What I’m Reading

Shelter In Place: Higher interest rates will make move up buyers with low, fixed mortgage rates and tons of equity less likely to move. Instead, they will likely renovate or expand their existing homes. At the same time, builders confidence is declining as rates rise and supply chain issues drag out construction schedules. The result will be less supply, which will keep markets tight even when demand inevitably declines. Bloomberg

Soaring: 2021 was a record setting year for single family rental growth. Corelogic

Creative Destruction: Business creation has exploded during the pandemic era. There were 5.4 million applications to start companies in 2021, a 53% jump from pre-pandemic levels in 2019, according to census data. A third of those were classified as “high-propensity applications,” meaning they’re new businesses that are likely to create jobs. Thus far in 2022, the pace is not slowing. This is great news for the economy coming out of one of the least entrepreneurial decades in US history. Axios IMO, this will also contribute to continued upward pressure on rents as marginal buyers continue to rent.

Behind the Curve: Wage growth is no longer outpacing inflation and workers are beginning to fall behind. Vox

Yield-Starved: Pension funds are pivoting away from investment-grade bonds and towards riskier private debt in an effort to increase yields. Wall Street Journal

Chart of the Day

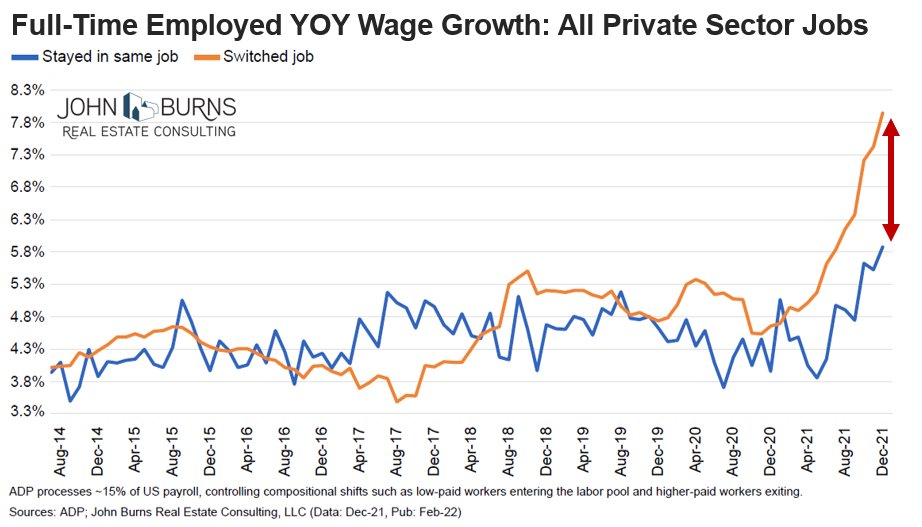

Who said quitters never win?

Source: JBREC

WTF

Bounty: A woman used part of a PPP loan to hire a hit because Florida. DNYUZ

Assist: A man accidentally shot himself in the foot while running away from police at a traffic stop because Florida. Local 10

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com