What I’m Reading

Under Pressure: CBRE’s latest cap rate survey showed compression almost across the board with the most desirable product types – multifamily and industrial – in the best locations trading at average cap rates that start with a 3. CBRE I suppose that at a certain point, the people who have been saying that cap rates have “nowhere to go but up” over the past 7+ years will be correct – broken clocks eventually are. However, that day has not come yet.

Setting Sights: Fixed income giant PIMCO is ramping up its commercial real estate holdings as historically low interest rates undercut bond returns. In particular, PIMCO has been targeting out of favor sectors like office and hospitality. Wall Street Journal

Red Tape: The federal government owns more real estate than it knows what to do with. In an effort to dispose of empty and unused properties, the Public Buildings Reform Board was established in 2016. However, it has mostly been ineffective as taxpayers foot the maintenance bills. Shocking. New York Times

Clash of the Titans: Carried interest is on the chopping block in the Biden administration’s budget proposal. However, heavyweights on both sides of the aisle, as well as in the private sector are pushing to preserve it’s capital gains tax status. Bisnow IMO, capital gains rates will likely go up some but carried interest will not be taxed as earned income in the final version of the budget. It doesn’t appear as though there is a broad-based appetite on either side of the aisle for anything other than incremental changes.

Balancing Act: The Biden administration’s plan to address housing affordability is a mixed bag for the housing industry. On one hand, it seeks to increase funding substantially. However, it also would raise taxes on real estate firms. Yardi Matrix’s Paul Fiorella perfectly summed up why little will actually be accomplished (in an environment where there isn’t much appetite for tax increases from the moderate wing – mainly Joe Manchin – of the Democratic party):

In the end, the affordable housing problem is about money. To create housing that costs less, either the cost of construction must be reduced (not likely, given rising costs of land, materials and labor costs); developers must accept reduced profits (which would eliminate the incentive to build); or the government must provide subsidies (i.e., direct payments, rent subsidies, or tax breaks for developers) paid for by tax dollars.

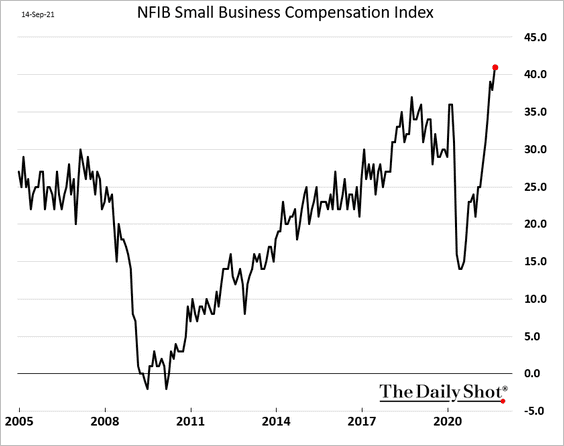

Chart of the Day

Small businesses are increasing compensation in an increasingly tight labor market.

WTF

Stealth Bomber: Oklahoma police are looking for a man who pooped in a freezer case at a super market. The Smoking Gun

Let it All Hang Out: A motorist is facing multiple felony charges for allegedly exposing himself to a series of toll collectors working on an expressway because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com