Chart of the Day A bit of a narrative violation from RealPage's Jay Parsons challenging the assumption that supply constrained markets tend to outperform when it comes to rental growth. Supply, in and of itself isn't a bad thing. In fact it adds to economic growth creating jobs for new...

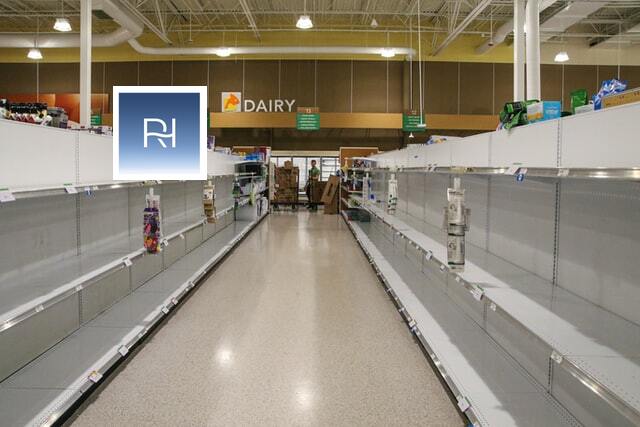

January 18th – Bare Shelves

What I'm Reading Bare Shelves: US home sales fell the most in 18 months in December. A lack of supply, not demand is driving the move. As would be expected in this environment, prices are still increasing rapidly. Bloomberg Coming Around: As the pandemic wears on, corporate America is increasingly...

November 15th – Tilting the Scale

What I'm Reading Tilting the Scale: Target allocations to commercial real estate increased for the eight straight year in 2021 according to a recent survey by Hodes Weill & Associates and Cornell University. The average target allocations increased to 10.7 percent, up 10 basis points from 2020, indicating the potential...

May 18th – Everything Must Go

What I'm Reading Everything Must Go: San Francisco's biggest tech companies are sitting on a mountain of empty office space that has come available for sublease. Unlike landlords, these companies are not in the business of leasing real estate and are willing to take big impairments to sublease at a...

February 24th – Slim Pickings

What I'm Reading Slim Pickins: Despite increasing mortgage rates, housing inventory is still at a record low. One thing to watch here as the vaccine rolls out: COVID exposure has been given as one reason that people are reluctant to list their homes. While that was undoubtedly true last spring,...