One Big Thing

Jonathan Litt of hedge fund Land and Buildings is predicting that next year will see a bounce back in the performance of pandemic-impacted real estate but that it will ultimately prove to be a mirage as secular headwinds turn against these market segments (emphasis mine):

The Vaccine Mirage businesses will likely enjoy a spike in activity due to pent up demand which may well prove a fleeting commodity. For example, a return to the office will likely rise to pre-pandemic levels initially, and gradually fade as the novelty wears off. When the dust settles, office workers will likely on average spend one less day a week at the office than they did pre-pandemic, or a potential 20% reduction to the number of people in the office on any given day. Urban office will likely experience substantial rent declines, lose occupancy, and assets values may fall as much as 40% over the next several years.

In addition, business travel will likely spike in response to Zoom fatigue as workers want to meet clients, attend conferences, and host offsite meeting with teams. But a new normal is emerging and corporate travel has likely seen a permanent impairment. Amazon’s CFO recently commented that the company saved $1 billion on travel in 2020, and while he expects travel to return, it will be at a much lower level. We have been increasingly hearing similar anecdotes from executives about business travel, work from home, and on-line shopping versus in-store.

What I’m Reading

Added Risk: The rise of co-working and other forms of flexible, short-term office space is making the market more volatile as landlords can no longer rely on long term leases to smooth over economic cycles. As an example, an estimated 21.8% of San Francisco’s office space is available for lease — the highest rate on record. That’s partly because of massive coworking vacancies. Wall Street Journal

Steepening: The US Treasury yield curve is now at a three year high. The Capital Spectator

Fire Away: The Federal Reserve announced that it will continue buying bonds until we see ‘substantial further progress’ in employment and inflation. Bloomberg

Double Trouble: More bad news for the office market: the number of remote workers in the next five years is expected to be nearly double what it was before Covid-19: By 2025, 36.2 million Americans will be remote, an increase of 16.8 million people from pre-pandemic rates, according to Upwork’s Future Workforce Pulse Report. UpWork

Fortune Favors the Bold: Hotel deals struck during the pandemic will likely outperform earlier transactions based on historical data from the Great Recession. Preqin

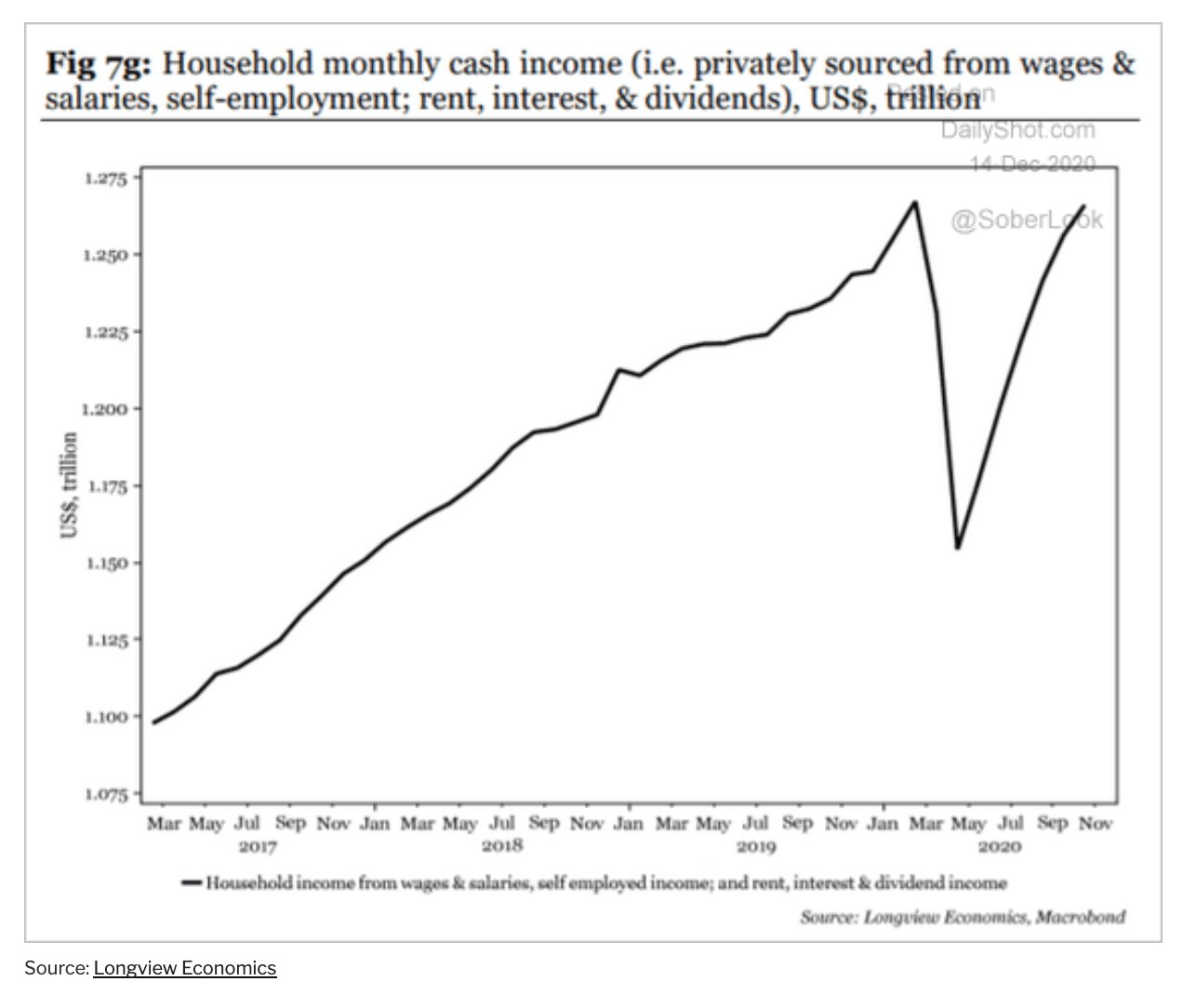

Chart of the Day

Excluding government support, US household incomes have now fully recovered. But they are $50B below where they would have been on trend.

Source: Adam Tooze

WTF

Season’s Beatings: Three people were arrested for a brawl over a Play Station 5 in a Walmart because Florida. CBS Miami

Essential AF: A San Diego judge ruled that strip clubs can remain open despite California’s stay at home order since no evidence has been presented by the state to link them to the spread of COVID. KUSI News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com