What I’m Reading

Standoff: Stimulus programs over the past two administrations, coupled with enhanced unemployment and rising asset values have left American balance sheets in better shape than ever. They have also given workers the flexibility to hold out en masse for higher wages, contributing to today’s labor shortage. (h/t Steve Sims) New York Times

Long Game: Institutional investors are shifting from value add plays to a long term hold apartment strategy as an inflation hedge, looking to lock in long-term fixed rate debt while benefitting from rising rents. Globe Street

Sounding the Alarm: The port crisis in California is bad and getting worse. Things have deteriorated to the point that the head of the California Trucking Association is calling for officials to declare a state of emergency. Insider

Piggy Bank: Older Americans are extracting cash from their home equity again after largely stopping to do so after the housing bubble. Urban Institute

Disconnect: Federal Reserve Staff forecasts – which have historically been more accurate than those of Wall Street analysts – still expect inflation undershooting the 2% target in 2022. Bloomberg

Chart of the Day

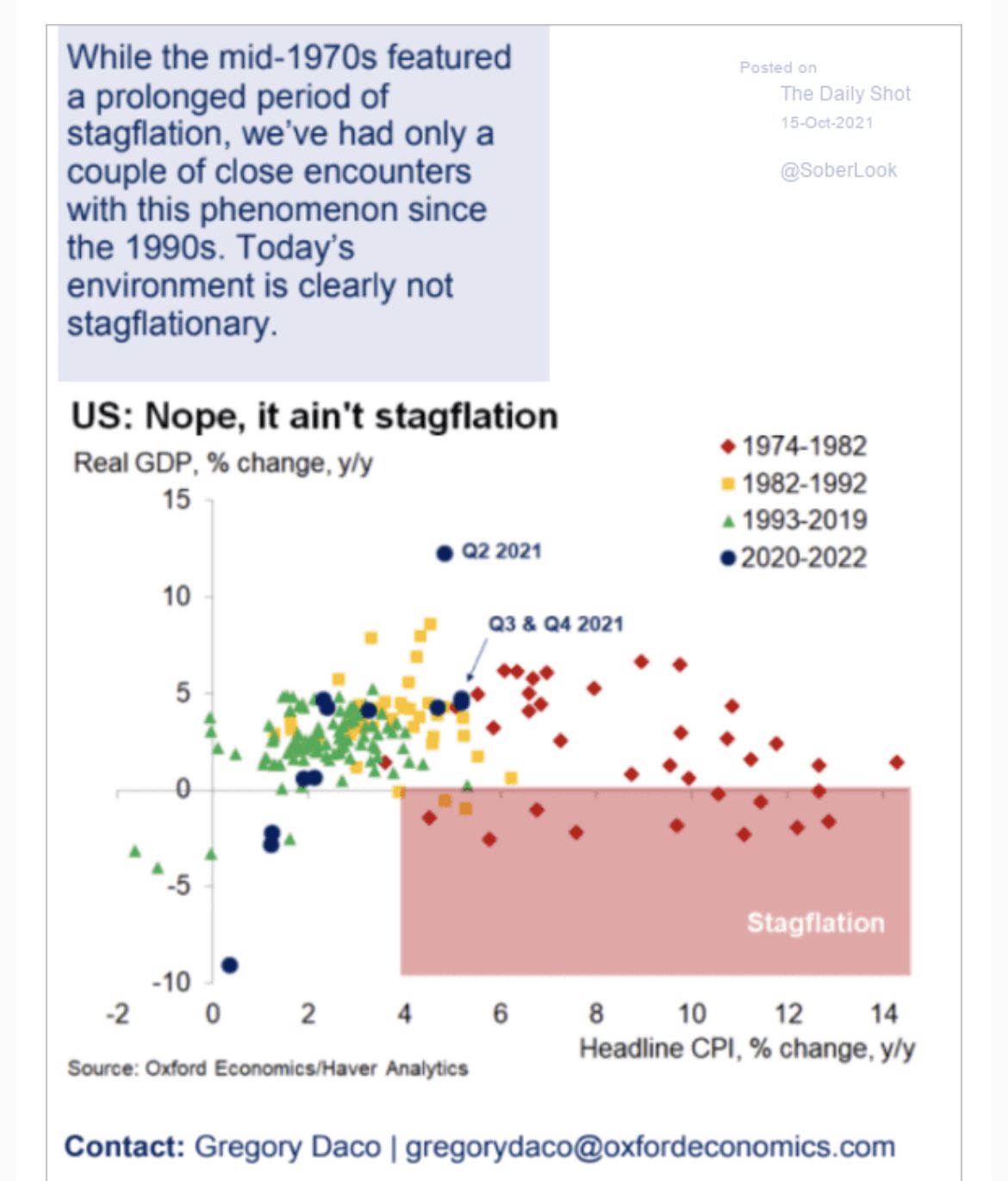

This is not the 1970s.

Source: The Daily Shot

WTF

Imaginary Friend: An accused auto burglar told cops that he broke into a vehicle so that he could “see his imaginary girlfriend Emma,” with whom he visits while “tripping on meth” because Florida. The Smoking Gun

Snack: A woman was arrested after biting her sister’s finger in a dispute over drunk driving, outside of a bar called World of Beer because Florida. Villages News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com