What I’m Reading

Tailwind: The US apartment market continues to strengthen with strong rent growth and occupancy at all time highs. RealPage FWIW, this is exactly what should logically be expected to happen in an environment with strong household formation demographics and an increasingly tight homebuying environment – Marginal buyers become renters.

Weighed Down: With vacancy and sublease availability remaining stubbornly high, the uncertain future of how office properties combat remote working trends is weighing heavily on the U.S. commercial mortgage-backed securities market. Commercial Observer

About Time: College enrollment has been declining since 2012. Now, inflation-adjusted college tuition is on the decline as well. Full Stack Economics

Reprieve: Home price growth has finally begun to slow and several prominent economists believe that prices will grow very slowly – or may even fall slightly – in 2022. However, most of the potential ownership cost savings will be eaten up by likely-higher mortgage rates. Fortune

Betting the House: As real estate funds increase multifamily allocations, they are buying operating companies – not just individual properties and portfolios – as part of the business model. Globe Street

Chart of the Day

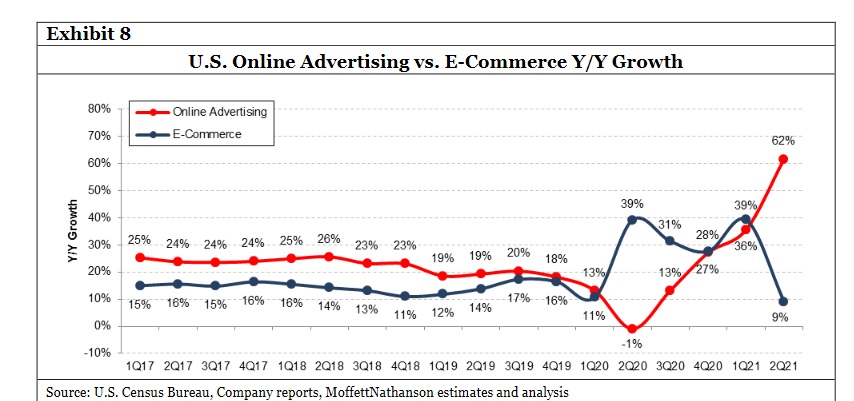

The bull case for brick and mortar retail in one chart.

Source: @ModestProposal

WTF

Nice: A new study found that taking Viagra cuts the risk of Alzheimer’s by up to 69 percent. NY Post

Side of Meth: A Tennessee Waffle House chef was arrested for selling meth from the restaurant where he worked. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com