What I’m Reading Wait and See: NNN lease investors had assumed that Republicans would win the Georgia Senate special election and the 1031 exchange would be safe. Now that the Democratic party candidates have prevailed, those investors are anxiously awaiting President Elect Biden’s first 100 day agenda to see if the...

January 7th – Reading the Tea Leaves

One Big Thing Now that the elections have come finally, mercifully come to a close, I thought that it would be a good idea to take a look at the likely winners and losers both in the real estate sector and the economy as a whole. I’m going to do...

January 5th – Unmasked

What I’m Reading Unmasked: The Corporate Transparency Act, which was tacked onto a defense bill, would require corporations and limited liability companies established in the United States to disclose their real owners to the Treasury Department, making it harder for criminals to anonymously launder money or evade taxes. The rule applies...

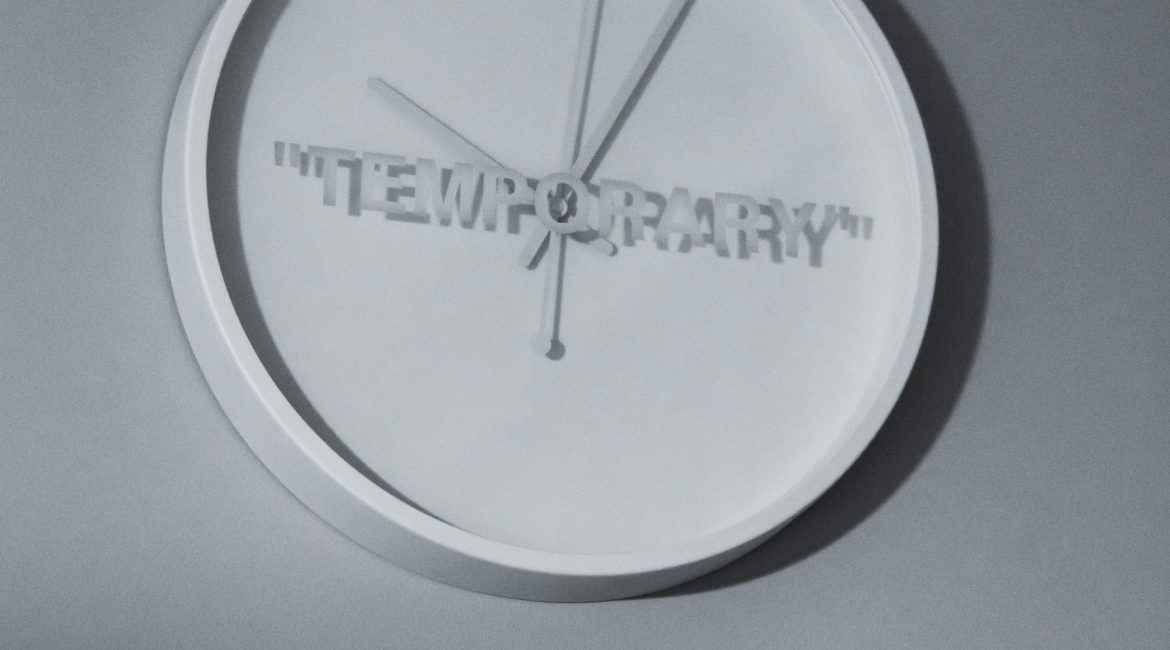

December 21st – Temporary Move?

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 18th – The Great Mirage

One Big Thing Jonathan Litt of hedge fund Land and Buildings is predicting that next year will see a bounce back in the performance of pandemic-impacted real estate but that it will ultimately prove to be a mirage as secular headwinds turn against these market segments (emphasis mine): The Vaccine...

December 17th – Flotation Aid

One Big Thing In the first week of December, the proportion of mortgage borrowers that sought forbearance rose to its highest level since August. Delinquencies are climbing as well, as some borrowers are either not eligible for forbearance or are still unaware that they may be eligible. NREI Reading the paragraph...

December 16th – Cracking the Code

Cracking the Code: Dr. Peter Linneman of Linneman Associates and Matt Larriva, vice president of research and data analytics at Chevy Chase, Md., property firm FCP, believe they have devised a methodology that accurately forecasts acquisition yields up to a year into the future. The model is based on the unemployment...

December 10th – Downdraft

What I’m Reading Downdraft: The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 75.4 percent of apartment households made a full or partial rent payment by December 6. While that is a whopping 780 basis point drop from 2019, it should be noted that December 5th and 6th both fell...

December 9th – Balancing Act

One Big Thing California’s eviction moratorium is scheduled to expire in early February. A new assembly bill is seeking to extend it through the end of 2021. Concurrently another assembly bill is attempting to establish a framework for dispersing rental relief. (h/t Steve Sims) Connect Media Two comments here: While I’m...

December 7th – Behind the Curve

What I’m Reading Behind the Curve: As expected, eCommerce orders surged to previously unseen levels this Black Friday and Cyber Monday. It got to the point that UPS put limits on pickups at several large retailers in an effort to not overwhelm their systems, despite knowing that this was coming. Wall Street...