What I'm Reading Deluge: Office occupancy losses hit record lows in 2020, totaling 84MM square feet with more than half of the losses occurring in CBDs. Expensive markets with a high concentration of tech-and energy-companies were the most impacted. The only relative bright spots were secondary and tertiary markets, which...

January 15th – Plug and Play

What I'm Reading Plug and Play: Remote work (which may or may not be temporary) during the pandemic has fueled demand for furnished short-term housing. What I find interesting here is that mobility had been falling for decades and the accelerated abruptly. Question is what happens to that increased mobility...

January 11th – Wait and See

What I’m Reading Wait and See: NNN lease investors had assumed that Republicans would win the Georgia Senate special election and the 1031 exchange would be safe. Now that the Democratic party candidates have prevailed, those investors are anxiously awaiting President Elect Biden’s first 100 day agenda to see if the...

January 7th – Reading the Tea Leaves

One Big Thing Now that the elections have come finally, mercifully come to a close, I thought that it would be a good idea to take a look at the likely winners and losers both in the real estate sector and the economy as a whole. I’m going to do...

January 5th – Unmasked

What I’m Reading Unmasked: The Corporate Transparency Act, which was tacked onto a defense bill, would require corporations and limited liability companies established in the United States to disclose their real owners to the Treasury Department, making it harder for criminals to anonymously launder money or evade taxes. The rule applies...

January 4th – Blurred Lines

What I’m Reading Blurred Lines: States are facing off in a high-stakes legal battle over who is entitled to income taxes on remote workers when one is employed by a company in one state but resides in another. The results of this high-stakes legal battle will have a profound impact on...

December 22nd – Under the Tree

Quick programming note: I’m going to be taking a break from blogging the next week or so and won’t be posting every day. That being said, if something looks particular interesting, I’ll check in. This week’s big news is obviously the $900 billion rescue package that looks likely to be...

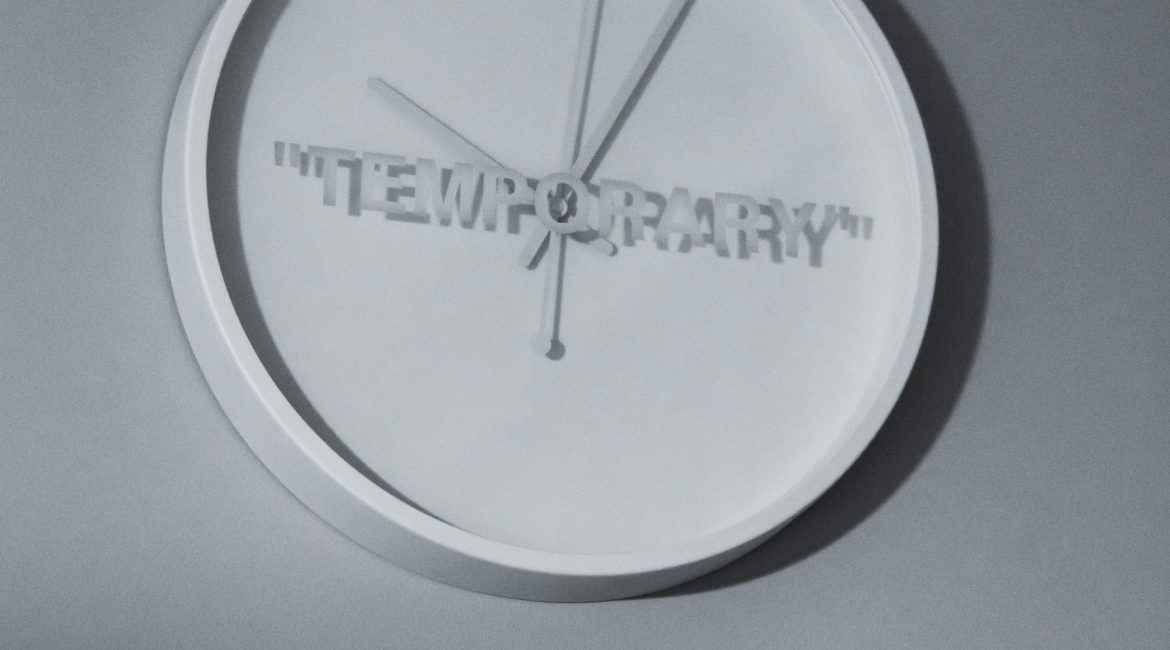

December 21st – Temporary Move?

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 16th – Cracking the Code

Cracking the Code: Dr. Peter Linneman of Linneman Associates and Matt Larriva, vice president of research and data analytics at Chevy Chase, Md., property firm FCP, believe they have devised a methodology that accurately forecasts acquisition yields up to a year into the future. The model is based on the unemployment...

December 15th – Checked Out

What I’m Reading Checked Out: Buyers are spending more time than ever in their vacation homes. Mansion Global See Also: A new homes.com survey found that 45% of respondents would move if they could work remotely. Forbes Soaring: Home equity reached a record high in 2020 as American homeowners gained a whopping $1 trillion. Core Logic See...