One Big Thing

Real Assets Adviser / IREI published an editorial that I wrote about some of the often-unseen risks in crowdfunded real estate transactions as part of their June edition:

Warren Buffet famously said, “Only when the tide goes out do you discover who’s been swimming naked.”

In recent years, the U.S. real estate industry has enjoyed positive economic growth and market fundamentals (with the obvious exception of spring 2020). During this five- to 10-year expansion period, crowdfunding emerged as a democratized way for investors to access commercial real estate. This new form of fundraising has opened doors to opportunities historically only available to large investors.

However, crowdfunding comes with some big risks, and thanks to the dazzling veil of an upward trending market, many of these risks have gone unnoticed……

Read the entire thing here: Real Assets Adviser / IREI

The editorial cuts to the core of why we launched the RanchHarbor investment platform: to give LPs with the investment discretion that they would find in a sponsor syndication / crowdfunding transaction and the protections found in blind pool funds, while providing single-check LP capital for real estate sponsors. Feel free to reach out to me if you’d like to learn more.

What I’m Reading

Creative Destruction: Small business owners are snagging prime retail locations in gateway urban markets like Manhattan as landlords look to fill vacant space. NPR

Fuel on the Fire: A $10 billion proposal by Democrat Maxine Waters that would give homebuyers up to $25,000 for a down payment is being called a priority by the Biden Administration. Any college freshman taking econ 101 could tell you that creating more demand in a white hot market with a major supply shortage will drive pricing up and make affordability worse. Yet, here we are. Politico

Fear Factor: Fear about possible elimination of 1031 exchanges, coupled with a general lack of supply and demand from yield starved investors has resulted in a booming net lease market. RE Journals

Ray of Hope? The US office market posted record negative absorption in Q1. The rate between asking and effective rates continues to widen, indicating that landlords are doing anything they can to avoid dropping face rates. On the bright side, the rate at which new sublease space is coming available has now slowed for two straight quarters, a sign that things could be starting to improve. Globe Street

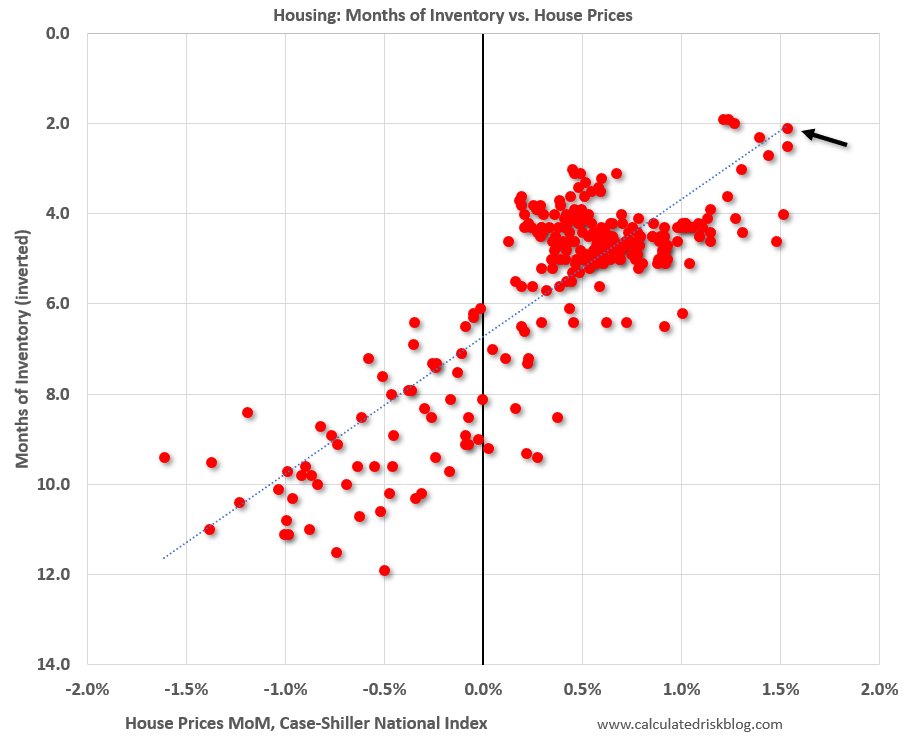

Chart of the Day

It’s almost as if there is some sort of relationship between supply and demand.

Source: Calculated Risk

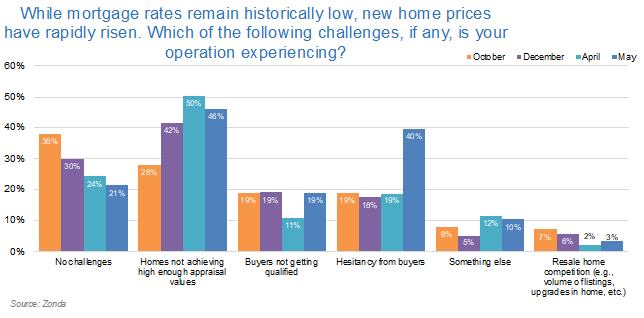

But buyers are starting to push back a bit on price.

Source: Zonda

WTF

Monkey Business: A Texas woman who jumped into the spider monkey exhibit at the zoo to feed the monkeys hot Cheetos has been fired from the law firm that she worked at. WSB TV 2

Thunder Dome: A Southwest Airlines flight attendant lost two teeth and walked away bloodied after she was physically assaulted by a passenger who refused to fasten her seatbelt. Best part is that Southwest isn’t even serving booze on flights right now. I expect this sort of thing from Spirit passengers. Southwest needs to get its shit together. (h/t Nicole Deermount) OC Register

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com