What I’m Reading

Pile Up: SKW Funding and Bain Capital have formed a JV targeting $1.3 billion of acquisitions and loan originations on troubled assets over the next several years. The money targeting distress keeps pouring in despite a lack of actual distress. Consider this yet another reminder that fundraising is more about marketing and narrative than actual investing. Commercial Observer

Sign of the Times: In a sign of the times for in-and-out-of-favor property types, WashREIT is selling the majority of its remaining office holdings in the DC area to Brookfield for $766MM. WashREIT is in the process of transforming from a DC-focused office REIT to one focused on multifamily in the Southeast. Given that the pricing of the transaction is around 20% below where Green Street pegged NAV, it has a bit of a fire sale feel. Commercial Search

Context Matters: CBRE out with great report that succinctly summarizes how inflation impacts real estate returns:

- The cause of inflation matters. If inflation is driven by strong economic growth, it would benefit CRE returns due to rising rents, lower vacancy, and rising income growth expectations.

- But if inflation is caused by a higher cost of goods and stagflation occurs, this type of inflation can hurt investment returns. Vacancy is higher and landlords find it harder to push through rent increases and interest rates may be higher. A higher general rate of inflation in the economy means that things look even worse in real terms.

- The impact also depends on if landlords can pass inflationary pressure to tenants. If there is oversupply on the market, it’s difficult for the landlords to increase rents when facing rising inflation.

- A key part of the relationship is the link between inflation and interest rates. If rising inflation leads to rising interest rates, that may push up cap rates and lower returns.

Back in Gear: A big decline in lumber prices has homebuilders restarting projects that were delayed due to construction cost issues. Housing Wire

Heads I Win, Tails You Lose: Mortgage companies have ramped up their purchases of government-backed mortgages in forbearance, and they are selling these loans back to investors at a profit. The trade is made possible by a policy meant to shrink the government’s own burden for dealing with mortgages where the homeowner isn’t paying. Wall Street Journal

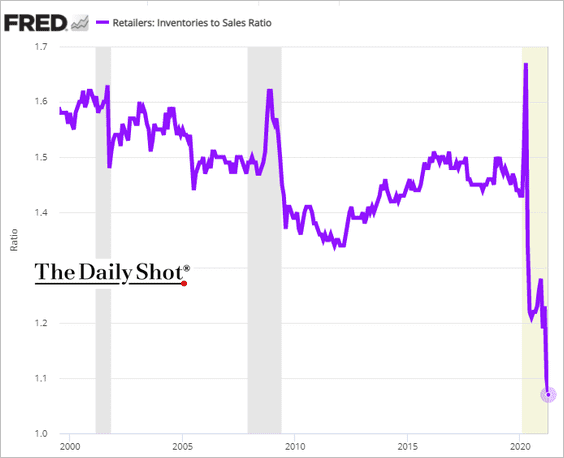

Chart of the Day

The retail inventory to sale ratio is at an all time low thanks to acute shortages.

Source: The Daily Shot

WTF

NYC Is Back: A man was arrested for masturbating in broad daylight in Times Square. NY Post

Grandmother of the Year: A drunk 75 year old woman let her 10 year old grandson drive her car. He subsequently crashed into an unoccupied SUV and she was arrested because Florida. iHeart Radio

Basis Points – A candid look at the economy, real estate, and other things sometimes related. Visit us at RanchHarbor.com