What I'm Reading Hitting the Wall: Trucking demand is “near freight recession levels,” according to Bank of America. Shippers’ outlook on rates, capacity and inventory levels are matching attitudes not seen since May and June 2020, when pandemic lockdowns sent freight volumes into a historic decline. Freight Waves Halted: Ships...

April 26th – Pacman

What I'm Reading Pacman: BREIT is buying another giant operating platform. This time, its industrial investor PS Business Parks, which will be purchased for $7.6 billion. Business Wire Permanent capital continues to eat the (commercial real estate) world. Race to the Bottom: Companies keep paring down their demands for days...

April 25th – Warning Sign

What I'm Reading Warning Sign: China's property market accounts for a massive % of global commodity consumption. Chinese housing starts have now fallen 17% or more for three consecutive quarters. Looks like a commodity downturn could be in the cards. Financial Times Mean Reversion: Soaring mortgage rates have resulted in...

April 22nd – Tough Nut to Crack

What I'm Reading Tough Nut to Crack: The price of a home sold in March set a record, as inventory dwindled and sales fell. Sharply rising mortgage rates are not showing much of an impact on housing yet. CNBC As discussed here previously, I believe that structural factors in the...

April 21st – Back to School

What I'm Reading Boomtown: A massive population influx has set off a boom in South Florida's industrial market. With low vacancies, scarce land and continued population and economic growth, its likely to continue. Wealthmanagement.com Back to School: BREIT's insatiable appetite continues with its just-announced purchase of student housing REIT American...

April 20th – Stay

What I'm Reading Staying Put: Nine out of ten mortgages in America carry an interest rate of less than 5%, which is the official level at which most new 30-year fixed-rate mortgages are now being written. Expect homeowners to hold onto their houses longer. Axios Sounding the Alarm: A Riverside...

April 19th – Mean Reversion

April 8th – Fake it Till You Make It

What I'm Reading Fake it Till You Make It: A Miami (of course) company is offering "crypto mortgages" Wall Street Journal However, a careful reading of the offering reveals that it's still just a loan secured by the property with an additional pledge of the borrower's crypto holdings. This will...

April 7th – Rise of the Machines

What I'm Reading Rise of the Machines: Drone companies, often backed by massive ecommerce platforms, have been cleared to expand their operations across the U.S. The technology has become faster and more reliable with development. The big question is whether or not it will result in mass adoption. Wall Street...

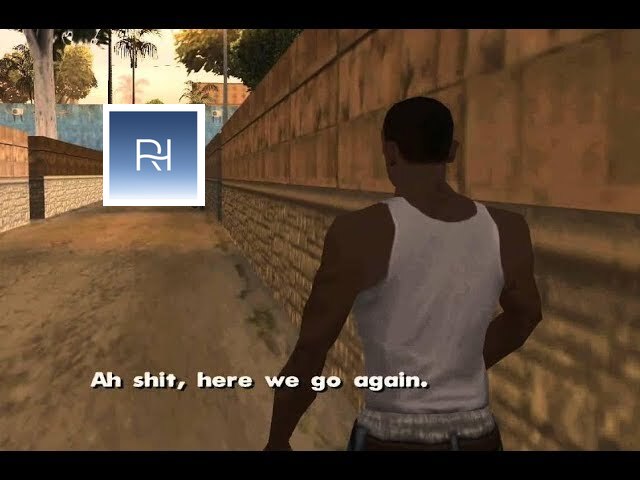

April 6th – Here We Go Again

What I'm Reading Here We Go Again: After being thwarted last year, the Biden administration is going after 1031 exchanges again in its proposed fiscal budget for 2023. That said, the proposal will meet strong opposition (again) and I sort of doubt that there is appetite for this in a...