What I’m Reading

Changing of the Guard: Office, hospitality and retail, three of real estate’s most institutionalized sectors, are facing long-term structural headwinds. At the same time, formerly-niche sectors like cold storage, self-storage, medical office and data centers are getting more institutional attention thanks to their resiliency in the face of the pandemic shutdown. PERE

Mixed Reviews: Homebuilding stocks took a hit on the Pfizer vaccine news earlier this week while apartment REITs surged. This is due mostly to the prospect of increasing mortgage rates. CNBC

How Low Can You Go? Sublease space, which continues to pile up in Manhattan is poised to eclipse the highs of both the Great Recession and tech bust. It is putting strong downward pressure on asking rates, which in some cases have fallen into the $30/sf range for shorter term sublease opportunities. Commercial Observer

What to Expect: The incoming Biden administration is likely to focus heavily on subsidies for affordable housing and infrastructure. At the same time, tax issues like opportunity zones, the 1031 exchange and the SALT cap will come under heavier scrutiny. Commercial Observer

Upward Momentum: Interest rates are rising and the yield curve is steepening. Capital Spectator

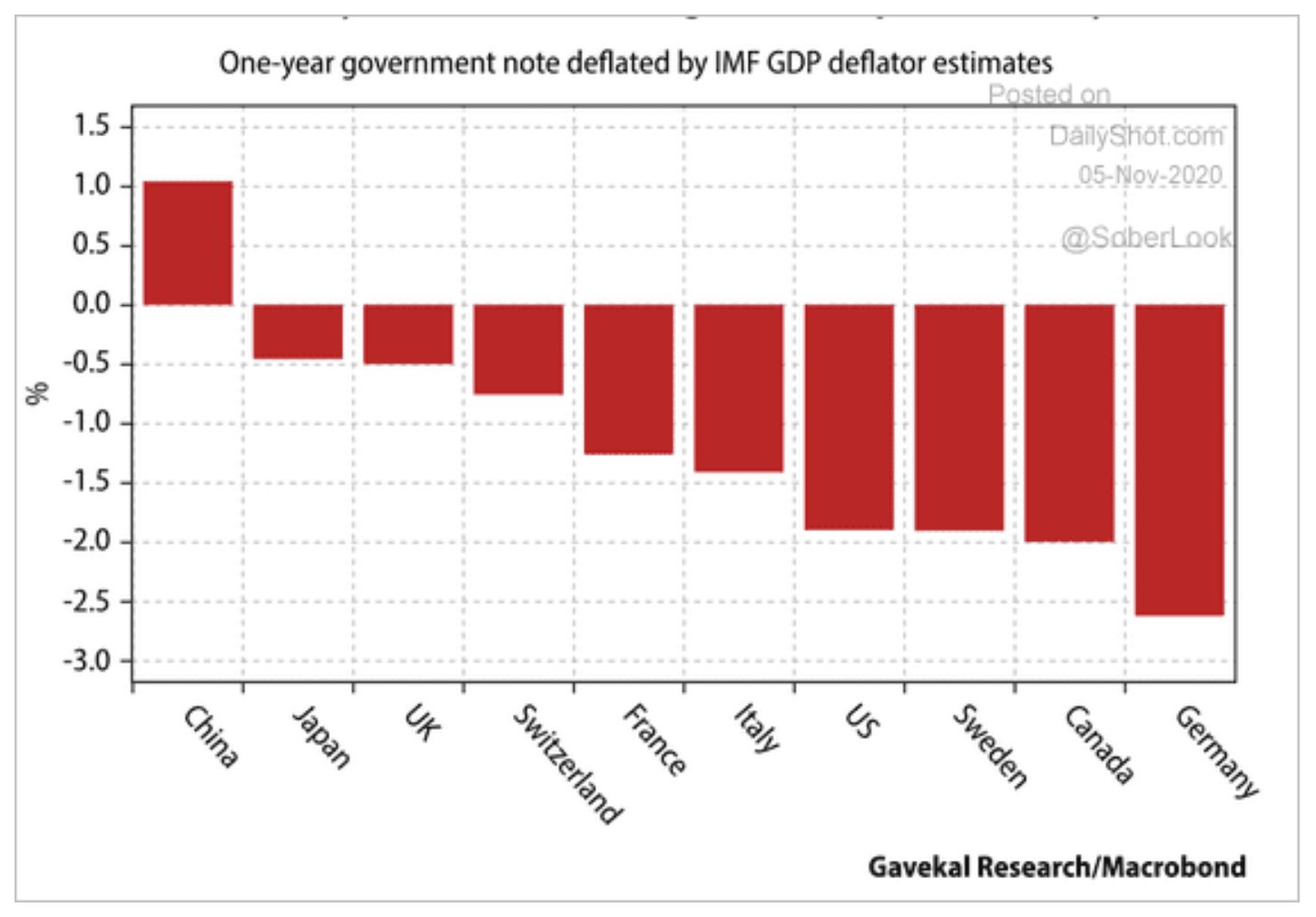

Chart of the Day

China is the only one of the world’s major economies currently offering investors positive real yields.

Source: @Gaveka

WTF

Do You Know Who I Am? Authorities arrested a Georgia woman after she allegedly tried to convince restaurant workers that she was an FBI agent and should get free food. OzarksFirst

Long, Strange Trip: A man who claimed to be on a ‘spiritual journey’ was arrested after stealing a sheriff deputy’s cruiser and credit card because Florida. 4 News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com