I’m back after taking a week off for July 4th. Missed you guys. Lots going on in the world so let’s get to it!

What I’m Reading

Staying Power: As the pandemic fades, there was a sense that the effort to shorten supply lines and bring production back home would fade. However, that isn’t happening. The construction of new manufacturing facilities in the US has soared 116% over the past year, dwarfing the 10% gain on all building projects combined, according to Dodge Construction Network. Reshoring appears to be here to say and will create an inflationary tailwind, at least for a while. AdvisorHub

Guillotine: U.S. mortgage lenders, real-estate brokers, and the companies that provide services to them may lay off thousands of employees in the coming months as many Americans put off buying a home. Reuters

Bargain Bin: Off-price chains are awash in appliances, apparel and outdoor furniture that never made it to stores. Swelling inventory levels are also proving to be a boon for liquidators and other companies that help dispose of the oversupply. Wall Street Journal

Staying the Course: The recent Fed meeting notes indicated that the central bank remains determined to choke off inflation by aggressively hiking rates. This despite increasing signs of deflationary forces popping up in the global economy. NY Times

Warning Signs: There are signs of stress growing in the corporate bond market as spreads continue to rise. Disciplined Systematic Global Macro Views

Chart of the Day

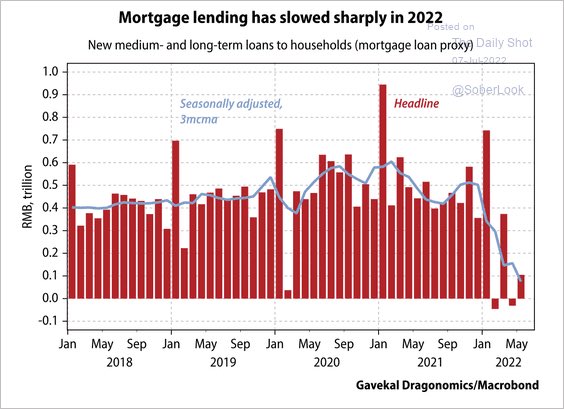

No surprises here. Mortgage lending has fallen off a cliff.

Source: The Daily Shot

WTF

Lethal Weapon: A man was busted for battering a police officer with a hot dog because Florida. The Smoking Gun

Horror Film: A camper in Japan woke up to find a giant, knife-wielding crab in his tent. NY Post

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com