What I’m Reading

Rocket Fuel: Morgan Housel’s latest piece about how COVID has substantially accelerated wealth and income inequality is an outstanding read and makes a strong case for an economic boom in the coming years – at least for some. This section on mortgage refinancing and the accompanying chart really stood out to me Collaborative Fund

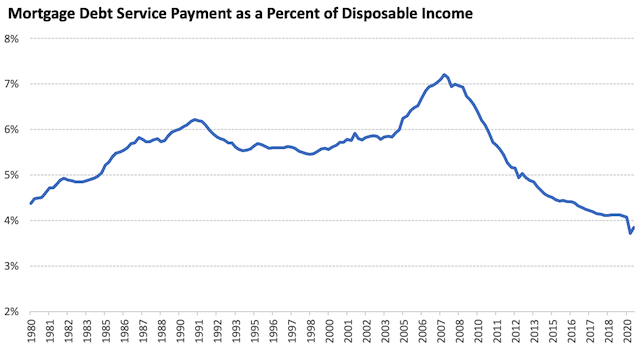

Mortgage refinancings also more than doubled in 2020, locking in interest rates that would have seemed like a joke a few years ago. Some companies are advertising 30-year fixed-rate mortgages for less than 2.3%, which can finance a half-million-dollar home for about $1,700 a month. Put differently: A $500,000 mortgage now has the same monthly payment that a $300,000 mortgage would have with 2007’s interest rates, and what a $210,000 mortgage had at mid-1990s interest rates.

The savings this has generated is astounding. In aggregate, mortgage payments as a percent of household income have declined from 7% of income in 2007 to less than 4% today, now a new generational low:

One of the biggest lessons of the past cycle should be that big waves are typically powerful and last much longer than rational expectations would indicate because they generate what George Soros called reflexivity – a positive feedback loop between prices, expectations and economic fundamentals. A rational person might look at the housing market today and think that it is richly priced, and honestly they are not wrong. However, looking at the chart above and the record savings Americans are carrying, there is a very good argument that it could become substantially more richly priced before correcting.

Misleading: We are currently experiencing a return in prices of demand-sensitive goods and services to pre-pandemic levels. As a a results, we won’t really know if there is an inflation problem or not until after the economy has normalized. Klement on Investing

Sweet Spot: Warehouse has been a pandemic darling thanks largely to eCommerce. However, one of the drivers of warehouse demand in 2021 will be brick and mortar retailers rushing to restock inventory. Globe Street

Branching Out: A new survey from WealthManagement.com found that financial advisors are substantially increasing their clients’ allocation towards commercial real estate as a way to diversify away from the frothy stock and bond market. WMRE

Culling of the Herd: COVID is proving to be the ultimate test for flexible office providers with the weakest companies shutting their doors or filing for Chapter 11. However, the post pandemic market could favor survivors in the space if tenants begin to employ a hub and spoke office model as many experts now predict. The Real Deal

Staying Put: The typical homeowner in 2020 had remained in place for 13 years, up slightly from 12.8 years in 2019 and well ahead of 2010’s reading of 8.7 years, according to a new analysis by real-estate brokerage Redfin Corp. This is making it even more difficult and expensive for would-be homebuyers and is paradoxically happening at the same time that renters are experiencing increased mobility. Wall Street Journal

Half Measures: President Biden’s proposed eviction moratorium and rental assistance are well intentioned but don’t do much of anything to address the $70 billion in outstanding rental debt that is accruing. NMHC

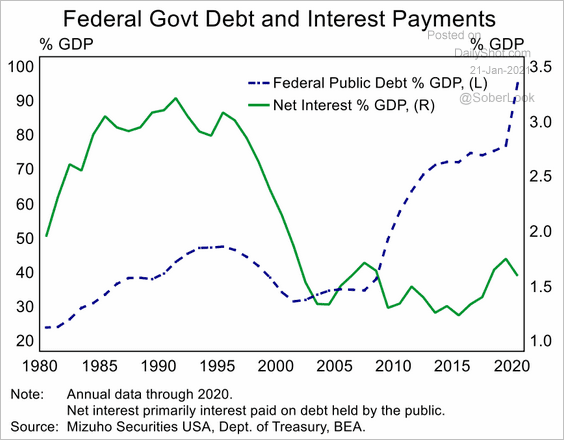

Chart of the Day

By holding down rates, the Fed has allowed the government to massively increase its debt without incurring higher interest expenses.

Source: @MizuhoAmericas

WTF

True Love: Boxer Floyd Mayweather is engaged to a stripper at his Las Vegas club. Seems that Floyd hasn’t learned Lesson Number 2 from Scarface. The Sun

It’s Always the Ones You Most Expect: A man who calls himself the “Monkey Whisperer” has been charged with conspiracy and trafficking for allegedly shipping primates — including endangered species — to clients all over the country because Florida. NY Post

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com