What I’m Reading

Boomerang: Millions of older Americans retired early during the pandemic, leaving the US in a severe labor imbalance. However, new data indicates that they are returning to the workforce in large numbers in recent months. Many retirees are being pulled back to jobs by a combination of diminishing covid concerns and more flexible work arrangements at a time when employers are desperate for workers. In some cases, workers say rising costs — and the inability to keep up while on a fixed income — are factoring heavily into their decisions as well. Washington Post I also have to assume that a not-insignificant number of early retirees were influenced to leave the workforce due to high asset prices boosting their retirement nest eggs. If asset prices continue to fall, more will likely return to work.

Behind the Curve: The fed took too long to fight inflation. Their best excuses range from the speed of the recovery to the unpredictability of when Americans would spend their pandemic savings, to the battle over Powell’s reappointment. Full Stack Economics

And, So it Begins: Newark, New Jersey is introducing a package of proposed measures designed to reduce large-scale investor buying of private homes, including strict rules about unsolicited offers and enhanced rent control. ABC 7 The SFR industry may act as an economic stabilizer for the housing market – especially at the lower end. However, it also may prove to be destabilizing from a political standpoint.

Mooning: The average rate for a 30-year mortgage jumped to 5.27%, its highest level since 2009, pricing more potential owners out of the market. At the same time, rents are at an all time high, making savings difficult. Bloomberg I sound like a broken record here but expect continued upward pressure on rents until we reach a point of demand destruction.

Tea Leaves: Big landlords are walking away from outdated office buildings with onerous debt, sending the keys back to lenders. New class A buildings continue to lease at impressive rates, indicating that the market is bifurcated. Most of the offices that have sold have been newer so the distress seen in old, obsolete product hasn’t really shown up in the comp data yet. The Real Deal

Chart of the Day

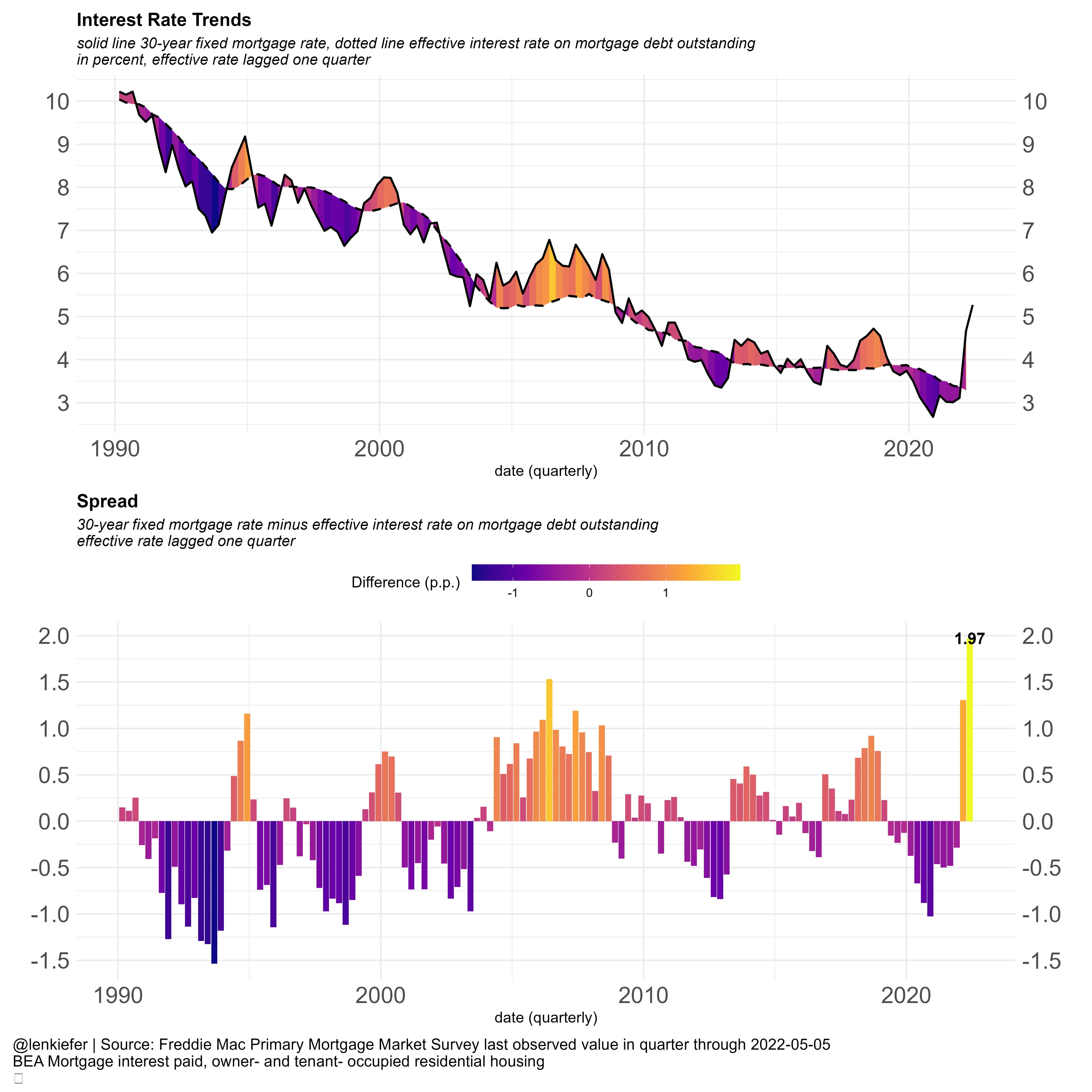

Mortgage rates are nearly 2 percentage points above the average effective rate of interest on outstanding mortgage debt in the U.S. Two big takeaways:

- Say goodbye to the refinance market (it has been on life support for a while)

- Look for rents to continue to head up and to the right as less people move and move-up buyers who can swing it hold onto their house with a rate in the 3%’s and lease out.

Source: Len Kiefer

WTF

Speed Bump: A 23-year-old woman had to be hospitalized after she was run over by a sheriff deputy’s SUV while sunbathing on a beach because Florida. (h/t Steve Sims) I Heart Radio

Unwanted Guest: A newlywed couple who brought a stripper home for a night of fun ended up in a domestic dispute with the husband being arrested because Florida. Wild 95.5

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com