One Big Thing

Like me, most of you probably woke up yesterday morning to the Pfizer COVID-19 vaccine news from the AP:

Pfizer Inc. said Monday that its COVID-19 vaccine may be a remarkable 90% effective, based on early and incomplete test results that nevertheless brought a big burst of optimism to a world desperate for the means to finally bring the catastrophic outbreak under control.

As expected, the stock market soared and the bond market sold off. I have mostly ignored drug company COVID news that roiled markets in the recent months because it was simply too early in the testing process and the results from early phases were highly speculative. While the Pfizer vaccine is still not a done deal, it is pretty far along in the testing process and I thought that it would be worthwhile to share a few thoughts on what this development could mean for the real estate market and the economy as a whole:

- We are not out of the woods yet. Pfizer has estimated that it could have enough doses for 25mm people by the end of this year. There are over 330mm people currently living in the US alone and 7.8 billion on earth. Getting this distributed will be a herculean task and will not happen overnight.

- COVID is getting worse in many places around the world as northern hemisphere temperatures cool and people spend more time indoors. We are now seeing over 100k new cases a day in the US with some hospitals nearing capacity issues. Europe is doing much worse and several countries have begun shutting down. Until a vaccine is widespread, we will need another fiscal rescue package to avoid collateral damage. The end is (perhaps) now in sight but that doesn’t mean that business won’t fail during the 3rd wave if business either remain closed or have to close again.

- Just as when COVID hit, a vaccine will have varying impacts on real estate by product type and geography. When the vaccine news came out, office REITs soared, as did hotel stocks while, stay at home plays like Zoom, Netflix and Peloton plunged. Color me skeptical on the office rebound. Much of the problem here is based on the potential behavioral changes spurred by the pandemic, as opposed to the actual disease itself – as an aside, one could make the same case on the bullish side for Zoom and Peloton. That is why I’m actually a bit more optimistic about hospitality assets than office – hotels may benefit from pent up demand with a reliable vaccine. Office, on the other had is facing behavioral headwinds that will take longer to iron out. Retail is on the same negative trajectory that it was on previously, just accelerated.

- Ultimately, the trillion dollar question is whether a reliable vaccine can spur a new positive feedback loop. There were two separate job loss events that came out of COVID. The first was from mass furloughs during the initial shutdown that caused the unemployment rate to spike over 14% in April. The second is the permanent job losses and economic contraction resulting from the economic disruption of the shutdown. The economy has bounced back hard this summer and fall, wiping out most of the furlough job losses. However, permanent job losses are still on the rise and economic activity has plateaued below its prior peak. We now get to see if pent up demand once we finally get the proverbial all-clear leads to a positive feedback loop of consumption, profits and hiring. If it does, we are in for an economic boom but the aforementioned behavioral changes over the past eight months could make it very uneven in the early going.

There is a lot more to come on these developments going forward. I’m skeptical about the roll out of a vaccine logistically. However, I’m still optimistic about real estate sectors like suburban multi-family, single family for rent and warehouse that have and will continue to benefit from the behavioral changes and amplification of trends that have resulted from COVID.

What I’m Reading

On the Ropes: The biggest commercial real estate brokerages in the country reported deep impacts from the coronavirus pandemic in the third quarter, most of which were the result of a persistent lack of certainty. Bisnow

Gotcha: More than half of adults who worked remotely during the pandemic are unaware that they could face tax consequences because they didn’t update their tax withholding to reflect their new location, a study by the American Institute of CPAs found. CNBC

Hitting the Bid: Despite notable struggles in hospitality and retail, the September US RCA CPPI National All-Property Index from Real Capital Analytics was still up slightly year-over-year for September thanks mostly to persistent strength in industrial and multifamily. Globe Street

Test Case: Hawaii’s Safe Travels program, which allows those who test negative within 72 hours of departure are exempt from quarantine upon arrival, may be a model for opening up international travel. Since implementation in mid-October, over 100,000 people have rushed to the islands from mainland states, delighting the beat-down tourism industry. However, some locals are still viewing the plan with skepticism, claiming that its untested and potentially puts them in harm’s way. NY Times

Chart of the Day

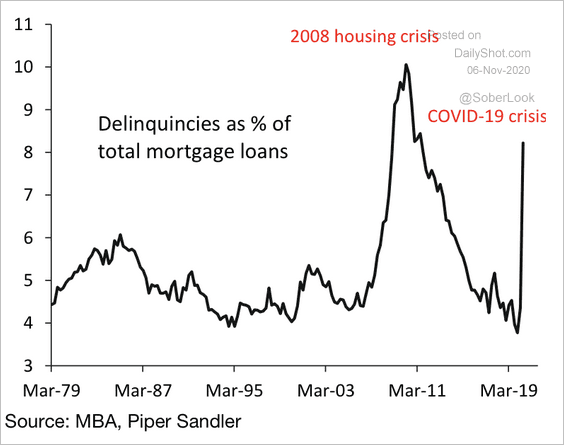

Mortgage loan delinquencies are creeping closing in on housing crisis levels.

Source: Piper Sandler

WTF

Its Happening: A mother bear and her cub were shot after climbing aboard a nuclear submarine because Russia. Don’t let the vaccine news distract you from the fact that Russian bears are commandeering nuclear subs in preparation for war. My solution for containment is to arm the moderate bears. BBC

Repeat Offender: A woman was arrested for masturbating in public, completely naked in front of a Popeyes dumpster because Florida. This was the second time she was caught in the past month an a half for the same thing. The last time it was for doing the deed outside of a 7-Eleven. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com