What I’m Reading

Fallout: CoStar is estimating that the reckoning from COVID will eventually result in $126 billion of distressed real estate sales with a heavy concentration in lodging and retail. However, with an estimated $200 billion of capital raised to capitalize on such an opportunity, it is difficult to see how we see wide-spread fire sale pricing. Mortgage Professional America

Checking In: NMHC’s first rent payment tracker of the year found that 76.6% of apartment households made a full or partial rent payment by January 6. This is down 1.7 percentage points from January 6, 2020. I would imagine that these numbers begin to stabilize some with more federal assistance on the way. NMHC

Blood Bath: Rents for retail space in Manhattan have tumbled to historic lows, dropping as much as 25% from 2019 levels according to the Real Estate Board of New York. REBNY

Beneficiary: Rental home construction is rising as purchase prices continue to surge. The trend towards more space is real and investors are betting Americans will keep flocking to spacious suburban living even if they can’t afford to buy. Wall Street Journal

Long Term Benefit: The coronavirus has displaced tens of millions of workers, and forced thousands of businesses to close. But the virus has also encouraged rapid changes in the way we work and consume—and some of those changes could be both beneficial and long-lasting. Barrons

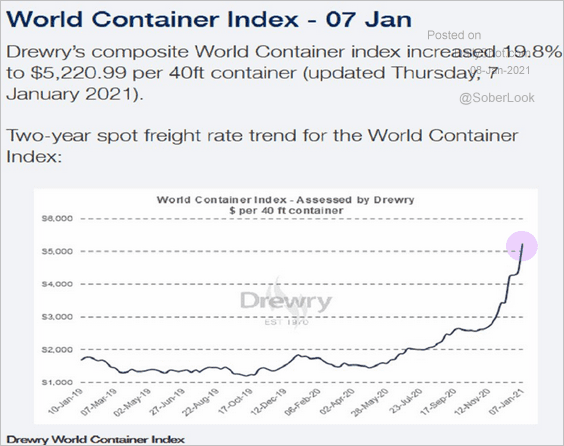

Shipping container rates are going parabolic.

Source: The Daily Shot

WTF

Self Harm: A man was hospitalized after setting himself on fire while attempting to commit arson because Florida. Fox 13

Good Riddance: American Airlines is banning emotional support animals. Shout out to all the weirdos who are going to have to drive cross-country with a peacock, snake or pig in the back seat of their car now. CBS News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com