What I’m Reading

Taking Flight: The message from the Federal Reserve earlier this week was extremely hawkish, forecasting aggressive rate hikes. That being said, the yield curve is now essentially flat (the 5y-30y US OIS curve went negative) and Fed Funds futures are projecting a rate cut in 2024. The Macro Compass

Ripple Effect: War in Russia is putting stress on supply chains, accelerating already-strong inflation and causing turbulence in credit markets. All of the above make it more difficult to get real estate transactions (and development) over the finish line. The Real Deal

Closing In: The NYC region is home to the largest concentration of online shoppers in the country. Ecommerce platforms looking to capitalize on this market are constructing, buying and leasing warehouses in NY at a record pace, oftentimes transforming neighborhoods in the process. New York Times

In Demand: A new analysis from Cushman & Wakefield predicts that market conditions will remain at historically tight levels, pushing warehouse occupiers and e-commerce tenants to alternative options as premium taking rents rise. Cushman predicts that rent growth will rise over 15% nationwide over the next two years. Globe Street FWIW, some markets will experience substantially higher growth than the nationwide average as local supply/demand dynamics vary.

Two Weeks Notice: High-end gig work in consulting, marketing, writing and project management has gained more traction during the pandemic. Professionals are finding that they can make as much or more money, live where they want and generally have more control over their lives. Wall Street Journal Overall, I love this trend as it seems like a net positive for workers and a way to help mitigate the high cost of living in expensive cities (more remote work). However, I also wonder how it will fare in a recessionary environment where the balance of power shifts from workers back to employers.

Chart of the Day

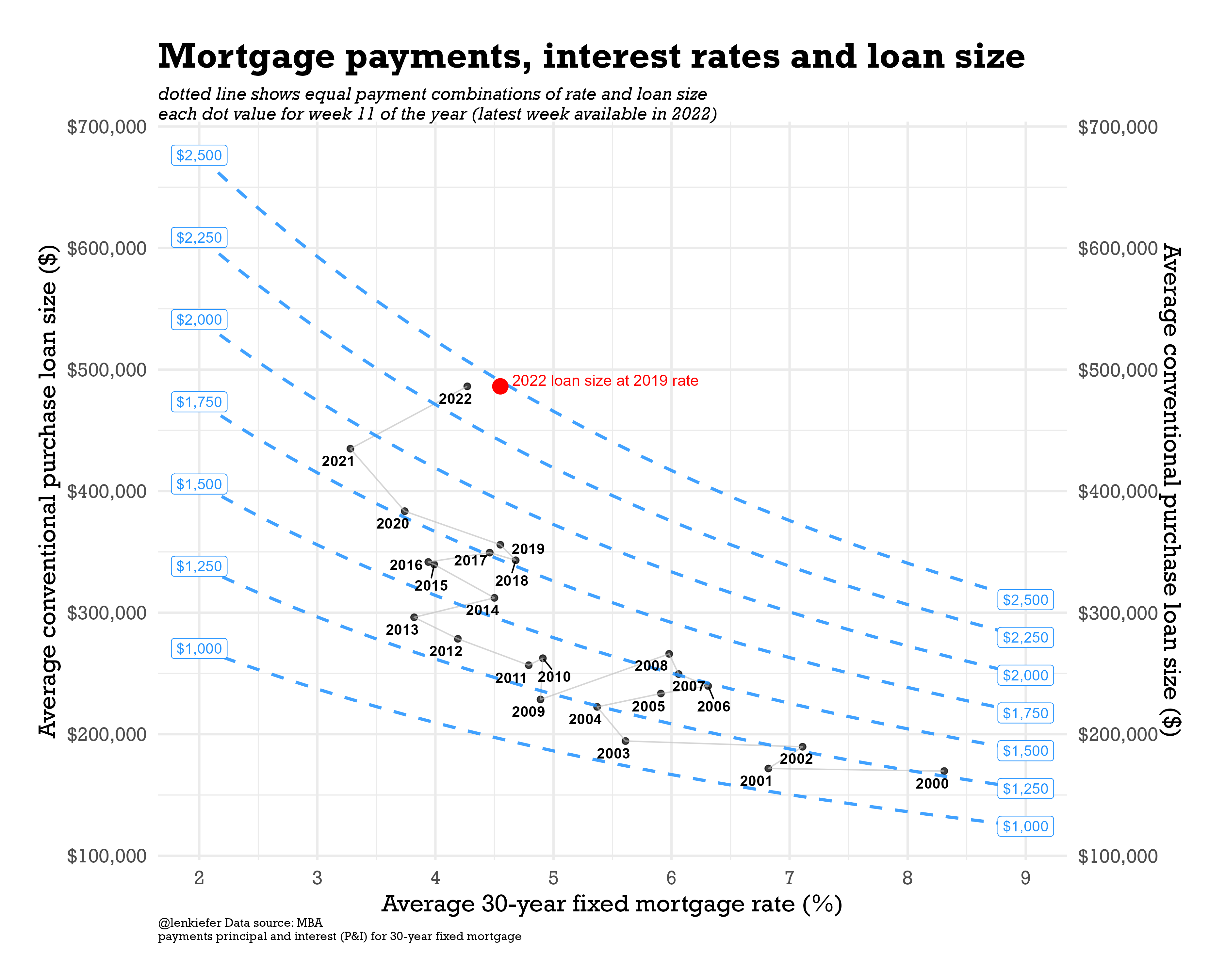

Housing is getting more unaffordable by the day.

Source: Len Kiefer

WTF

Monkey Business: A man pled guilty to the illegal sale of a monkey to rapper Chris Brown because Florida. Fox 13 Tampa Bay

Food Fight: A man was arrested after (allegedly) hitting his girlfriend in the face with a burrito during a domestic altercation because Florida. ABC 27 Tallahassee

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com