One Big Thing

Interesting story in Globe Street early this week about ReadyCap providing $104MM in construction-to-bridge financing on a new 200 unit apartment building in San Francisco. The project had apparently been behind on leasing thanks to COVID and therefore not able to obtain permanent financing when the construction loan matured. (h/t Steve Sims) Globe Street

Almost exactly a year ago (March 10th, to be exact), I found myself on a flight home from an Idaho ski trip with my family. The virus was spreading and financial markets had gone into a tailspin with stocks and treasury yields plunging. While blogging at the old Landmark Links and trying to make some sense of the carnage / cut through the day to day noise, I focused in on liquidity and the critical role it would play in determining the economic trajectory of the next year: Landmark Links

We’ve seen more than a bit of anecdotal evidence that the fire hose of liquidity that has flooded the private debt space in recent years has provided ample cover for maturity defaults and cost overruns that have been present for the better part of this expansion. The willingness of lenders to extend bridge-to-bridge and construction-to-bridge financing to otherwise busted projects has masked a lot of issues that otherwise would have come to the surface much sooner. If/when that wave of liquidity dries up, things will change quickly and there is already some evidence that the ultimate sources of that capital are beginning to run into issues. Much of the real estate market has benefited from low supply which will provide some cushion, at least in terms of asset values should this liquidity tidal wave run dry. But rest assured, the inability to recap struggling projects is the immediate risk in the market right now.

Somewhat ironically, while commercial real estate will likely run into a rough patch if liquidity starts to dry up, residential (both for rent and for sale) actually seems to be fairly well positioned. There are few if any markets where oversupply is anything close to an issue and thanks to Fannie Mae and Freddie Mac, liquidity is abundant. We will be in a period of positive demographic growth for several years and people need places to live. In fact, there is already anecdotal evidence that the US residential market is being viewed as a safe haven investment as other sectors get hammered. Couple that with the fact that refinancing activity is off the charts and nearly 70% of American homeowners are now in the black when it comes to potential refinance savings and its not difficult to see how a much-maligned housing sector becomes a tailwind in an economy that is suddenly facing more than a few headwinds. This will be especially true if mortgage rates revert to their historical 10-Year Treasury + 180 basis point spread, rather than the elevated 250+ basis point spread that they are priced at today. Liquidity will be more important than cap rates, if it starts to dry up, there will be pain but also opportunity for those who are well positioned.

It has been almost exactly a year since I started writing this blog on a daily basis – first at Links (before RanchHarbor was internet official) and now at Basis Points. Except for a relatively brief period in March and April, liquidity has remained relatively abundant and enabled transactions like the refinance mentioned above to occur, rather than wind up in a workout. Now we have entered a new phase where interest rate pressures are decidedly upward but the same underlying theme remains: market liquidity ultimately trumps asset performance at least in the short to intermediate term.

If you are still looking for widespread distress – outside of assets like retail and hospitality that have been acutely impacted – two questions must first be answered: when will liquidity dry up and why? If you can’t, its difficult to imagine a substantial amount of distress, even if rising rates/deteriorating fundamentals result in property values decreasing somewhat.

I’ll finish with a quote from an article from Daniel Rasmussen & Greg Obenshain of Institutional Investor who summed this up perfectly in January of 2020 before the pandemic fully took hold:

Default cycles require not just insolvency, but also a lack of external funding to give highly leveraged companies another chance. If there is no funding source to replace that which is lost, then the weakest companies default, trading and credit losses mount and fund flows get even worse.

Same as it ever was.

What I’m Reading

Confidence Game: Builder confidence decreased in March as higher construction costs and interest rates began to take a toll on outlook. To be clear, confidence numbers are still very high and this was still a strong reading. However, the market is now experiencing headwinds not seen in nearly a year. Calculated Risk Blog

Signs of Life: Covid-19 ravaged hotel bookings, but now occupancy rates are rising and lodging firms are hiring as vaccine distribution helps spur leisure travel. Wall Street Journal

To the Moon: As crazy as the housing boom seems in some US regions, it is nothing compared to what is going on in Canada. Our neighbors to the north never really experienced the downturn that we had during the Great Recession and their housing market has moved in only one direction in all of recent memory: up. This is what insanity looks like:

Things are starting to get a bit loony: in Toronto a detached garage — sans the home — was recently listed for sale for C$729,000. In Woodstock, Ontario, a city of about 40,000 southwest of Toronto, the average increase in home values last year was greater than most residents’ annual income.

Backlash: Young people are getting frustrated with working from home. In a newly released survey by CommercialCafe, around 37% of Gen Z respondents said their work-life balance has deteriorated as a result of pandemic WFH policies. Contrast that with the 55% of Baby Boomers who said they haven’t experienced any change in their work-life balance at all since COVID-19 began. Millennials and Gen X also generally had favorable views of remote work. To be clear, corporate real estate decisions rarely hinge on the opinions of the most junior members but this is a trend that should be watched if a backlash continues to grow. CommercialCafe

Chart of the Day

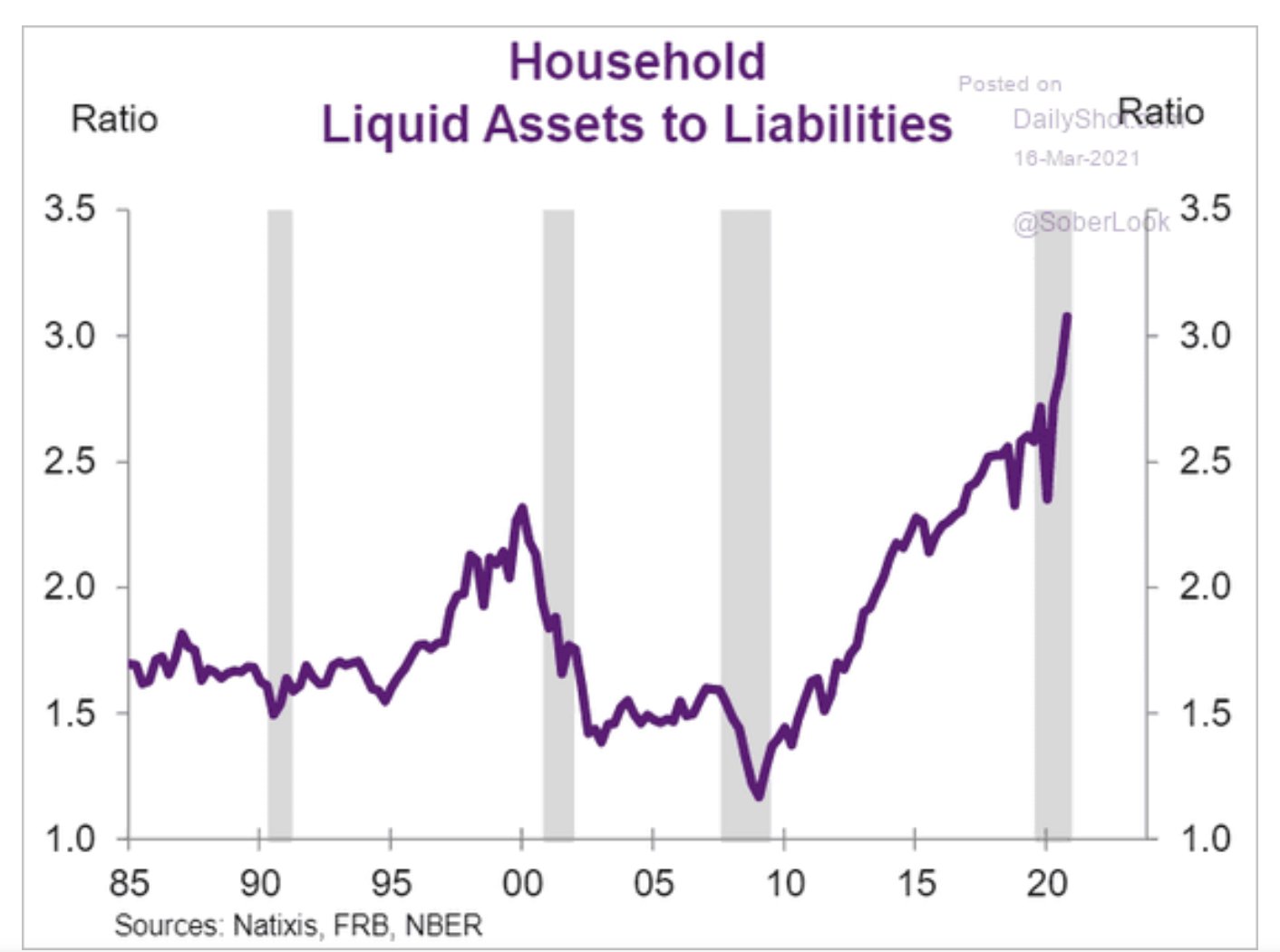

The ratio of liquid assets to liabilities of US households are at record levels. Impossible to overstate how different this environment is from 2008.

Source: Natixis

WTF

Bombs Away: A man who was upset that his stimulus check had not yet arrived was arrested for throwing a smoke grenade at Mar-a Lago because Florida. Also, because he apparently has been living under a rock since early January. Florida News Times

Tough Breakup: A woman was arrested after striking her ex boyfriend with a hammer, puncturing his car tires and smearing bbq sauce and whipped cream on his car because Florida. Local 10

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com