What I’m Reading

New High: The nationwide price to rent ratio has hit its highest level since at least 1975, taking out the 2006 peak. While I am still not sold on the idea that we are in a bubble, valuations are clearly very rich and we are clearly well into an affordability crisis. I also read this as bullish for multifamily and SFR as affordability problems will continue to push marginal buyers towards renting. Federal Reserve Bank of St Louis

Sticking: About 60% of U.S. consumers now buy groceries online, and the same percentage of these shoppers plan to do so at the same frequency or more once the COVID-19 crisis subsides, according to a new study by Coresight Research. Supermarket News

Slow Burn: Struggling properties that were hit hard by the pandemic still find themselves in purgatory. Lenders are in no rush to foreclose but some hospitality and retail sectors are simply not recovering. Economic reopening also takes away the COVID crutch that they have leaned into over the past yet.

My opinion here remains unchanged – re-opening will prove to be a double edged sword for struggling properties that can no longer use COVID as an excuse, forcing lenders to act. However, there is so much money out there chasing distress that many will be recapped or sold at relatively small discounts. Bloomberg

Rebound: Rents for apartments rose 1.3% in April, according to RealPage, which is the fastest pace for a single month in about a decade. And the jump comes right at the beginning of prime leasing season, as the majority of household moves occur between April and September. Single family home rents are moving even faster, jumping 4.3% YoY in March according to Corelogic. You are about to start hearing the term Owner’s Equivalent Rent a whole lot more as housing cost enters the CPI discussion after largely taking a year off. CNBC

It’s Complicated: Real estate can be a good inflation hedge but only for landlords who are actually able to raise rents. IF inflation really takes hold, those who own property with long term leases and don’t have the ability to adjust rents will not fare well. Owners of hotels, rentals and self storage are well positioned here. Wall Street Journal

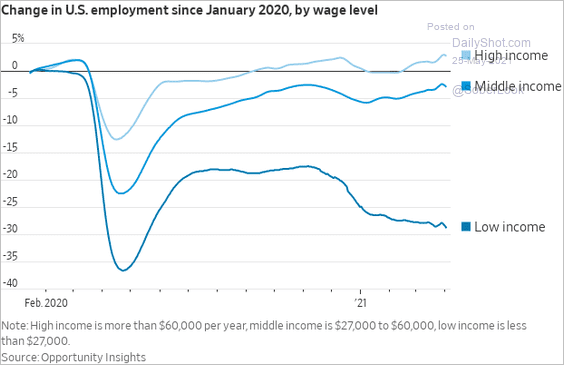

Chart of the Day

Low income employment is still lagging behind despite recent wage gains. Guessing that this has a lot to do with enhanced unemployment insurance.

Source: The Daily Shot

WTF

Act of God: An intoxicated man told troopers during a traffic stop that he was driving erratically because his truck was “struck by lightning” because Florida. NBC 2

Catch Me if You Can: A nearly naked woman who was rammed by police after a 110mph chase in a stolen Cadillac through two counties, was driving on a suspended license and in possession of meth because Florida. Daily Mail

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com