What I’m Reading

Fire Sale? Zillow is looking to unload 7,000 homes for $2.8 billion after royally screwing up their iBuying strategy and substantially overpaying for acquisitions. They are listing the homes at a loss. The news came after Zillow announced that they would be taking a pause from buying last month. They will be looking to unload the homes to investors rather than selling them individually to owner-occupiers. I’m old enough to remember when people were shrieking about how Zillow would corner the housing market. Oh well. Bloomberg

No Vacancy: Top warehouse markets in the US have vacancy levels hovering around 1%. However, the problem is deeper than that. The inside of leased warehouses are bursting at the seams and have little if any space for more goods. The lack of vacancy is largely the result of a rapid supply chain shift from a just in time model to a just in case model, which sent demand soaring thanks to substantially higher space requirements. NBC News

No End in Sight: Rents on newly-signed apartment leases continue to soar on a year-over-year basis. While it hasn’t really showed up in inflation numbers that rely on Owners Equivalent Rent (OER), I suspect it will begin to spill over more substantially next year. Calculated Risk Blog

Feeding Frenzy: Mortgage companies in the U.S. issued $21 billion of mortgage-backed bonds in October, the second heaviest month of borrowing since the 2008-09 financial crisis, according to research by Bank of America Corp. What is perhaps most notable here is that the increase in originations is being driven by activity in the “private label” market, where costs have now fallen below the GSEs in many cases. Wall Street Journal

Misplaced Blame: Communities that have grown frustrated with a lack of housing options are pushing ballot measures like taxes and bans on Airbnb short term rentals in an effort to create more affordable housing. NY Times Let’s be honest for a moment: short term rentals are sort of a drop in the bucket. The real problem is NIMBY politics that haven’t allowed enough homes to be built to meet demand.

Chart of the Day

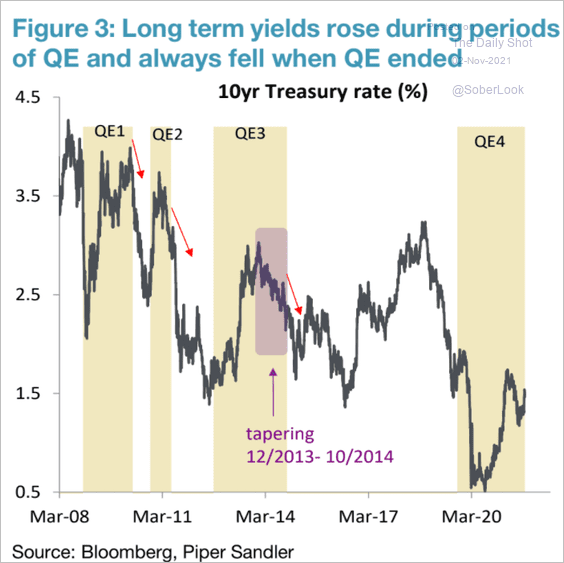

Following up on yesterday. Long yields tend to rise during periods of QE and fall when QE ends. No guarantee that it happens this time but there is a precedent.

Source: The Daily Shot

WTF

Monkey Business: A pet monkey belonging to a University of Texas football coach’s stripper girlfriend allegedly bit a child who was trick-or-treating on Halloween. NY Post

Why We Can’t Have Nice Things: Golden West College students are about to send the school’s mascot – Rustler Sam – packing. The mascot, who was originally depicted as a cartoon cattle thief holding a smoking “GW” branding iron, wearing a 10-gallon hat and smoking a cigarette has been deemed no longer politically correct. LA Times

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com