What I’m Reading

Round Trip: Mortgage rates are back to 2019 levels but prices are far above where they were in 2019. Calculated Risk IMO, the impact on stressed home affordability on rent growth is still being generally underestimated, despite the explosive growth over the past year or so.

Pile Up? Once the busy container market normalizes and sees lower demand, fewer delays and less congestion at ports, supply chains may end up drowning in millions of empty containers. Shipping Watch

We Mean it This Time: As omicron fades, employers are telling their workers that their return-to-the-office plans are for real this time. Your move, employees in arguably the tightest labor market ever. New York Times

Trickle Down: Tertiary markets are being flooded with residents who are fleeing boom cities (which are being flooded with residents fleeing expensive coastal markets). This fanning out of the population means that prices in tomorrow’s “affordable” city is already unaffordable. New York Times

Million Dollar Listing: The number of US cities with average home prices of $1MM tripled last year. CNBC

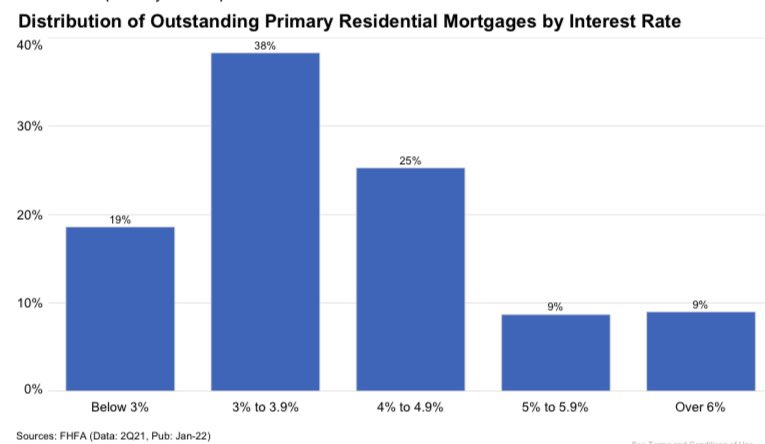

Chart of the Day

This does not bode well for refinance volume, or for that matter, the move up market. The result will be even less supply.

Source: Rick Palacios, Jr

WTF

Frozen Sausage: A Finnish cross country skier suffered from a frozen penis – for the SECOND time in his career – during the 30km cross country race at the Olympics. Reuters

Let it All Hang Out: A lawyer who was refused bar service, stripped down and demanded to be served because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com