What I’m Reading

Cash Trap: The rapid appreciation of the dollar this year helps boost the exports of weaker countries while alleviating inflationary pressures in the US by lowering the cost of imports. However, it also translates into higher import prices, more costly external debt servicing and greater risk of financial instability for developing countries. Financial Times

Friends with Benefits: U.S. officials and allies around the world are looking to establish friendly supply routes for key goods amid a war and global pandemic. However, shifting production away from China will likely add to inflation. Wall Street Journal There is a big tradeoff here between low cost efficiency (China) and supply chain security. IMO, Mexico could be an eventual big winner.

Credit Where Due: The White House announced a package of reforms designed to address the housing shortage in the US earlier this week. The federal government is going to start using financial incentives—specifically, Department of Transportation grants—to encourage local governments to reform their land use regulations. They are also going to attempt to incentivize production of manufactured homes. Most issues remain at the local level but the plan seems to cover many of the areas where the federal government has the potential to improve housing affordability. Full Stack Economics I’ve been pretty critical of the administration on a bunch of issues because they’ve deserved it. However, this seems like a step in the right direction.

Measure of Safety: This article about why a large equity cushion makes CLOs substantially safer than CDOs is quite good but what really got me was the opening paragraph, which is a perfect description of regulatory-enhanced economic cycles in the US:

A good way to look at financial history is that every post-crisis period overcorrects whatever the previous crisis got wrong. After 2000, rates were cut aggressively, and growth companies were viewed skeptically, so a lot of leverage flowed into a) financing buyouts, and b) financing mortgages. After 2008, policymakers decided that extensive stimulus, fiscal or monetary, could easily ignite the next bubble before the effects of the previous one had been fully worked off, so we ended up with a long era of subpar growth and low real rates. In 2020, we basically reversed this: remember the brief and wonderful period where it looked like recessions were a policy choice, and that it was entirely possible to spend enough money to actually reduce the poverty rate during a recession?

Staying Power: Eased pandemic restrictions mean that fewer people are stuck at home with their extra stuff. However, rent performance and demand are still on the rise for self storage even with construction booming in some markets. The Real Deal

In Demand: Last mile warehouse facilities continue to find high demand from both investors and end users, sending rents and prices skyrocketing. WealthManagement.com

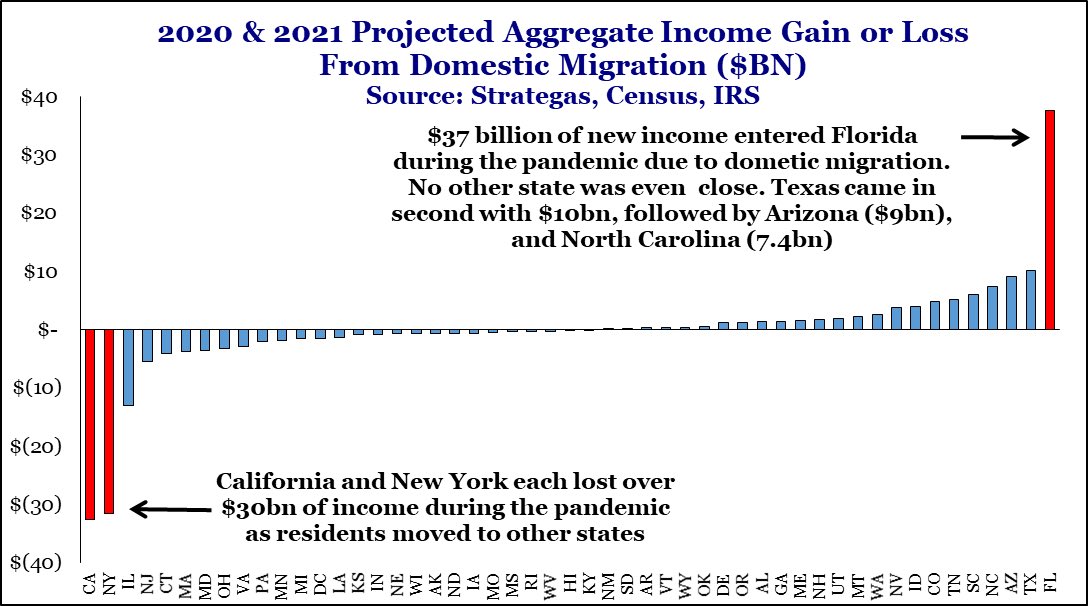

Chart of the Day

When it comes to pandemic era income gains, Florida stands alone. California and New York are on the other end of the spectrum.

Source: Daniel Clifton

WTF

Shitty Way to Go: A woman died after falling into a septic tank while gardening because Florida. (h/t Tad Springer) News Channel 8

Whacked: A woman is facing felony charges for allegedly beating her husband with a belt after she “caught him watching pornography on his cell phone and masturbating” because Florida. (h/t Steve Sims) The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com