What I’m Reading

Locked Down: In a move that should come as no surprise, President Elect Joe Biden and his team are leaning towards extending the CDC eviction moratorium that is set to expire December 31st. Ultimately, this program is just a band aid that forces landlords to shoulder the burden while it is in place and then leaves the tenant responsible for the accrued rental debt when it expires. If the program is to be extended, there really needs to be some sort of direct renter aid program put in place. New York Times

Exodus: The pandemic has accelerated migration out of large cities, and most of the movement is—at least for now—permanent. A report from MyMove found that nearly 16 million people fled large cities during the pandemic with 14.2 million people filing a permanent change of address form. Globe Street

Death Sentence: Los Angeles is banning outdoor dining in an effort to control COVID, despite not providing any scientific evidence that outdoor dining increases the spread. Outdoor seating options were a lifeline for restaurants – many of whom made a substantial investment to build outdoor accommodations. Now they are being banned right as we hit the busy holiday season, putting their ability to stay in business in doubt. This is frankly cruel and has no scientific basis. Los Angeles Times

Jingle Mail: As shopping centers across the country continue to struggle with a new surge in infections and lockdowns, the expiry of forbearance agreements, and secular headwinds that predated the pandemic, a growing number of mall owners are ready to hand back the keys to their lenders. Trepp published a list of mall properties that owners are most likely to give up on and it prominently featured some of the country’s largest retail landlords. The Real Deal

Bigger(?) Short: Dave Burt, who made a fortune for investors betting against subprime is once again betting that homes will fall in value – but not because of a financial crisis. Burt’s calculations show that close to a third of U.S. homeowners are vulnerable to big losses in the value of their homes from climate change, partially as a result of increasing insurance premiums.

Color me skeptical on this one. While I do believe that climate change will have an impact on property values in impacted areas, it seems rather difficult to place a bet on – especially one using a negative carry instrument like credit default swaps. The challenge with betting on climate change as a default mechanism is that it impacts markets unevenly – as opposed to say, mass default on pick a payment loans.

In other words, it hits different places at different (and somewhat unpredictable) times. A flood from a hurricane in Florida doesn’t necessarily have a great correlation with fires in California. Also, it is nearly impossible to mitigate for infrastructure (higher seawalls or better forestry management) that could change the risk equation in a meaningful way. Combine those factors and this seems like more of a morality play than a way to actually make money (h/t Taylor Grant) CNBC

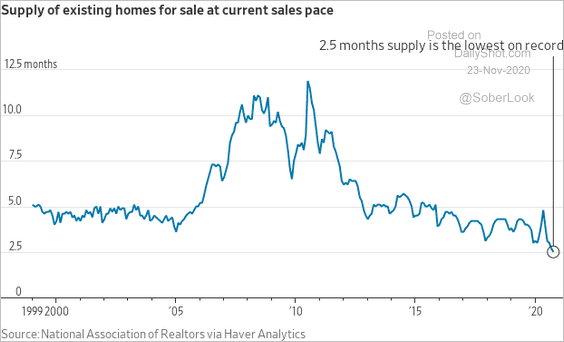

Chart of the Day

The inventory of US homes for sale, measured in months of supply, is the lowest on record.

Source: The Daily Shot

WTF

Weaklings: Vegans and other non-meat-eaters are more likely to suffer broken bones thanks to a lack of calcium, iron, and vitamin B12, according to a new study by Oxford University. Of course this is common sense but then again, veganism is a religion, not a diet. (h/t Steve Sims) MarketWatch

Make it Rain: A woman was arrested at a Motel 6 for creating counterfeit money, also for meth because Florida. Orlando Sentinel

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com