What I’m Reading

Pulling the Ripcord: Looking back, the non-bank mortgage lenders rushing to sell shares to the public last year was probably the peak of the business cycle. Since then, borrowing costs have doubled, the market has slowed to a crawl and the buyers of those IPOs are left holding the bag. Bloomberg We were all over this when the non-bank lenders filed IPO documents. However, the decline has been even quicker than expected.

Throwing in the Towel: Developers Silverstein Properties and Metro Loft have bought a struggling office building in the city’s financial district into. apartments. Coming soon to a city near you. Wall Street Journal

Warning Sign: Distressed CMBS losses soared in May with several retail and hospitality projects making up the bulk of the problems. Commercial Observer

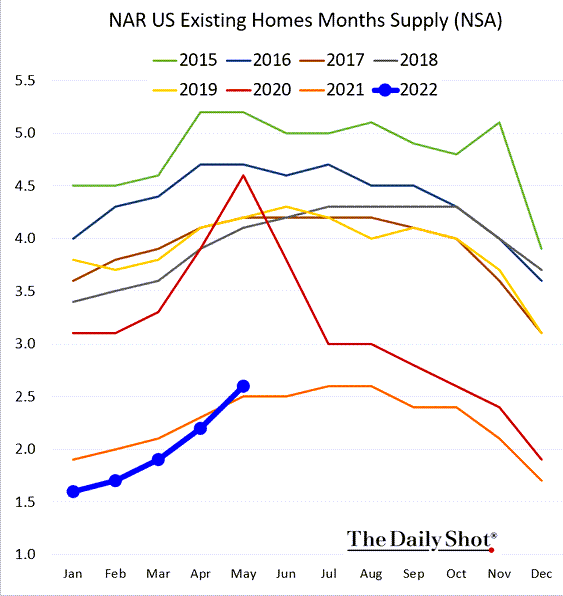

Priced Out: Housing affordability has hit a 15-year low with mortgage payments now higher than rent in 45 of the 50 largest US metros, up from 22 in 2019. Inventory has begun to recover but is still 50% below 2019 levels. Zillow

Holding the Line: Commercial construction starts and planned starts are still increasing despite recession warning signs, driven by larger projects that tend to be more cycle resistant. Bisnow I would imagine that this will change soon, especially for smaller projects that are more cycle sensitive as rates and construction costs continue to soar. We are already hearing plenty of anecdotal evidence of this.

Chart of the Day

A bit of perspective: housing inventory is increasing but from a still incredibly low level.

Source: The Daily Shot

WTF

House Party: A large group of teenagers broken into an $8m mansion, trashing it while hosting boxing matches because Florida. Click Orlando

Virtual Reality: An 18 year old was arrested for selling fentanyl, cocaine and oxycodone to undercover officers on Snapchat because Florida. Tampa Free Press

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com