What I’m Reading

Pointing Fingers: Frustrations are boiling over at the Ports of LA and Long Beach as freight continues to pile up. Truckers are pointing fingers at a lack of dock help to offload ships. Port officials are pointing to a struck driver shortage. The only thing that both seems to be able to agree upon is that the infrastructure at America’s two largest ports is not adequate to handle this situation. CBS Los Angeles

No-Mans Land: The EB-5 program is stuck in limbo after a reauthorization bill failed to pass over the summer. Industry participants expect that it will eventually be re-authorized but the timeline is highly uncertain with all of the drama playing out in the current Congress. WealthManagement.com

Rebirth: With portions of the hospitality industry hurting, conversion of hotels to multifamily has been a white hot business. Globe Street This is MUCH easier to do than the often-mentioned conversion office buildings to multifamily. For one, the units are typically already set up as studios or one bedrooms so there are no floorplate mismatch issues. Beyond that, plumbing infrastructure in a hotel property is already adequate for multifamily.

More Problems: Beleaguered retailers are facing yet another challenge. Factories in Vietnam, a major apparel and footwear supplier to the U.S., have been forced by the pandemic to close or operate at reduced capacity, complicating the all-important holiday season. New York Times

Disconnect: Jim Costello of Real Capital Analytics had a great quote about the relationship between interest rates, cap rates and mortgage rates:

If we get a fed funds rate closer to 2% and a 10 year Treasury approaching 3%, you should not expect that the current spreads to mortgage rates and cap rates should just stack up on top of that 3% interest rate level. Those spreads themselves expand and shrink over time based on the different risk perceptions of the participants in the equity and debt portions of the capital stack. If the interest rate increases come about from a scenario where everybody in the market is fearful, those spreads could actually increase relative to recent levels and pricing would be savaged.

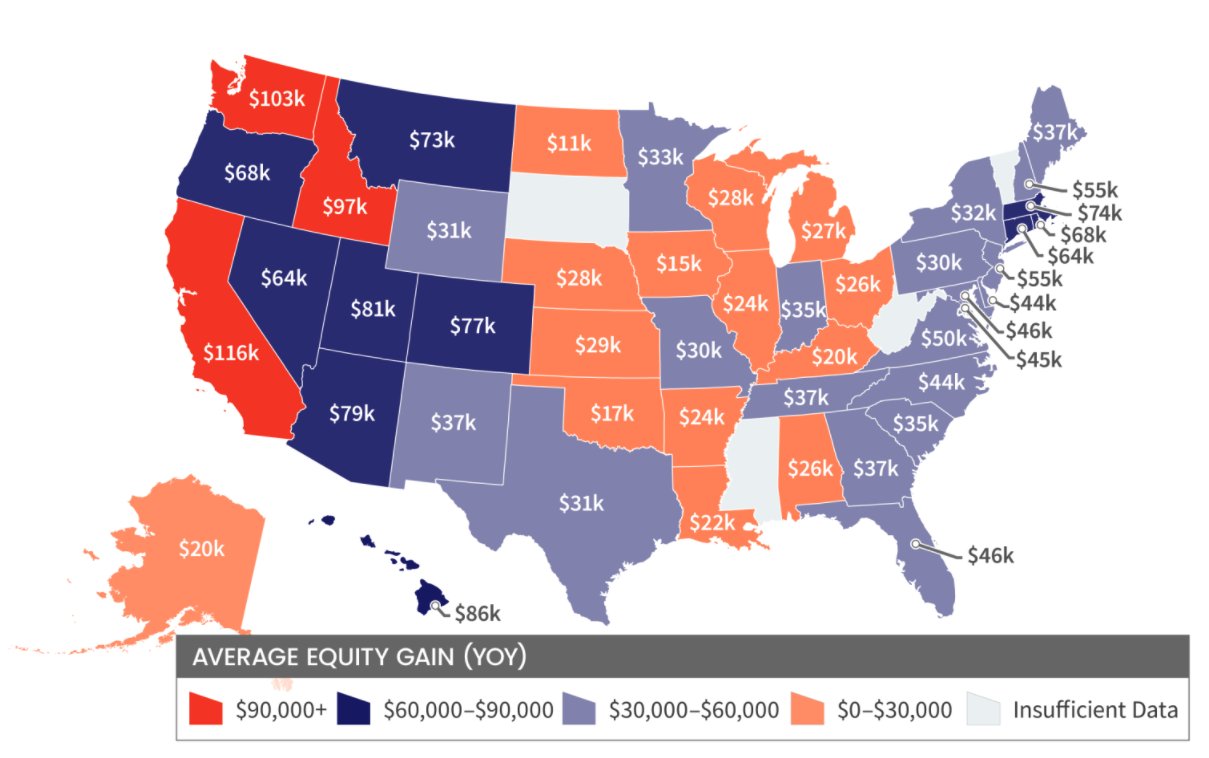

Chart of the Day

The past 12 months have been a great time to own a home in the US – especially in the western part of the country.

Source: Heidi Groover

WTF

Perfect Crime: A museum says they gave an artist $84,000 in cash to use in artwork. He delivered blank canvases and titled them “Take the Money and Run.” CBS News

Don’t Drink the Water: Researchers have found that the levels of MDMA and cocaine found in a river that runs through the site of the Glastonbury Festival in England are high enough to harm protected species of wildlife. Sky News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com