One Big Thing

Construction prices are soaring and eating into the yields of multifamily developers. In an environment like this, its nearly impossible to forecast costs over the typical 2-3 year build cycle for most large multifamily buildings. As a result, developers have to gamble that rent increases will keep up to allow them to make a profit. WealthManagement.com

When costs are increasing rapidly, each new building must achieve rental levels higher than the last in order to be financially viable. IMO, the biggest beneficiary will continue to be owners of well-located existing buildings. Construction cost increases act as a growing barrier to entry. As costs increase, development becomes even more “top heavy” with luxury units, meaning less construction that targets middle income residents who account for a plurality of demand.

Value add multifamily has had a long run but we remain bullish on it so long as conditions that lead to this sort of supply / demand imbalance persist (and assuming that it can be had at a basis that makes sense which is increasingly easier said than done in this environment).

What I’m Reading

Sweet Spot: Single family build to rent communities are experiencing a boom as potential buyers who either can’t afford (or can’t find) a home become renters. I expect this to continue so long as affordability and supply issues persist in for sale housing – in other words, for quite a while. Wall Street Journal

Carrot: The Biden Administration’s infrastructure bill includes $5 billion to incentivize zoning reform that would spur cities to allow more housing to be built. The money would be put in a fund that would provide grants for municipalities to build and improve schools, roads and other infrastructure in exchange for loosening restrictive zoning codes. Reuters

Round Trip: Property prices nationwide are only 1% below pre-pandemic levels according to Green Street’s latest property price index release. Obviously, this is a mixed bag. Self storage, industrial, manufactured housing and some apartment markets are valued well above where they were before COVID. Others, not so much. Globe Street

Desperate Measures: In the latest anecdotal example of extreme worker shortages, a Jersey Mike’s in California is offering hiring bonuses of up to $10,000. Wage inflation is legit, folks. Business Insider

Chart of the Day

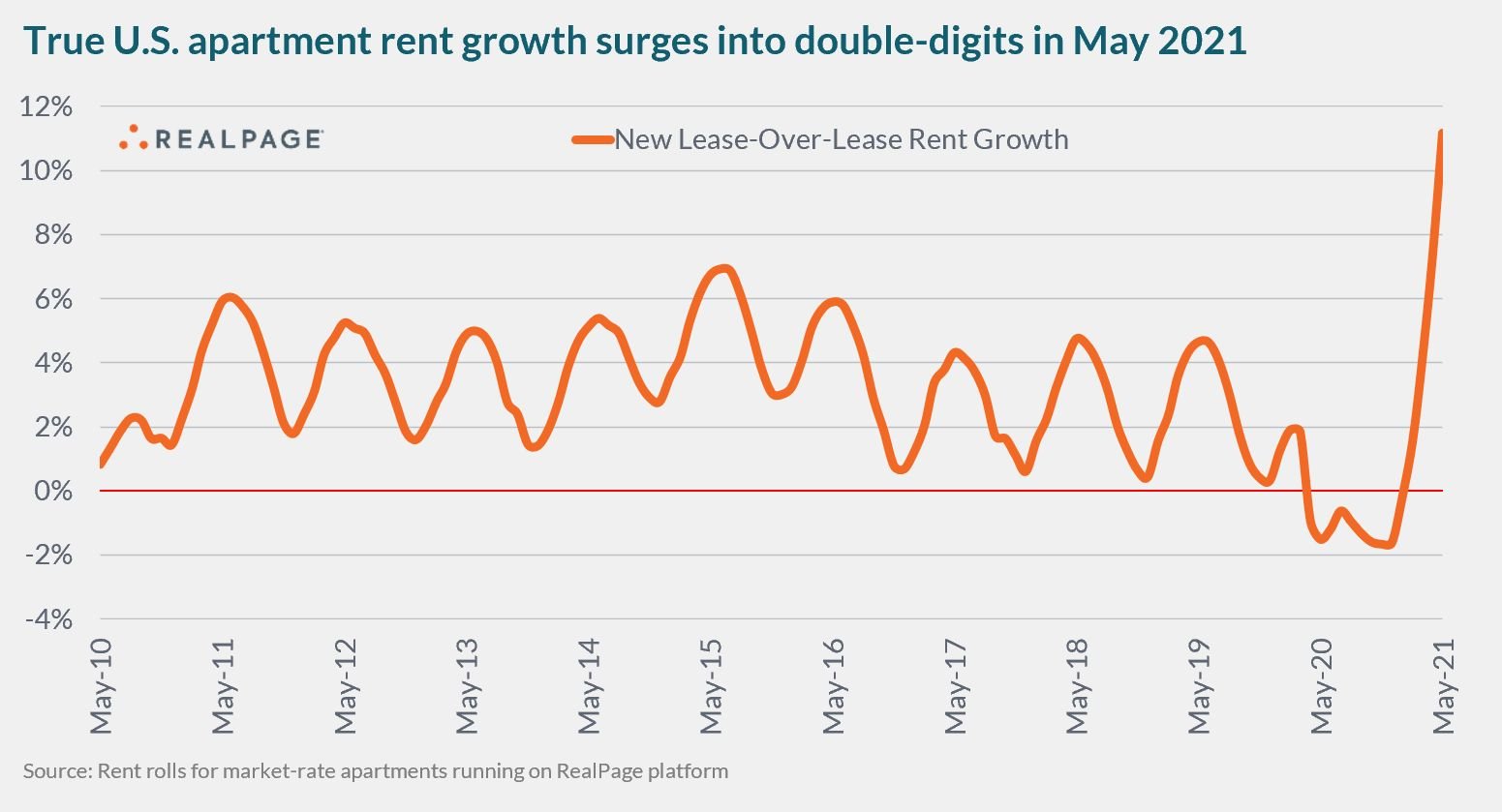

When marginal buyers can no longer afford to buy (or perhaps even find a home to buy), they become renters. More demand + same rate of supply growth = explosive rent growth.

Source: Real Page

WTF

Top: Disgraced former Congressman Anthony Weiner (aka Carlos Danger) is considering a new career in “political collectibles” starting with the sale of his infamous crotch shot as an NFT. I get that Wiener needs money but who the hell would buy this? New York Post

Father of the Year: A 32 year old man tossed a two month old baby at police after a high-speed car chase because Florida. Sky News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com