What I’m Reading

Everything Must Go: San Francisco’s biggest tech companies are sitting on a mountain of empty office space that has come available for sublease. Unlike landlords, these companies are not in the business of leasing real estate and are willing to take big impairments to sublease at a substantial discount in order to fill the space. So far there have been few takers though as sublease space continues to pile up, creating a longer term headwind for the SF office market. CNBC

Where it Counts: Bill McBride has been writing the Calculated Risk Blog for 17 years and has been as insightful (and typically correct) as anyone out there about the US housing market. He sums up the current state of housing perfectly:

No one has a crystal ball, but one thing I’ve learned over the years is to watch housing inventory. And it is my sense that Existing Home Inventory Might Have Bottomed. If inventory has bottomed, then the question will be: How quickly will inventory increase? I don’t have an answer yet, but if inventory increases slowly, house prices will continue to rise rapidly, and if inventory increases sharply, house price growth will slow.

Flooding the Zone: Debt funds continue to proliferate in the US commercial real estate market and ample liquidity is forcing them to tighten spreads in order to remain competitive. Globe Street

Under Pressure: A new survey from the National Multifamily Housing Council shows that builders are increasingly concerned about supply constraints and increasing costs, with 40% of respondents citing price increases north of 20% for their most impacted materials. This will result in delays and higher replacements costs, creating an even stronger tailwind for well-located existing product. NMHC

Growing Pains: Shortages caused by supply chain issues are holding back production and causing some wild price fluctuations. One thing that I definitely underestimated over the past year is just how difficult it is to restart a supply chain that has been shut down – even for a short period of time. If demand bounces back quickly, it can take a very, very long time. Bonddad Blog

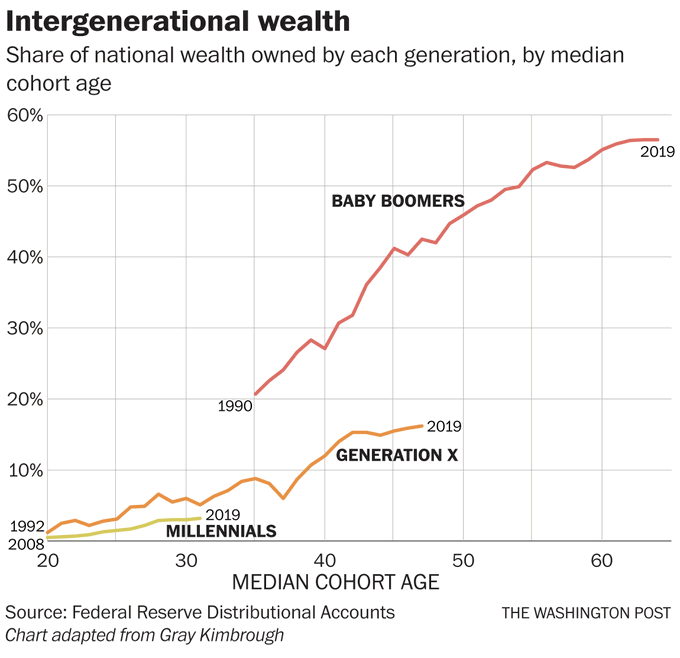

Chart of the Day

Source: @DividendGrowth

WTF

Sore Loser: A woman who lost $400 playing slot machines at a casino called in a bomb threat to “blow off steam” because Florida. The Smoking Gun

Smoking Gun: A man who committed burglary with Samurai sword was arrested after leaving his cell phone with photos and video of him at the scene because Florida. TampaBay.com

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com