What I’m Reading

Cooling Off? Some of the hottest housing markets in the country are showing signs of slowing down with inventory increasing and more sellers reducing asking prices. Bloomberg

The article specifically talks about Boise – a rental market that we are bullish on (we recently closed our second multifamily investment there). A few takeaways: 1) Trees don’t grow to the sky – home prices in Boise – and other hot markets – have become untethered from rents and incomes in recent years and simply cannot increase at a double digit annual rate indefinitely. This growing affordability issue is part of the reason that we are bullish on the workforce rental housing segment of the market where rent growth has actually lagged income growth over a 10-year period, despite a recent spike. 2) Much of the slowness is explained by seasonal factors that skipped 2020 altogether but are present in the market in “normal” years. 3) The Boise market is projected to experience solid population and job growth over the next 5 years. If mortgage rates increase and stretch housing affordability further, marginal buyers in the market will become renters.

Acceptance: Upward pressure on prices from supply chain and labor challenges have put negative pressure on returns. So far, equity capital is absorbing the cost pressures by accepting lower returns. Globe Street

Test: Apartment fundamentals have been impressive in 2021 with rents soaring in most cities and vacancy dropping to record-low levels. However, regulatory headwinds and operating cost inflation could pose challenges in some markets moving forward. Yardi Matrix

Tapped Out: Warehouse availability in the U.S. fell to record lows in the third quarter, according to figures from real-estate firms that show industrial space is all but disappearing near some of the country’s busiest distribution hubs. Wall Street Journal

Sweet Spot: The market for single family rentals is showing no signs of slowing down as a confluence of factors – including growing acceptance of remote work and strained housing affordability – provides a tailwind. New York Times

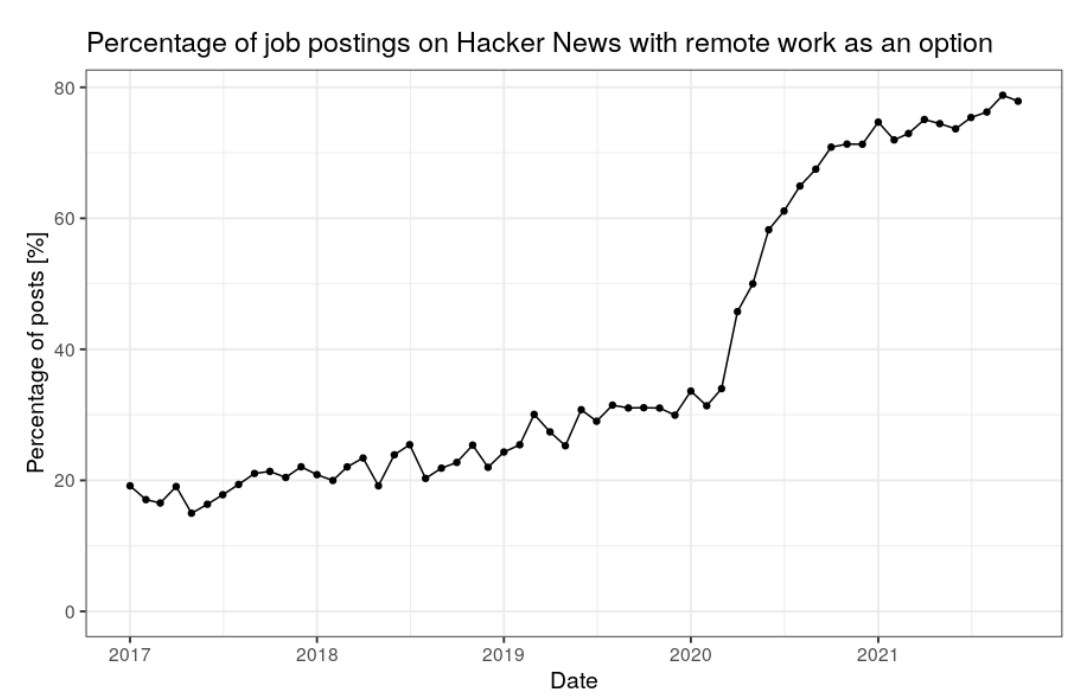

Chart of the Day

Note that the trend was upward-sloping before COVID but accelerated dramatically afterwards and has stabilized around 80%. All sorts of interesting consequences if it is as durable as it appears.

Source: Michael Nielsen

WTF

Chicken Fight: A woman who hit a teenage employee because “unhappy with the service at the KFC drive-through window” has been charged with a felony because Florida. The Smoking Gun

Employee of the Year: An Irish man was sentenced to prison after releasing two live rats in his former workplace. MSN

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com