What I'm Reading Roll the Dice: Escalating material prices have made it challenging for contractors and manufacturers to bid on jobs, with owners sometime finding themselves paying out of pocket to cover overruns. Wall Street Journal Opt Out: Some workers are beginning to look for legal remedies that allow them...

January 8th – Ultimatum

What I’m Reading Ultimatum: In another sign that flexible work arrangements will become a job perk, twenty-nine percent of working professionals say they would quit their jobs if they couldn’t continue working remotely, according to an online survey of 1,022 professionals by LiveCareer, an online resume and job search consulting...

January 7th – Reading the Tea Leaves

One Big Thing Now that the elections have come finally, mercifully come to a close, I thought that it would be a good idea to take a look at the likely winners and losers both in the real estate sector and the economy as a whole. I’m going to do...

January 6th – No Going Back

What I’m Reading No Going Back: The pandemic has has accelerated the adoption of data access as an essential CRE technology. At this point, it is no longer just a pandemic solution and is here to stay. Globe Street Priced Out: Despite record low mortgage rates, the spike in housing prices last year...

January 5th – Unmasked

What I’m Reading Unmasked: The Corporate Transparency Act, which was tacked onto a defense bill, would require corporations and limited liability companies established in the United States to disclose their real owners to the Treasury Department, making it harder for criminals to anonymously launder money or evade taxes. The rule applies...

January 4th – Blurred Lines

What I’m Reading Blurred Lines: States are facing off in a high-stakes legal battle over who is entitled to income taxes on remote workers when one is employed by a company in one state but resides in another. The results of this high-stakes legal battle will have a profound impact on...

December 22nd – Under the Tree

Quick programming note: I’m going to be taking a break from blogging the next week or so and won’t be posting every day. That being said, if something looks particular interesting, I’ll check in. This week’s big news is obviously the $900 billion rescue package that looks likely to be...

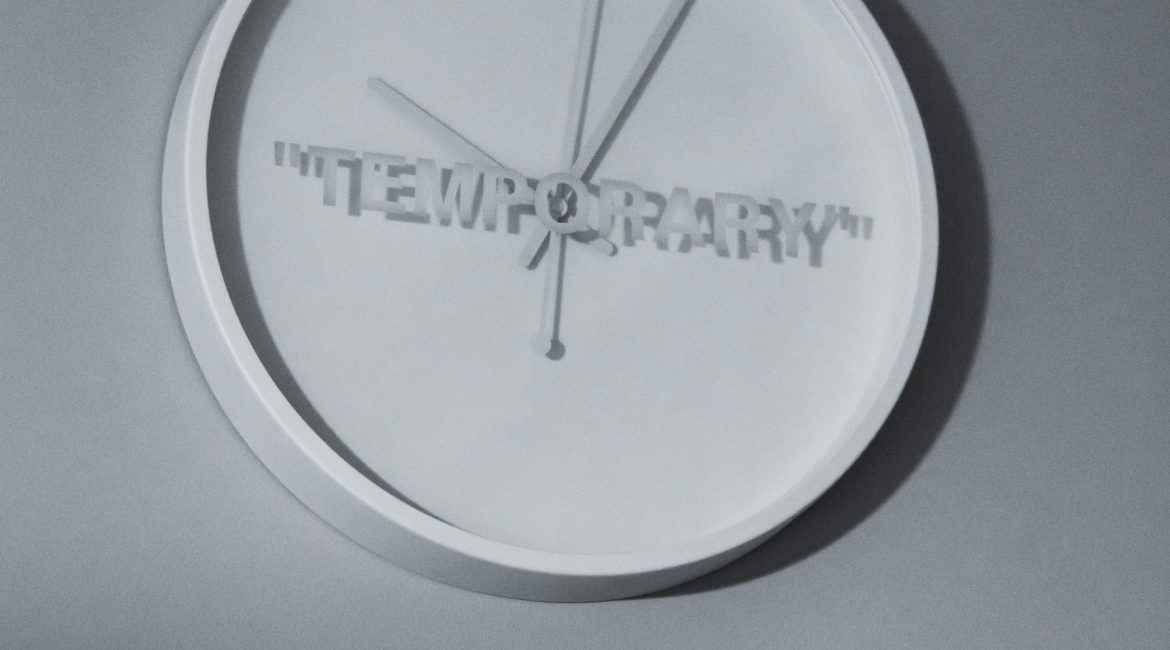

December 21st – Temporary Move?

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 18th – The Great Mirage

One Big Thing Jonathan Litt of hedge fund Land and Buildings is predicting that next year will see a bounce back in the performance of pandemic-impacted real estate but that it will ultimately prove to be a mirage as secular headwinds turn against these market segments (emphasis mine): The Vaccine...

December 17th – Flotation Aid

One Big Thing In the first week of December, the proportion of mortgage borrowers that sought forbearance rose to its highest level since August. Delinquencies are climbing as well, as some borrowers are either not eligible for forbearance or are still unaware that they may be eligible. NREI Reading the paragraph...