are still in NYC paying such high costs.

COVID caused a lot of trends – like moves away from big expensive cities – to accelerate. It also proved to companies looking to cut costs and reduce taxes that their workforces can function well without being clustered in expensive, high tax metros. Any city or state that ignores these facts does so at its own peril. Taxes, cost of living, schools and quality of life all matter. Perhaps New York will bounce back soon after the COVID era ends. Or, perhaps it won’t and values and rents will have to drop a lot further before it turns the corner. But anyone using the 70s and 80s in New York as a positive analogy for today – especially those whose livelihoods depend largely on office performance – comes off as talking their own book.

What I’m Reading

Shrinkage: The labor market has shrunk dramatically during the pandemic, especially among women and baby boomers. Wall Street Journal

Mall Rats: The inside story of a tiny black sheep hedge fund, their massive bet that shopping malls would crash, and how they proved Wall Street wrong. Esquire

Real Time: One long-lasting result of the pandemic may be innovations that make home buying faster. NY Times

Healing: Both foreign and domestic investors are returning to the market, with inquires hitting 90% of pre-pandemic levels. Globe Street

Chart of the Day

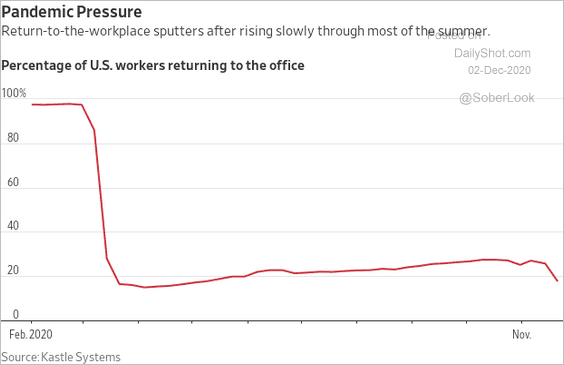

And now we check in on how the whole ‘return to the office’ thing is going….

Source: The Daily Shot

WTF

Negative Side Effects: Yet another downside to getting COVID is that it may cause erectile dysfunction, according to doctors. I can’t help concluding after reading this that Pfizer has positioned themselves to win either way. NBC

Breakdown: Breakdancing is going to be an Olympic sport in 2024. Yes, break dancing. I take back every mean thing I ever said about speed walking. Reuters

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com