What I'm Reading Tale of the Tape: Mortgage debt as a percentage of GDP sits just below 50%, high on a historical basis but nowhere near GFC levels of over 70%. Calculated Risk Roll Up: Blackstone's BREIT purchased Sunbelt rental apartment owner Preferred Apartment Communities in a 5.8 billion deal. ...

February 16th – Got Ya Covered

What I'm Reading Got You Covered: As commercial real estate lenders and investors eye new yield opportunities, the industrial outdoor storage (IOS) sector has emerged as an asset class with large-scale, long-term growth potential. Commercial Observer The Big Short: Wall Street investment firms are buying up more vacation homes, aiming...

February 9th – Round Trip

What I'm Reading Out of the Basement: The amount of negative yielding debt in the world is falling rapidly. After topping out at $17.8 trillion at the end of 2020, it has dropped to $6.1 trillion today. Expect this to continue to fall as central banks hike. Bloomberg One big...

February 8th – Fire Sale

What I'm Reading Fire Sale: Retail rents are plunging in Manhattan as a lack of office workers makes businesses less viable. On the positive side, falling rates and aggressive concessions have led to falling availability as tenants snap up prime locations at a discount. Bloomberg Decelerating: CoreLogic is projecting that...

February 2nd – Rush Hour

What I'm Reading Rush Hour: Buyers are scrambling to purchase homes while rates are still low. In the meantime, supply is down substantially. As a result, buying has become even more competitive, especially at lower price points leaving prospective homeowners stuck between soaring rents and unobtainable ownership. CNBC Widening Out:...

February 1st – Guessing Game

What I'm Reading Guessing Game: Pandemic uncertainty has made it extremely difficult for appraisers to assign values to office buildings. IMO, this will continue until the dust clears and the impact on demand from work from home can be fully quantified. Globe Street Windfall: Crypto whales are cashing out some...

January 28th – The Great American Camp Out

What I'm Reading The Great American Camp Out: Results for the RV Industry Association’s December 2021 survey of manufacturers determined that total RV shipments for 2021 ended with a record 600,240 wholesale shipments, surpassing the 2017 total of 504,599 shipments by 19%. Total RV shipments for 2021 increased 39.5% over...

January 27th – Risky Business

What I'm Reading Risky Business: With interest rates rising, and property prices at all time highs, Canadian homeowners are increasingly turning to variable rate mortgages as a lower cost alternative. Variable rate mortgages, which offer a substantially lower initial payment now make up over half of all new home loans...

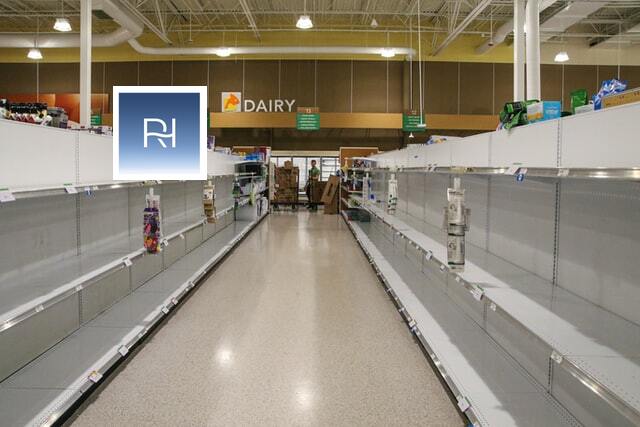

January 18th – Bare Shelves

What I'm Reading Bare Shelves: US home sales fell the most in 18 months in December. A lack of supply, not demand is driving the move. As would be expected in this environment, prices are still increasing rapidly. Bloomberg Coming Around: As the pandemic wears on, corporate America is increasingly...

January 14th – Locked Down

What I'm Reading Locked Down: With Covid-19 flaring up across China, major manufacturers are shutting factories, ports are clogging up and workers are in short supply as officials impose city lockdowns and mass testing on a scale unseen in nearly two years. There have even been rumors of a potential...