What I’m Reading

Tilting the Scale: Target institutional allocations to commercial real estate increased for the eight straight year in 2021 according to a recent survey by Hodes Weill & Associates and Cornell University. The average target allocations increased to 10.7 percent, up 10 basis points from 2020, indicating the potential for an additional $80 billion to $120 billion of capital to be allocated to real estate in the coming years. Allocations are expected to increase substantially in 2022 as well. This is happening at a time when state pension funds are flush with cash that must be reinvested into an environment characterized by high asset prices. Commercial Property Executive

Hot Seat: With inflation running hot, we are about to get a whole lot more focus on rents, which tend to be sticky to the upside and lag actual market movement thanks to a measurement quirk. Bloomberg

Warning Shot: Almost a quarter of financial-services firms are planning to reduce their workforces in New York City in the next five years according to a new survey from the Partnership for New York. This is a big deal for a city that is highly reliant on tax revenue generated by office workers. Bloomberg

Key Indicator: There are more than a few cross currents in the US housing market right now. However, the trajectory of the market – as always – will hinge on inventory levels, which are still quite low. Calculated Risk

Difficult Choices: Unprecedented demand for appliances and supply chain issues are forcing builders to buy early or go with non-matching sets. Globe Street

Chart of the Day

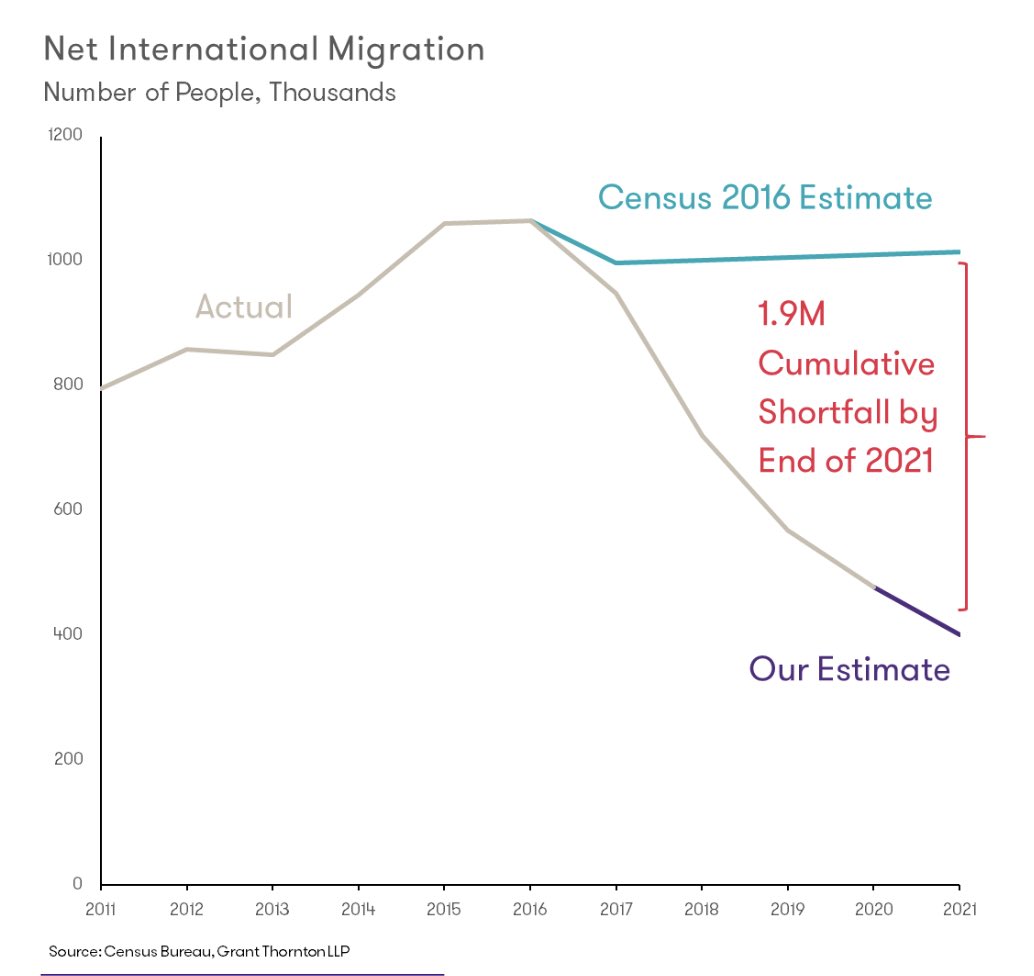

This is having a real and substantial influence on the labor market. More immigration would help. A lot.

Source: Diane Swonk

WTF

Fish in a Barrell: A drunk 19 year old was arrested when she rear ended a police car at a stoplight because Florida. Tampa Bay 10

Eat Fresh: A new lawsuit claims that Subway’s tuna salad contains chicken, pork and cattle DNA. NY Post

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com